Every inbound pitch deck is a trade-off. It’s a potential opportunity versus the certainty of tedious, manual CRM entry that drains analyst time and slows down your entire pipeline.

This isn't just about a few minutes of copying and pasting. The administrative drag between a founder's email and a structured entry in your CRM is a critical gap where competitive edge is lost.

The Hidden Drag on Your Deal Flow

Manual data entry creates a serious lag. An analyst must open an email, download a PDF or navigate a DocSend link, hunt for key data points across 15-20 slides, and then meticulously transfer everything into your CRM. It's low-value work that scales poorly.

For a fund receiving 50 pitches a week, this administrative slog easily consumes 10+ hours of an analyst's time. That's a full workday that could have been spent sourcing, conducting diligence, or building relationships with founders.

Quantifying the Real Cost

The cost isn't just wasted hours. Manual work introduces errors. A typo in a company name, a misplaced decimal in a funding amount, or a missed metric degrades CRM data integrity.

Over time, these errors create a database you can't trust for pipeline analysis or rediscovering promising companies you passed on months ago.

The true cost of manual data entry isn't just the hours logged; it's the high-potential deals that slip through the cracks due to processing delays and the compounding effect of inaccurate CRM data that undermines your firm's institutional knowledge.

This operational friction has direct consequences:

- Delayed Decisions: Hot deals don't wait. While your team is buried in data entry, your response time suffers, giving faster firms an advantage.

- Missed Opportunities: A strong deck sitting unprocessed in an inbox is invisible. By the time it's logged, the round may be oversubscribed.

- Analyst Burnout: You hired analysts for their insights, not their typing speed. Forcing them to perform mind-numbing clerical work is the fastest way to burn out top talent.

In today's market, manual data entry is a choice to be slower and less efficient than the competition. Automation is a core requirement for maintaining pace.

Building Your Automated Deal Ingestion Pipeline

To master deal flow, you must automate the source: the inbox. The first step is a hands-off ingestion pipeline that captures every pitch deck the moment it arrives at a dedicated address like deals@your.vc. The goal is to completely eliminate the cycle of downloading, saving, and manually uploading files to your CRM.

This pipeline requires a secure, programmatic connection to your email server. The industry standard is OAuth 2.0 for Gmail, which grants authenticated access without ever storing or exposing account passwords. This allows an automation tool to detect new emails in real-time and trigger the workflow.

From Unstructured Email to Structured Data

Founders send decks in every format imaginable. Your pipeline must handle them all, from a simple PDF attachment to a link buried in the fourth paragraph.

A robust system must process these sources flawlessly:

- Direct PDF Attachments: Identify and download the PDF from the email automatically.

- DocSend & Cloud Links: Parse the email body, find URLs for services like DocSend, Google Drive, or Dropbox, follow them, and download the content.

- Password-Protected Decks: Autonomously handle password-protected DocSend links, accessing the content without manual intervention.

This is a practical application of what data integration is—transforming disparate, messy inputs into a single, clean, and unified format ready for processing.

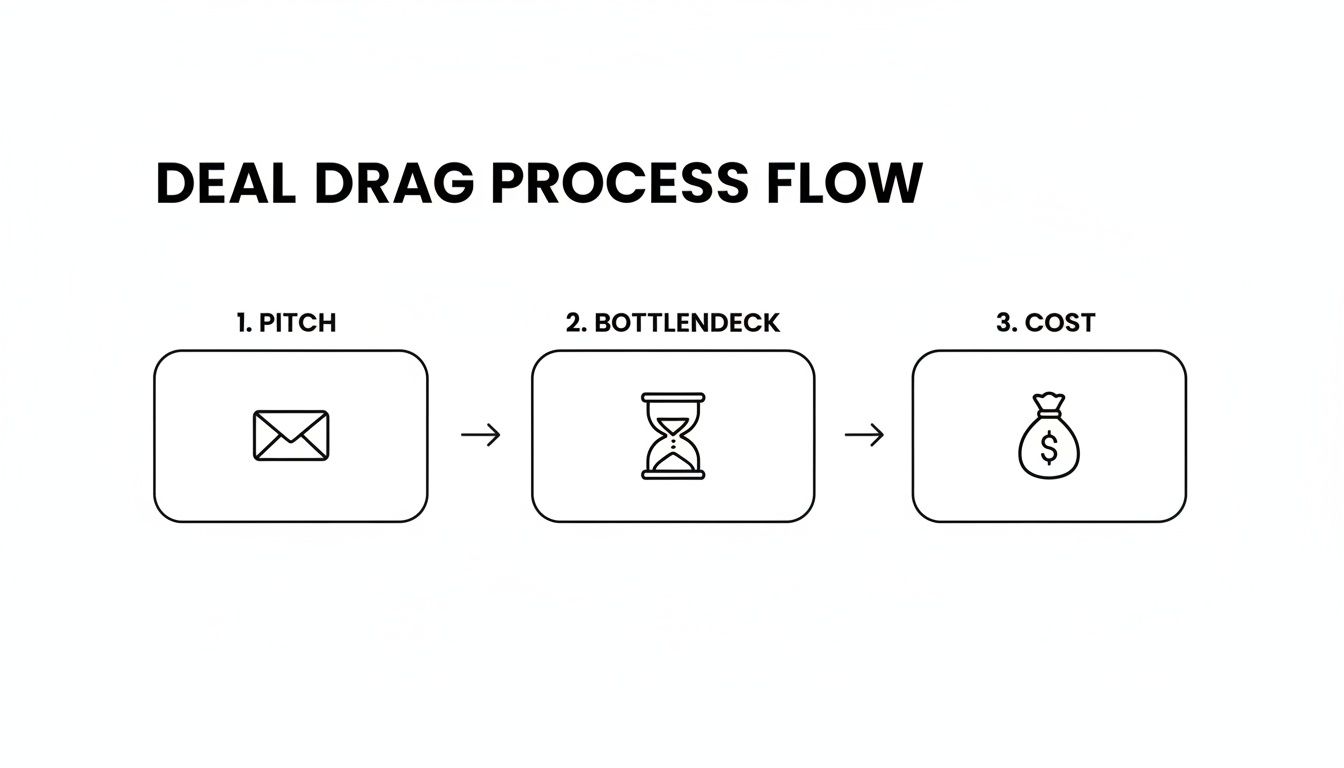

As the diagram shows, manual ingestion is a major chokepoint. It inflates both the time and the cost of simply getting a deal into your system before true evaluation can begin.

The Foundational Layer of Automation

By implementing an automated pipeline, you establish a foundational layer for your entire deal flow strategy. Every opportunity is captured consistently, ensuring nothing is lost in a busy inbox or overlooked by a swamped analyst.

This flips a reactive, manual chore into a proactive, automated workflow. The result is a clean, consistent stream of deal information queued up for the next steps: AI-powered data extraction and CRM population.

From Pitch Deck to CRM: Using AI to Extract and Populate Data

With a pipeline capturing every inbound deck, the next step is transforming those documents into structured data within your CRM. This is where AI, trained specifically on the anatomy of pitch decks, provides significant leverage.

Generic Optical Character Recognition (OCR) is insufficient. It scrapes text but lacks the context to differentiate a founder's name from a competitor's, or projected revenue from historical actuals. A specialized model is required to intelligently pinpoint the data points that drive your screening process: founder names, company one-liner, funding stage, and key traction metrics, even when embedded in charts.

This intelligent extraction is the core of how to automate data entry, enabling the creation of rich, complete deal records without manual copy-paste.

Mapping Extracted Fields to Your CRM

Extracting data is half the battle; populating it correctly in your CRM is the other. This involves mapping extracted information to your CRM's specific fields.

Using Affinity as an example, the AI maps data intelligently:

- Company Name & One-Liner: Pushed to the Organization Name and Headline fields.

- Founder Information: Creates new Person records for each founder, linked to the correct company.

- Funding Stage: Recognizes terms like "Seed," "Series A," or "Pre-seed" and maps them to your "Status" or "Stage" dropdown fields.

- Key Metrics: Critical numbers like ARR, user counts, or GMV are placed into custom note fields or dedicated data columns for easy comparison.

This direct mapping enforces consistency. Every new deal is logged with the same structure, transforming your CRM from a repository of incomplete entries into a reliable source of truth. The principles behind applying AI to financial documents are broadly applicable, as seen in areas like artificial intelligence in investment banking.

Gaining Speed and Unprecedented Accuracy

The impact on your team is immediate. For a VC fund seeing hundreds of decks a week, this automation can cut manual data entry workloads by over 80%.

For a fund processing 50 pitches weekly, that is 10+ hours of analyst time recovered—time better spent on due diligence and sourcing.

Beyond speed, automation enhances accuracy. The typical error rate for manual data entry is 1-4%. An automated system can achieve 99.959% to 99.99% accuracy, virtually eliminating data entry errors.

The goal is to eliminate low-value screening work. By removing repetitive parsing and logging, your team can focus its entire effort on high-value judgment. This is about getting to a 'yes' or 'no' faster, with clean, consistent data to support the decision.

By implementing an automated extraction and population process, you build a faster, more intelligent deal flow engine. From the moment a deck arrives, your team has the structured data needed to make sharp, informed decisions—a significant competitive advantage.

Weaving Automation into Your Team's Daily Rhythm

An automation system is only valuable if it integrates seamlessly into your team's existing workflow. The output must be immediately actionable within the tools your team already uses for communication and decision-making, primarily Slack.

A lightweight integration via Zapier Webhooks provides an effective notification loop. The moment a new record is created in a CRM like Affinity, a webhook fires a summary to a dedicated Slack channel (e.g., #new-deals).

Streamlining Approvals Right Inside Slack

This integration can be extended to create an informal approval gate within Slack, saving partners from logging into the CRM to review every new deal.

An effective Slack notification should be a scannable brief:

- Company Name and one-liner

- Founder names

- Key metrics (ARR, funding stage)

- A direct link to the new Affinity record

Action buttons or emoji reactions (👍 for "worth a look," 👀 for "assign to analyst," 👎 for "pass") allow senior partners to stay engaged with deal flow without leaving their primary workspace, turning a multi-step process into a single click. Similar workflows can be built for other modern CRMs like Attio.

Moving Beyond "Time Saved" to Hard ROI

"Saving time" is a soft metric. To justify an automation stack, you need hard data demonstrating its impact on pipeline velocity. A real-time dashboard is essential for this.

Your dashboard should be a diagnostic tool, not a vanity board. It must provide a quantitative view of your pipeline's health, throughput, and efficiency to prove the ROI of your automation stack.

The intelligent document processing market is projected to hit $6.78 billion by 2025. For VCs, where manual entry can account for 80% of reducible administrative effort, a tool like Pitch Deck Scanner can save 5+ hours per person per week with a 97% success rate. For more context, see these insights on document processing trends.

To translate these benefits into tangible results, your dashboard must track key metrics:

- Processing Success Rate: The percentage of inbound decks processed without manual intervention. Target: 95%+.

- Time to CRM: The average lag between email receipt and a structured record appearing in your CRM. This should be measured in minutes, not hours.

- Team Throughput: The number of deals processed per week or month, demonstrating increased capacity without additional headcount.

Tracking these numbers allows you to shift the conversation from a vague "I feel more productive" to a concrete "We are now processing 40% more deals with the same team." You can explore practical examples in our guide on CRM data examples.

Manual vs. Automated Deal Entry ROI

For a firm reviewing 100 new deals per week, the difference is stark:

| Metric | Manual Data Entry (Per Week) | Automated System (Per Week) |

|---|---|---|

| Analyst Time Spent | 5-8 hours | < 30 minutes |

| Cost (Analyst Time) | ~400 (at 50/hr) | ~$25 |

| Time-to-CRM | 24-48 hours | < 5 minutes |

| Data Error Rate | 5-10% | < 1% |

| Missed Opportunities | High (due to lag/errors) | Low |

Automation fundamentally changes the economics of deal flow, freeing up your team's most valuable resource—their time—to focus on building relationships and making better investment decisions.

Ensuring Enterprise-Grade Security and Compliance

Granting programmatic access to your firm’s deal flow requires absolute trust in the platform's security architecture. For venture capital firms, where deal confidentiality is paramount, enterprise-grade security is non-negotiable.

Secure access begins with OAuth 2.0 authentication. This standard is critical because it allows the system to connect to your inbox without you ever sharing login credentials, eliminating a primary security risk.

Protecting Your Data at Every Stage

Data protection must be multi-layered, covering data both in transit and at rest.

Critical security protocols include:

- End-to-End Encryption: All data must be encrypted during transit (TLS 1.2 or higher) and while stored (AES-256), rendering it unreadable even in the event of an infrastructure compromise.

- Logical Data Isolation: Your firm's data must reside in a separate logical container, with no possibility of cross-contamination with another firm’s data, ensuring strict confidentiality.

- OWASP-Aligned Practices: The platform’s code must be developed following the Open Web Application Security Project (OWASP) Top 10 guidelines, demonstrating a commitment to defending against common security vulnerabilities.

The guiding philosophy must be zero trust. A secure automation platform operates as if threats are everywhere, implementing strict controls at every layer to protect your firm’s most valuable asset: its information.

Any platform built for serious investment firms understands that security is an ongoing commitment to protecting the integrity of your deal flow, enabling you to automate core operations with confidence.

Common Questions We Get About Automation

Investment teams often have practical questions about how automation handles the nuances of real-world deal flow. Here are the most common ones.

How Do You Handle Password-Protected DocSend Links?

Password prompts are a common bottleneck. A robust automation system handles this seamlessly. The platform securely stores the necessary credentials to access, download, and process password-protected DocSends automatically. The deck is analyzed without any manual intervention required from your team.

What if the AI Gets Something Wrong?

No AI is perfect. That's why a "human-in-the-loop" validation step is essential. If the system has low confidence in an extracted data point, it flags the item for manual review in a simple dashboard. This means your team isn't reviewing every deck—they’re only checking the 1-3% of exceptions, maintaining high data quality while maximizing time savings.

How Long Does It Take to Set Up and Connect to Our CRM?

Onboarding is fast. Modern platforms connect with a few clicks. You authorize inbox access via OAuth 2.0 and connect your CRM with an API key. A guided interface then helps you map the extracted fields to your CRM. The entire system can be live, from inbox to CRM, in under an hour, with no engineering resources required from your firm.

Can We Extract Custom Fields Specific to Our Thesis?

Yes. While standard fields like "funding stage" are pre-configured, best-in-class solutions allow you to define custom extractions. You can train the AI to identify specific keywords, unique metrics, or data patterns critical to your fund's investment thesis, ensuring the data flowing into your CRM is directly relevant to your decision-making process. For a broader look at this topic, you can find answers to other common business automation questions.

The bottom line is that modern automation is built to handle the specific, often messy, workflows of VC. It’s designed to solve real-world problems like password-protected links and data validation, freeing up your team to focus on making smart decisions, not doing clerical work.

Stop wasting hours on manual data entry. With Pitch Deck Scanner, you can automate your entire deal ingestion pipeline, from inbox to CRM, in minutes. See how much time your firm can save by starting a free 21-day trial today at https://pitchdeckscanner.com.