For a venture capital firm, scaling deal flow isn't an aspirational goal; it's an operational imperative. This is where workflow automation stops being a buzzword and becomes a competitive advantage. It’s about strategically eliminating the low-value, repetitive work that consumes your team's time, systematically removing the friction between a pitch deck landing in an inbox and a sharp, informed investment decision.

What Workflow Automation Means in a VC Context

Let's cut through the generic productivity talk. In the high-stakes environment of venture capital, workflow automation is a laser-focused solution to a specific problem: the constant firehose of inbound pitch decks that buries your team in administrative work.

It's the technology that takes over the thankless job of monitoring an inbox, extracting key data from decks, and manually creating new records in your CRM, whether that's Affinity or Airtable. This isn’t about replacing an analyst's judgment or a partner’s intuition. It’s about freeing them from the drudgery that comes before the real analysis can even begin. A solid automation engine acts as your digital front line, ensuring every opportunity is captured, logged, and enriched without a single manual click.

Shifting Focus from Data Entry to Deal Analysis

Every minute an associate spends copying a founder's name, market size, or funding details from a PDF into a database is a minute they aren't assessing a deal's potential. The core function of automation here is to reclaim those minutes—which quickly add up to hours—and redirect them toward high-value work.

Consider the manual process:

- An email with a pitch deck arrives, often as a password-protected DocSend link.

- An analyst must open it, hunt for key information, and perhaps download or screenshot slides.

- They then switch to the CRM, create a new record, and begin manually typing everything in.

- This cycle can consume 10-15 minutes per deck. At a volume of hundreds per week, the time cost is substantial.

Workflow automation collapses this entire manual chain of events into a single, instant action. The email arrives, and a process kicks off automatically to extract, structure, and deliver clean, decision-ready data directly into your pipeline.

This is a fundamental operational shift. It expands your team’s bandwidth, enabling them to review more deals with greater depth and speed. Most importantly, it dramatically lowers the risk of a high-potential company getting lost in a disorganized inbox.

While this is its power in VC, you can explore broader resources to understand the foundational concepts of workflow automation. For a fund, however, it’s simply the critical infrastructure needed to compete in a market that never slows down.

What's Under the Hood? The Core Parts of a VC Automation Engine

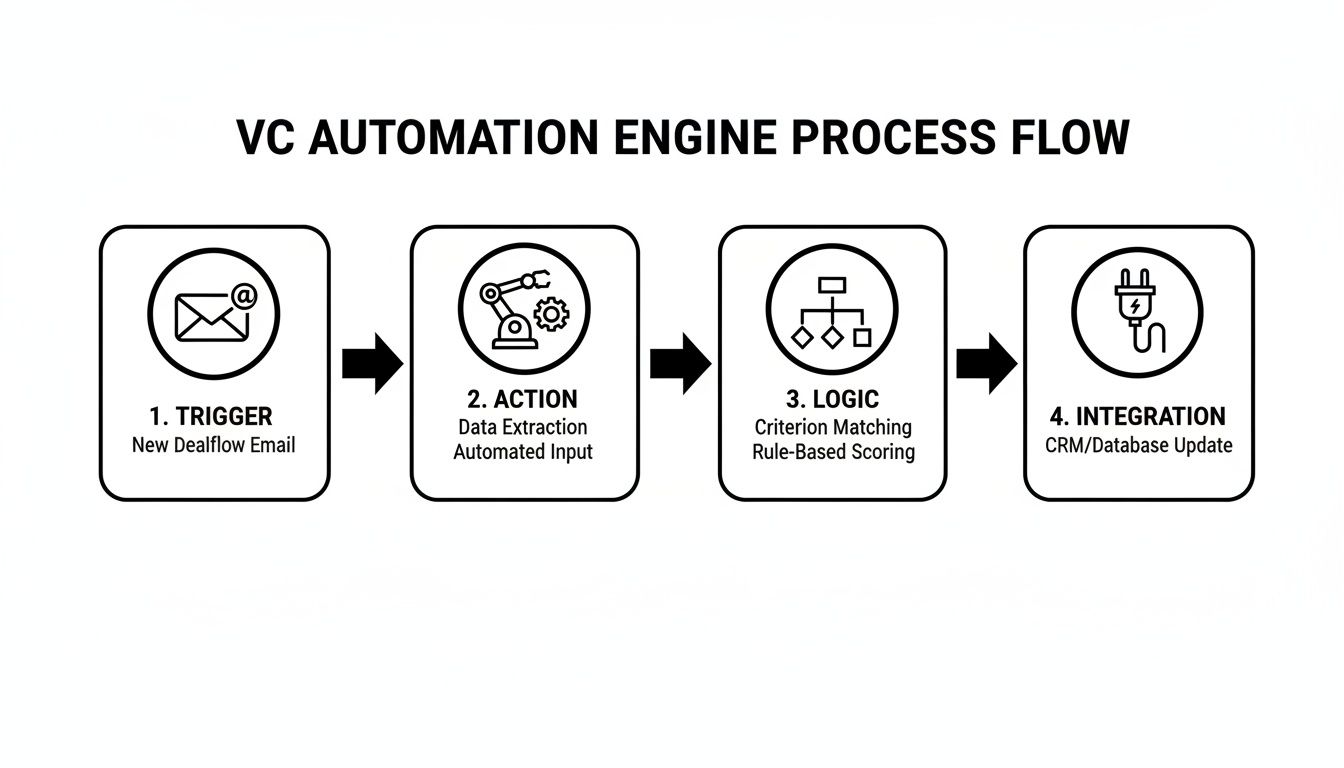

It’s tempting to view a workflow automation system as a single piece of software, but it's more like an engine with distinct, interconnected parts. For a VC firm, this engine is precision-tuned for one function: processing deal flow. Understanding how these parts work together reveals exactly how automation transforms a pitch deck from an email attachment into a fully vetted opportunity in your CRM.

The entire system operates on a powerful principle: conditional logic. At its core, it's a series of "if this, then that" commands. This structure is what turns a chaotic inbox into a systematic pipeline, ensuring every deal is handled consistently, every time, without manual intervention.

The Trigger: What Kicks Things Off?

Every automated workflow needs a starting signal, and that's the Trigger. This is the specific event that sets the entire engine in motion. For VCs, the most critical trigger is the arrival of a new email that contains a potential deal.

This is more than just detecting an attachment. A smart trigger can be configured to watch for specific keywords like "pitch deck" or "seed round," or identify links from platforms like DocSend. Think of the trigger as your firm's digital bouncer—it stands guard at the inbox, identifies incoming deal flow, and immediately initiates the screening process.

The Action: Doing the Heavy Lifting

Once an email trips the trigger, the engine springs into Action. These are the specific, predefined tasks the software executes. This is where the tedious manual data entry is eliminated from your team's workload.

Instead of an analyst manually opening a PDF to hunt for information, the automation engine performs actions like:

- Parsing the Deck: The system reads the attached pitch deck or follows the DocSend link to identify and pull out key data points.

- Structuring Information: It locates and organizes details like founder names, company name, market size, traction metrics, and the current funding ask.

- Data Enrichment: Advanced systems can enrich this data by automatically looking up founder profiles on LinkedIn to add more context.

The Logic: Making Smart Decisions

With the data extracted and organized, the system applies Logic. This is the brain of the operation, using conditional rules to decide what happens next. It acts as a digital traffic controller, routing the right information to the right people based on your firm’s investment thesis.

A well-defined logic layer is what separates simple data collection from true pipeline management. For instance, if the system flags a company's sector as "FinTech," the logic can automatically assign that deal to the partner who covers that vertical.

The Integration: Connecting to Your CRM

Finally, the entire process culminates in Integration. This is the critical hand-off where the structured, enriched data is pushed into your firm’s central nervous system—your CRM. Whether you use Affinity or Attio, the integration creates a new deal record, populates all the fields, and attaches the original pitch deck.

This last step closes the loop and makes the time savings tangible. By the time an analyst sees the opportunity, the administrative legwork is already complete. Grasping these core components is the foundation for learning how to automate repetitive tasks and reclaiming your team’s most valuable resource: time.

Automating Your Pitch Deck Funnel, from Inbound to Analysis

Theory is one thing; practical application is another. For venture capital, the most immediate and high-impact area for workflow automation is the top of the deal funnel. This is about transforming the chaotic flood of incoming pitch decks into a structured, manageable pipeline.

This isn't a futuristic vision of AI making investment decisions. It’s a practical, step-by-step process that eliminates the administrative bottleneck between an inbound email and a go/no-go screening decision. The automation begins the second an email lands in your inbox and ends when a complete, accurate deal record is created in your CRM.

From Unstructured Email to Structured Data

The manual process is fraught with friction. An analyst receives an email, often with a password-protected DocSend link, and the slog begins. They must open the link, find the password in the email body, and then painstakingly hunt through slides for critical information.

An automated system bypasses this entirely. It is built to:

- Capture Every Inbound Deal: The system monitors specific inboxes, spotting any email containing a pitch deck, whether it's a PDF attachment or a link to a platform like DocSend.

- Process Secure Links: Modern tools handle password-protected links automatically. No more copy-pasting credentials or taking screenshots for record-keeping.

- Extract Key Information: Using AI, the system effectively "reads" the deck and pulls out the exact data points your team needs for initial evaluation.

This is where the most significant time savings occur. The 10 to 15 minutes an analyst normally spends on manual data entry for a single deck is instantly returned, allowing them to shift from administrative work to qualitative analysis.

The visual below shows how a purpose-built VC automation engine moves from a trigger event all the way to integrating with your core systems.

As you can see, what starts with a simple trigger—an email—is pushed through a series of automated actions and logical steps. Only then is the final, clean data integrated back into your workflow.

Eliminating the Manual Work, Not the Analyst

Once the data is extracted, it’s organized into a clean, standardized format. The automation engine identifies and structures the information your team values most, such as:

- Team Composition: Founder names, roles, and professional backgrounds.

- Traction Metrics: Key performance indicators like ARR, user growth, or other crucial data points often buried in charts and tables.

- Funding History: Details on previous rounds, prior investors, and the current ask.

- Market & Sector: The company’s industry, target market size, and a snapshot of the competitive landscape.

This structured information is then pushed directly into your CRM. A new deal record is created and fully populated before anyone on your team has even reviewed it. The purpose of this level of workflow automation isn't to replace an analyst's judgment, but to arm them with complete information from the start. To dig deeper into this, you can learn more about how to automate data entry for investment pipelines.

By stripping away the repetitive, low-value parts of screening, you free up your analysts to apply their expertise where it counts: evaluating the substance of the deal, the strength of the team, and the potential of the market. This shift doesn't just make them more efficient; it ensures a promising startup never gets lost in the shuffle of an overloaded inbox.

Calculating the Tangible ROI of Your Automated Deal Flow

Adopting any new tool comes down to one question: what's the return? Vague promises of "working smarter" don't justify a budget line item. For workflow automation, the ROI isn't an abstract concept. It's a hard, measurable impact on your fund's most critical asset: time.

The most immediate return is a sharp reduction in hours spent on low-value administrative work. Consider an analyst receiving 100 pitch decks a week. If manual screening, data extraction, and CRM entry take just 10 minutes per deck, that’s over 16 hours every week—two full workdays consumed by clerical tasks. Automation reduces that time to nearly zero, freeing up those 16 hours for deep-dive research, founder conversations, and market analysis.

Quantifying the Gains: Time and Coverage

It's not just about saving time. The second—and arguably more important—return is expanded deal coverage. Every missed email or buried pitch deck is a potential lost opportunity. By automating the top of your funnel, you ensure that 100% of inbound deals are captured, processed, and ready for review in your pipeline.

This systematic approach removes human error from the equation. No more worrying about a game-changing startup slipping through the cracks because an inbox was flooded. It transforms your deal flow from a reactive scramble into a predictable, scalable operation.

The real financial win isn't just about trimming administrative costs. It's about fundamentally increasing the odds of finding your next outlier by ensuring you see everything that comes your way.

This isn't a niche trend; it's a major operational shift. The global workflow automation market is projected to reach between 40.77 billion and 80.57 billion by 2031-2035. This growth is fueled by the urgent need for operational efficiency. With over 80% of organizations planning to increase automation spend, the technology's value is clear. To dig deeper into the financial side, it's worth mastering AI ROI to understand and calculate these returns effectively.

Manual vs. Automated Pitch Deck Processing: A Comparative Analysis

When the numbers are placed side-by-side, the difference is stark. The table below breaks down the resources required to process 100 inbound pitch decks manually versus with a dedicated automated system.

| Metric | Manual Workflow (Per 100 Decks) | Automated Workflow (Per 100 Decks) |

|---|---|---|

| Time to Process | 16-25 hours of analyst time | < 1 hour of system processing time |

| Data Entry Errors | High potential for typos and omissions | Minimal; data is extracted and structured consistently |

| Deal Coverage Rate | Variable; prone to missed emails and delays | Near 100%; every inbound deck is captured |

| Speed to First Review | Days; dependent on analyst bandwidth | Minutes; deals are ready for review instantly |

| Data Consistency | Inconsistent; depends on individual analyst habits | Standardized; every record is populated uniformly |

This direct comparison highlights the core value of workflow automation. It’s not about replacing the human judgment central to venture capital. It’s about eliminating the operational friction that prevents your team from doing what they do best: making smart, informed investment decisions. The ROI is clear—in hours saved, opportunities captured, and a reliable pipeline.

What's Really Powering Modern VC Automation?

Deal flow automation is not just a script; it’s an ecosystem of technologies working in concert. For a venture capital firm, understanding the mechanics isn't about becoming a developer—it's about seeing how these tools solve the real-world problems of sifting through hundreds of deals and managing a mountain of unstructured data. This isn't abstract tech; it's the engine that transforms a chaotic inbox into a strategic advantage.

The primary hurdle has always been the unstructured nature of pitch decks. They are narratives designed to persuade, not databases designed for machines. Key information is scattered across slides, embedded in images, or buried in text. Modern AI acts as the translator between this human narrative and the structured data your team requires.

AI and NLP: Your New Digital Analyst

At the core of any intelligent deck processing tool are Artificial Intelligence (AI) and Natural Language Processing (NLP). NLP is the software's ability to read and comprehend human language. When it analyzes a pitch deck, it doesn’t just see words; it understands their context.

This is how a tool like Pitch Deck Scanner can perform work that previously consumed a junior analyst's day:

- Entity Recognition: It identifies and extracts specific data points—founder names, company HQs, market size figures (e.g., "10B TAM"), and key traction metrics (e.g., "ARR of 1.5M").

- Sentiment Analysis: It can differentiate between a phrase describing a "target market" versus one discussing a "competitor's market," a subtle but crucial distinction.

- Summarization: It can condense long paragraphs into key sentences, perfect for a deal memo or CRM field.

In short, AI and NLP handle the initial "read-through" at machine speed, extracting the vitals so your team can proceed directly to high-level, qualitative analysis.

Cloud-Native Platforms: Built for Scale and Security

The second component is the underlying infrastructure. Modern automation platforms are cloud-native, meaning they were built from the ground up for the cloud. For a VC firm, this provides two non-negotiable benefits: scalability and security.

A cloud-native architecture means the system can handle your deal flow whether you receive ten decks a day or a thousand during a demo day spike, without concerns about server capacity. More importantly, reputable platforms offer enterprise-grade security, ensuring sensitive deal information is encrypted and protected.

APIs and Webhooks: The Glue That Holds It All Together

Finally, a tool's value is determined by its connectivity. Real utility comes from how well it integrates with the software your team uses daily. This is where Application Programming Interfaces (APIs) and Webhooks are critical.

An API acts as a universal adapter, allowing different software programs to communicate and share data. A Webhook functions like a real-time alert system, pushing an update from one app to another the moment an event occurs.

Together, they form the connective tissue for your entire automated workflow:

- API Integrations: This is how an automation tool can connect to your CRM—whether it's Affinity, Attio, or another platform—to create a new deal record and populate it with extracted data. It ensures information lands exactly where it belongs without manual copy-pasting.

- Webhook Functionality: This enables dynamic, real-time actions. For example, when a new deal is created in your CRM, a webhook could instantly trigger a notification in a specific Slack channel, alerting the relevant partner to a promising company in their sector.

The combination of AI, cloud computing, and deep integrations is what drives the modern workflow automation market, projected to reach $78.25 billion by 2035, according to workflow automation trends from Business Wire. For VCs, synchronizing these technologies is the key to building a truly efficient and scalable deal flow machine. To learn more, check out our guide on choosing the right deal management software for your firm.

Navigating the Traps: Common Automation Pitfalls and How to Sidestep Them

Implementing a new system is one thing; ensuring it delivers value is another. Even powerful automation tools can fail if deployed incorrectly. For venture capital firms, success depends on avoiding common missteps that can turn a promising tool into an operational headache.

Mistake #1: Picking a Generic, "One-Size-Fits-All" Tool

The most common mistake is adopting an automation tool not built for venture capital. A platform designed for marketing campaigns or a sales pipeline doesn't understand the unique structure of a pitch deck or the specific data fields required by a VC-focused CRM like Affinity.

This mismatch forces your team to create complex, fragile workarounds. You end up spending more time fixing the "automation" than you save, defeating the purpose.

The solution is straightforward: choose a purpose-built platform. A specialized tool like Pitch Deck Scanner already speaks the language of VC—it understands concepts like ARR, TAM, and founder backgrounds without configuration. It's designed to integrate seamlessly with the systems you already use, creating a smooth data pipeline from day one.

Mistake #2: Trying to Automate Human Judgment

Another classic error is attempting to make software perform qualitative analysis. The point of workflow automation is not to replace an analyst's critical eye; it's to give them more time to apply it. Building complex rules to auto-reject deals based on a few keywords or simple metrics virtually guarantees you will miss unconventional companies with massive potential.

There is no substitute for human intuition and the ability to spot a compelling narrative hidden within the data.

Think of automation as a co-pilot for your analysts, not a replacement. The tool's job is to handle the tedious work—to eliminate the 10-15 minutes of manual screening and data entry for every deck. It serves up a clean, complete record so your team can proceed directly to high-value tasks: qualitative assessment, deep dives, and strategic thinking.

This approach delivers efficiency gains without sacrificing the nuanced evaluation that leads to smart investing. The system handles the "what," freeing up your team to focus on the "why."

Mistake #3: Overlooking Enterprise-Grade Security

Finally, do not treat security as an afterthought. You are connecting your firm's primary deal flow channel—your email inbox—to an external platform. This requires absolute trust in its security protocols. A breach that exposes proprietary pitch decks or internal notes is a direct threat to your reputation and competitive advantage.

Avoid any platform that is unclear about its security policies or uses outdated authentication methods.

This is non-negotiable. Prioritize solutions with robust, enterprise-grade security. Look for these essentials:

- Secure Authentication: The platform must use a secure, read-only protocol like OAuth 2.0. This grants access without ever seeing or storing your team's email passwords.

- Data Encryption: Ensure all data is protected with strong encryption, both in transit (moving between systems) and at rest (stored on a server).

- Compliance and Audits: Look for evidence that the provider adheres to recognized security standards and undergoes regular third-party security audits.

By proactively addressing these common pitfalls, you can ensure your firm’s adoption of workflow automation builds a faster, smarter, and more secure engine for your deal flow.

Clearing Up Your Workflow Automation Questions

Adopting any new system into a fund raises questions. When considering what workflow automation means for your team's daily operations, you need direct answers that respect the high-stakes reality of venture capital. It all comes down to ensuring any tool you implement is secure, effective, and fits your existing process.

How Secure Is Connecting Our Firm's Email to an Automation Platform?

Security is paramount when dealing with proprietary deal flow. Top-tier platforms prioritize this by using secure, read-only protocols like OAuth 2.0. This is the industry standard for granting application access without ever exposing your credentials.

Think of it as giving a valet a key that only opens the car door but won’t start the engine. The platform is granted permission to see new emails but never stores your actual password, and access can be revoked at any time. Furthermore, all data should be protected with enterprise-grade encryption, both in transit and at rest. It’s a layered defense designed to protect your fund’s most valuable information.

Will Workflow Automation Replace Our Junior Analysts?

No. The goal is to make them more effective, faster, and more strategic. Automation is not about replacing human insight; it's about eliminating the lowest-value parts of the job—the manual data entry and repetitive first-pass screening of every pitch deck that hits the inbox.

By removing this administrative burden, your analysts can focus on what drives smart investment decisions: deep-dive market research, competitive analysis, founder conversations, and thorough due diligence. It elevates their role from data clerk to strategic analyst.

Can Automation Be Customized to Our Unique Deal Flow Process?

It must be. A rigid, one-size-fits-all approach is unworkable in venture capital. Any worthwhile automation platform must be flexible enough to adapt to your process.

Look for a platform that allows you to define custom rules and integrates with the tools your team already uses. For instance, you should be able to configure custom logic for:

- Deal Tagging: Automatically apply tags like "FinTech" or "B2B SaaS" based on keywords found in a deck.

- Partner Assignment: Route deals directly to the relevant partner based on their investment thesis.

- CRM Syncing: Map data fields precisely to your firm’s unique CRM configuration to ensure clean, consistent data.

The best systems also offer integrations through tools like Webhooks, enabling a wide range of custom actions. You can build custom Slack notifications or connect your deal flow engine to thousands of other applications. The technology should adapt to your workflow, not force you to change how you operate.

Ready to eliminate manual pitch deck processing and give your team back their time? Pitch Deck Scanner connects securely to your inbox and automates your deal flow from email to CRM. Start your free 21-day trial and see the impact in minutes.