Deal management software isn’t a productivity hack; it's the operational backbone that replaces the chaotic jumble of spreadsheets, overflowing inboxes, and generic CRMs. For venture capital firms, it creates a single source of truth for every deal, from the first inbound deck to the final wire transfer, by automating the low-value grunt work of data entry and standardizing pipeline tracking.

This lets your investment team move faster on promising deals, spot patterns in your pipeline, and make decisions based on firm-wide data, not fragmented notes.

Escaping the Deal Flow Spreadsheet Trap

Most funds start with a spreadsheet. It’s flexible and familiar. But it breaks the moment deal flow scales from a trickle to a firehose. When you’re processing hundreds of decks a month, that spreadsheet becomes a bottleneck, a source of manual error, and a graveyard for missed opportunities.

The hidden cost is your team's time. Analysts spend 5-10 hours a week just copying and pasting founder details, market size, and traction metrics from pitch decks into rows and columns. That’s time stolen from deep diligence, founder relationships, or sourcing the next breakout company. This isn't just inefficient; it's a strategic handicap in a competitive market.

The True Cost of Manual Tracking

Relying on manual systems exposes your firm to entirely avoidable risks. Your firm’s collective knowledge gets scattered across individual inboxes, siloed in personal notes, or lost in Slack channels. When a promising company isn't followed up on because the reminder was buried in an email chain, you don't just lose one potential investment—you lose your competitive edge.

The problems go far beyond data entry:

- Inconsistent Data: Without a standardized intake process, one partner tags a company as "pre-seed" while another writes "$500k round." This makes meaningful pipeline analysis impossible.

- Zero Visibility: How can partners get an accurate, real-time snapshot of the entire firm's pipeline? They can't. Not without an analyst manually piecing together multiple spreadsheets—a report that’s already outdated by the time it's finished.

- Collaboration Friction: Sharing notes and feedback becomes a nightmare of endless email chains. You're constantly asking if everyone is looking at the latest version of the tracker.

The following table breaks down how much strategic advantage is lost when firms stick to manual methods.

Core Inefficiencies of Manual vs. Automated Deal Flow

| Key VC Activity | Manual Method (Spreadsheet & Email) | With Deal Management Software |

|---|---|---|

| Deal Sourcing & Intake | Manually entering data from hundreds of inbound emails and decks into a spreadsheet. | Automated parsing of decks and emails into structured deal records. |

| Pipeline Visibility | Partners rely on weekly meetings and manually updated reports. Data is often stale. | Real-time, firm-wide dashboard showing deal stages, ownership, and key metrics. |

| Team Collaboration | Feedback is scattered across email threads, Slack, and personal notes. It’s easily lost. | Centralized notes, tasks, and ratings are attached directly to the deal record for everyone to see. |

| Reporting & Analytics | Manually compiling data for LP reports is a multi-day, error-prone process. | Instant, automated reports on pipeline health, sourcing channels, and team performance. |

| Institutional Memory | When a team member leaves, their knowledge and network contacts often leave with them. | All interactions, notes, and documents are stored centrally, creating a permanent firm asset. |

It's clear that manual tracking isn't just inefficient—it puts a hard ceiling on a firm's growth and effectiveness.

The fundamental problem is that spreadsheets were built for crunching numbers, not for managing the dynamic, relationship-driven chaos of a venture pipeline. Forcing a tool to do a job it was never designed for inevitably creates data silos and strategic blind spots that can cost you your next great investment.

From Reactive Data Entry to Proactive Deal Management

This is a scaling problem that manual tools are fundamentally unequipped to handle. Moving to a dedicated deal management software is the logical next step for any fund serious about performance. These platforms are built from the ground up to manage the unique lifecycle of an investment deal.

To appreciate the solution, it helps to see how specialized systems bring order to complex information. For instance, understanding what contract management software is and how it works provides a great parallel. Just as that software centralizes and automates legal agreements, deal management platforms do the same for your pipeline.

By centralizing all your deal information and automating routine tasks, these systems transform your firm's capacity. What was once a reactive, mind-numbing data-entry chore becomes a proactive engine for gathering intelligence. This shift is no longer a luxury—it's a competitive necessity.

What Does a VC Operating System Actually Do?

A dedicated deal management platform is the central nervous system for your entire investment firm. It’s the single integrated environment that coordinates everything from first contact to portfolio management, creating a single source of truth that replaces fuzzy "institutional memory" with hard, institutional data.

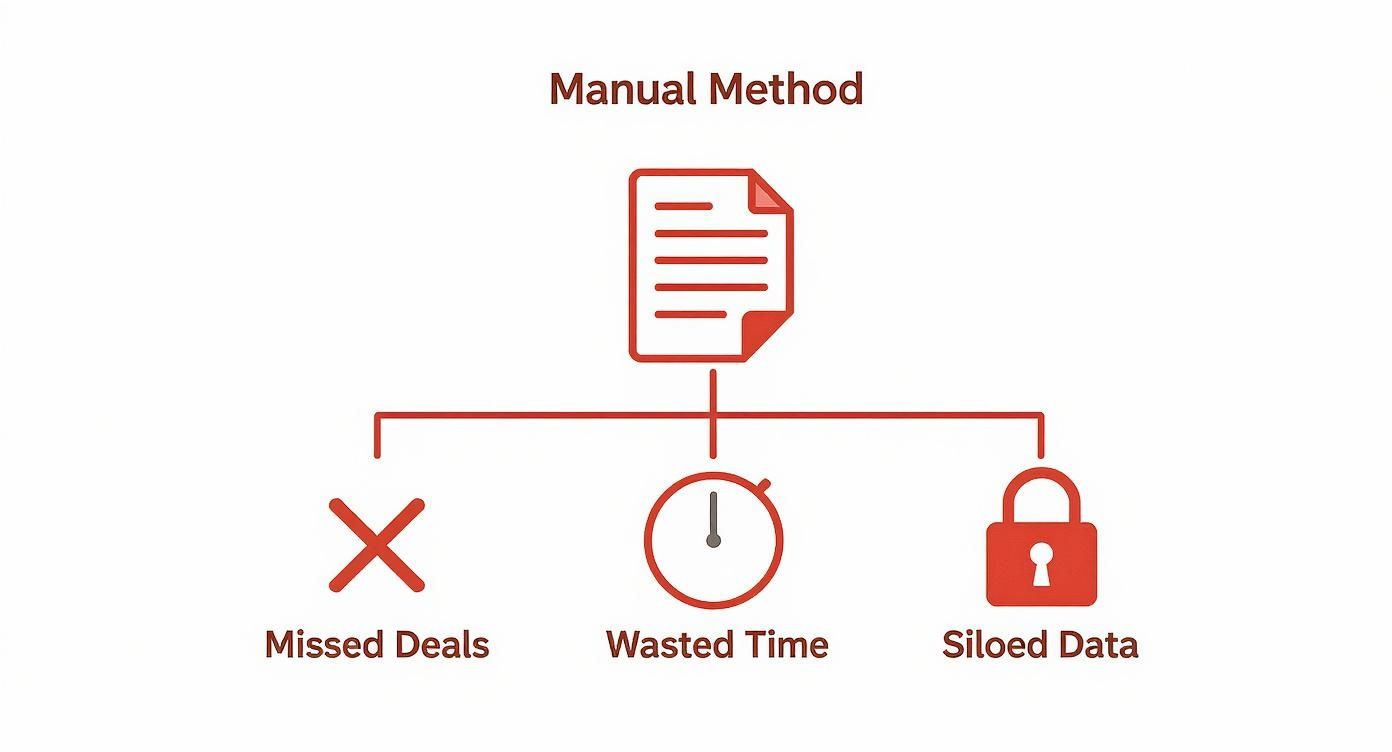

The manual approach—a chaotic mix of spreadsheets, email chains, and shared drives—is a system practically designed to let opportunities fall through the cracks.

This is what that chaos looks like in practice.

Sticking with manual processes isn't just inefficient; it leads directly to strategic failures. Promising deals are missed, analysts burn hours on low-value data entry, and crucial information stays locked in individual inboxes. A proper VC operating system is built to fix these exact problems.

A Unified and Automated Pipeline

The core of the system is a single, unified pipeline that gives everyone in the firm an instant, at-a-glance view of every deal. This isn't just a prettier spreadsheet; it’s a living dashboard that reflects what's happening right now. When an associate drags a deal from "Initial Screening" to "Partner Review," the entire team sees it instantly.

This eliminates the weekly pipeline meeting that’s already obsolete by the time it's over. Partners can immediately spot where deals are getting stuck, see which sectors are heating up, and know exactly who is responsible for each opportunity.

Smart workflow automation handles the repetitive work. The best deal management software automates data intake, pulling key details directly from inbound pitch decks.

- Automated Data Extraction: The software reads PDFs and DocSend links, grabbing founder details, traction metrics, and market size without manual copy-paste.

- Structured Deal Creation: That information is used to create a new deal record automatically, neatly tagged and categorized based on your firm’s criteria.

- Instant Triage: This frees your analysts to spend their first minutes actually analyzing the deal, not transcribing it. The initial screening process becomes exponentially faster.

Purpose-Built Relationship Management

Off-the-shelf CRMs are built for linear sales funnels. That model breaks down in venture capital, where relationships are a complex, overlapping web. A single person can be a founder you’re vetting, a co-investor on another deal, and a source for your next introduction—all at the same time.

A purpose-built VC CRM understands this. It tracks every email, call, and meeting, linking them to the right people, companies, and deals. You get a complete, historical view of your firm's entire relationship network, eliminating awkward double-outreach or messy handoffs. This structured approach to networking is a critical pillar of a strong investment decision-making process because it provides the crucial context behind every opportunity.

A great VC operating system ensures that when an analyst leaves, their network intelligence doesn't walk out the door with them. It remains a permanent, searchable asset for the entire firm.

Collaborative Diligence and Portfolio Monitoring

Once a deal gets serious, the platform becomes the central hub for due diligence. Team members can drop in notes, upload documents, and assign tasks right inside the deal's record. Everything is in one secure, auditable place, so sensitive information isn't floating around in email threads or personal Dropbox folders.

The system extends into portfolio monitoring, too. You can integrate performance data from your portfolio companies to track key metrics, manage follow-on rounds, and generate reports for your LPs. This creates a powerful feedback loop: data from your portfolio's performance feeds back into the front of your pipeline, helping you sharpen your investment thesis based on what’s actually working.

Turning Inbound Chaos Into Actionable Intelligence

The biggest bottleneck for any VC fund isn't a lack of opportunities—it's the relentless volume of inbound deal flow. The traditional workflow is a grind: download the deck, skim for key details, manually type them into a spreadsheet or CRM, and repeat. This process turns your analysts into data entry clerks instead of the strategic thinkers you hired them to be.

A dedicated deal management software flips this on its head, turning the chaotic flood of decks from a chore into an automated intelligence engine. Instead of manual triage, the system acts as your first line of defense. It automatically parses decks from your email, extracts critical data points, and builds a structured deal record in your pipeline—instantly.

From Manual Skimming to Automated Insights

Modern platforms do more than just grab the company name. They are trained to identify and structure the high-value data points that determine whether a deal is worth a second look.

- Founder & Team Background: The software extracts founder names, previous companies, and educational history, providing immediate context on team experience without manual LinkedIn searches.

- Key Metrics & Traction: It finds ARR, user growth, and other vital metrics that might be buried on slide 12 and puts them front and center for quick assessment.

- Market & Sector: The system automatically categorizes the company by industry, business model (e.g., B2B SaaS), and target market size, allowing for instant filtering and sorting of your pipeline.

This automation creates a standardized, data-rich profile for every inbound opportunity, eliminating the inconsistencies of manual spreadsheets and ensuring every deal is measured against the same core criteria from the start.

The goal is to eliminate the repetitive, 10-minute manual review for every single deck. By automating this first screen, you give back hundreds of hours a year to your team, letting your analysts focus their expertise on the 10% of deals that actually deserve a deeper dive.

Reclaiming Your Team's Strategic Focus

This isn't about replacing human judgment; it's about augmenting it.

When an analyst opens a new deal and immediately sees the founder’s background, key traction numbers, and TAM, their thinking shifts. They're no longer asking, "What is this company?" They can jump right to the critical question: "Does this fit our thesis?"

The benefits are immediate. An analyst can screen 20-30 companies in the time it used to take to manually process five. This faster triage means promising deals get surfaced to partners in hours, not days—a significant advantage in a competitive market. Plus, the system ensures your data is structured and clean from the moment it enters your pipeline. You can learn more about how to improve your workflow with automated data entry and see its impact on managing your pipeline.

Ultimately, good deal management software gives your team back its most valuable asset: analytical expertise. By taking over the high-volume, low-value task of initial data extraction, it frees your people to do what they do best—build relationships, conduct deep diligence, and find the outlier companies that will drive your fund's returns.

Measuring ROI Beyond Hours Saved

The immediate win from deal management software is reclaiming the hours your team wastes on manual data entry. But that’s just the start. The real value is realized when you use the platform as an intelligence engine for the entire firm.

This is where the conversation shifts from saving time to gaining a strategic edge. The goal isn't just to move deals through the pipeline faster; it's to make fundamentally smarter decisions that compound over the life of your fund.

Turning Your Pipeline Into a Proprietary Dataset

Every pitch deck, every meeting note, every stage change—it’s all data. When trapped in disparate inboxes and spreadsheets, it’s just noise. A proper deal management software captures and structures everything into a private dataset that reflects your firm’s unique view of the market.

This allows you to run analysis that was previously impossible, answering mission-critical questions with hard data, not just gut feelings.

- Source Effectiveness: Where do your best deals really come from? Is it a specific angel investor, a particular accelerator, or a partner firm? Now you can track it and double down on what works.

- Thesis Validation: Are you consistently passing on companies that raise large rounds from top-tier VCs six months later? This analysis highlights blind spots in your investment thesis before they cost you another unicorn.

- Funnel Conversion Rates: What percentage of companies advance from initial screening to a full partner meeting? Knowing your conversion rates at each stage helps identify bottlenecks and forecast your investment pace more accurately.

By digging into this data, you can methodically tune your sourcing strategy, sharpen your investment focus, and improve every step of your process.

Building Persistent Institutional Knowledge

In venture capital, knowledge is often tied to individuals. When a star analyst or partner leaves, their network and deal history walk out the door with them. That’s a massive brain drain for the firm.

A deal management platform acts as the firm’s collective memory. It’s a central hub that captures crucial context and makes it permanent and searchable. Every email, piece of feedback, and document is logged against a company or contact.

The platform transforms individual experience into a collective, enduring asset. A new hire can get the full backstory on a founder in minutes, ensuring you don't repeat past mistakes or miss critical context from a meeting that happened two years ago.

This shared brain becomes a huge competitive advantage that survives team turnover and allows your firm’s intelligence to compound over time. It also streamlines LP reporting. When all your notes, documents, and decisions are in one auditable system, pulling together a report is a quick export, not a week-long scramble.

This gets even more powerful when you integrate specialized tools like contract lifecycle management (CLM). The CLM market is projected to grow from USD 3.0 billion in 2025 to USD 5.6 billion by 2030, as firms require digital control over their legal agreements. You can learn more about the growth drivers in the contract management software market. Integrating a CLM into your deal management system means everything from the first handshake to the final signature is tracked and secure.

How to Select and Implement Your Firm's Tech Stack

Choosing the right deal management software isn’t about finding the platform with the most features. It’s about selecting an operational backbone that fits how your firm actually works. To cut through the noise of vendor pitches, focus on what will concretely impact your team's day-to-day workflow.

Think of this less as a software purchase and more as a foundational investment in your firm's operational engine.

The Non-Negotiable Selection Checklist

Before booking a demo, define your core requirements. This helps you move past marketing fluff and judge platforms on what truly matters to a high-performing investment team.

- Seamless CRM and Email Integration: Your team lives in their inbox and CRM, whether that's Affinity, Salesforce, or another platform. The software must integrate flawlessly. If it creates a new information silo or forces constant tab-switching, it’s dead on arrival. The integration needs to be deep, automatically syncing contacts and communications.

- Robust Security and Compliance: This is a zero-tolerance area. Look for SOC 2 Type II certification and get clear answers on GDPR compliance. Your firm's data—your deal flow, LP notes, and internal debates—is your most valuable asset. Ask direct questions about data encryption, access controls, and security audits.

- Scalability for Future Growth: The platform that works for Fund I must hold up for Fund IV. Can it handle higher deal volume, a larger team, and more complex reporting without slowing down? Ensure you can easily customize pipeline stages, add new tags, and change user permissions as your firm evolves.

- Expert and Responsive Support: When something breaks, you need help from someone who understands the venture capital world, not a generic call center. Test their support responsiveness during the trial period. A knowledgeable support team is a critical extension of the product itself.

From Trial to Team-Wide Adoption

The single most important step is a mandatory, team-wide trial. A tool can look great in a polished demo, but its real value—and its flaws—are only discovered when an analyst, an associate, and a partner all use it to manage live deals. This uncovers workflow friction that a single user might miss.

During the trial, insist that every person on the investment team logs at least five deals and their notes. The collective feedback from this exercise is the only way to ensure high user adoption after you sign the contract.

The best deal management software isn't the one with the most features; it’s the one your team actually uses. Widespread adoption is the only metric that matters for achieving a positive ROI.

A Framework for Successful Implementation

Once you’ve chosen a platform, a structured rollout is critical. A rushed implementation creates bad habits that are difficult to undo.

- Define Your Data Migration Strategy: First, decide what historical data is essential to move over. Importing years of messy spreadsheet data can be counterproductive. It's often better to start fresh, migrating only active deals and key contacts for a clean slate.

- Standardize Pipeline Stages and Tags Upfront: Before anyone logs in, the partners must agree on a standardized set of pipeline stages, industry tags, and deal statuses. This taxonomy is the bedrock of all future analytics. Without consensus, your data will be inconsistent, and pipeline reports will be useless.

- Conduct Role-Specific Training: One-size-fits-all training doesn't work. Analysts need to master data entry and screening features. Partners need to know how to pull up real-time dashboards for LP meetings. Tailor the training to what each role actually does to get everyone using the platform to its full potential from day one.

The broader market for tools that streamline these processes is booming. The global proposal management software market, a close cousin to deal management, was valued at USD 2.33 billion in 2022 and is projected to hit USD 5.81 billion by 2030. This growth confirms the industry-wide push for better automation and tighter CRM integration. As you build out your own stack, our guide on deal sourcing platforms offers more context on how these pieces fit together.

The Future of AI in Venture Capital Deal Flow

Today's deal management software is about solving operational headaches. Tomorrow, it will be about building predictive intelligence. The next leap in venture capital isn’t about screening deals slightly faster; it's about using your firm's proprietary data to uncover opportunities before they hit the mainstream.

The groundwork for this future is being laid right now, inside the structured databases of these platforms. Every deal you log, every metric you extract from a pitch deck, and every outcome you track is fuel for sophisticated AI models. Without this clean, organized data, any attempt at advanced analytics is dead in the water.

From Reactive Screening to Predictive Sourcing

We're moving past AI as a simple data-entry clerk. The next phase is proactive, thesis-driven sourcing, where AI acts less like an admin and more like a strategic analyst operating at a scale no human team can match.

Imagine an AI model trained on your firm's entire investment history—every win, loss, and near-miss. These systems could then constantly scan the market for faint signals, flagging new startups that share the subtle DNA of your biggest winners long before they appear in common deal flow channels.

This shift will change how firms operate:

- Predictive Deal Surfacing: Instead of keyword matching, AI will recommend companies that fit your investment thesis with high precision, understanding nuanced factors like founder background, tech stack, and early market traction.

- AI-Driven Market Mapping: When evaluating a new investment, AI will instantly map the competitive landscape, identifying not just obvious rivals but also stealth-mode startups and adjacent technologies.

- Founder Communication Analysis: AI tools can analyze sentiment and intent in communications to help gauge founder conviction or spot potential red flags, complementing the crucial human element of relationship building.

The market for this type of intelligent software is growing rapidly. For instance, the global contract management software market was valued at USD 1,400.16 billion in 2024 and is projected to hit USD 4,837.75 billion by 2033. This massive growth, detailed in a contract management software market analysis from straitsresearch.com, shows how heavily the industry is investing in systems that automate and integrate deeply into core workflows.

Getting a robust deal management software in place today isn't just about clearing your inbox faster. It's a strategic move to start building the proprietary dataset that will power your firm's AI-driven edge for the next decade.

The firms that win in the next cycle will be those who treat their deal flow data as a core strategic asset. By installing the right operational backbone now, you’re not just solving today's problems; you're building the intelligence engine you need to win the deals of tomorrow.

Frequently Asked Questions

How Secure is Modern Deal Management Software?

Top-tier platforms are built with enterprise-level security. Look for providers with SOC 2 Type II certification, a rigorous, third-party audit confirming they have airtight controls for managing your data. All data, from deal notes to LP communications, should be encrypted both in transit and at rest, with access strictly controlled by user roles. You decide who sees what, and your proprietary information remains secure.

Will My Team Actually Use It?

Adoption hinges on one thing: the software must be easier than the old way of doing things. If it isn't faster than your team's current spreadsheet-and-email workflow, they won't switch. The best systems achieve this by integrating directly into existing habits, especially email and CRM. When an analyst sees the platform automatically extract deal info from an inbox and populate a CRM record, the value becomes self-evident. It's not about forcing a new process; it's about eliminating the tedious work they already hate.

Can It Integrate With Our Existing CRM Like Affinity?

Yes. A high-quality platform must integrate deeply with relationship-focused CRMs like Affinity. This should be a true two-way sync, not a basic link. In practice, when a new pitch deck is parsed by the software, a new, fully detailed record should be instantly created in Affinity. Any notes, files, or status updates should sync across both platforms, ensuring everyone is working from the same data without manual double entry.

Stop drowning in manual data entry. Pitch Deck Scanner automatically extracts key data from inbound decks and syncs it directly to your CRM, giving your team back hours every week. Start your free 21-day trial and see how much faster your deal flow can be.