Automating the manual components of your deal flow isn't about generic productivity gains; it's about reallocating your most valuable asset—analyst and associate time—toward high-judgment work. The objective is to deploy technology for predictable, rules-based tasks so your team can focus on complex diligence, founder relationships, and thesis development. This starts by identifying the manual bottlenecks in your deal pipeline and implementing tools that eliminate administrative drag, allowing you to scale deal flow without scaling headcount.

Move Beyond Manual Deal Flow Intake

The daily influx of pitch decks is the lifeblood of a venture firm, but the manual processing required is a significant operational drag. Every inbound email represents a potential opportunity buried under clerical work: open email, download deck, find key data, manually enter it into your CRM. This isn't just inefficient; it's a strategic bottleneck that introduces lag into your entire investment cycle.

This administrative load has a quantifiable cost. An analyst spending hours each week on data entry is an analyst not sourcing proprietary deals, meeting with founders, or conducting deep market research. This time drain is precisely why firms are adopting intelligent automation to eliminate the manual intake process.

The True Cost of Manual Processing

The cost of managing deal flow by hand extends beyond lost hours. It directly erodes your firm's competitive edge and compromises pipeline data integrity.

Here’s the operational impact:

- Delayed Time-to-Review: Every minute a promising deck sits unread in an inbox is a minute a competitor could be engaging that founder. Manual processing creates a critical lag between a deal's arrival and its initial evaluation.

- Inconsistent Data Entry: When multiple team members log deals, data formats and completeness inevitably vary. This "dirty data" degrades the quality of your pipeline, making it impossible to run meaningful analytics or identify trends. Our guide on https://pitchdeckscanner.com/blog/automated-data-entry details how to establish a single source of truth.

- Missed Opportunities: In the rush to clear an inbox, critical details are easily overlooked. A key metric on slide 17 or a notable angel investor can be missed in a cursory manual scan, leading your team to pass on a high-potential deal.

The broader market is aggressively tackling this problem. The automation software market, valued at USD 22 billion in 2023, is projected to grow at a 16.79% CAGR through 2031. This trend reflects a universal push to eliminate repetitive work. It’s the core function of tools like Pitch Deck Scanner, which connects to your email via OAuth 2.0 to automatically detect, parse, and structure deals directly into your CRM.

The goal is not to replace analyst judgment. It's to eliminate the administrative friction that impedes it. Effective automation delivers a fully parsed, structured, and ready-to-analyze deal record, empowering your team to function as evaluators, not data entry clerks.

To identify the highest-value opportunities, we've mapped common VC time sinks to their corresponding automation solutions.

Mapping Manual Tasks to Automation Opportunities

| Manual Task (The Problem) | Time Cost (Per Week) | Automation Solution (The Fix) |

|---|---|---|

| Opening emails, downloading decks, and entering company info into a CRM. | 5-10 hours | An email-to-CRM tool like Pitch Deck Scanner that auto-parses decks and creates new deal records. |

| Manually updating pipeline stages and sending follow-up emails. | 3-5 hours | CRM workflows (e.g., in HubSpot or Affinity) that trigger automated follow-ups based on stage changes. |

| Compiling weekly/monthly pipeline reports from CRM data into spreadsheets. | 2-4 hours | A tool that can automate repetitive Excel reporting by pulling live data directly from your CRM. |

| Researching founder backgrounds, company funding, and market size for every deal. | 4-6 hours | An integrated data enrichment tool (like Clearbit or PitchBook) that automatically appends company and contact data to CRM records. |

As illustrated, the opportunities extend far beyond initial intake. By identifying and automating these chokepoints, from deck processing to reporting, you transform your pipeline from an administrative burden into a strategic asset.

Building Your VC Automation Framework

Effective automation requires re-engineering a process, not just plugging in a new tool. For an investment team, this means moving beyond ad-hoc fixes and building a structured system that actively eliminates low-value work. A solid framework ensures you’re making targeted improvements that accelerate deal flow and improve data quality—not just automating for its own sake.

The first step is a clinical audit of your current deal flow process. Map every single step: from the moment an email with a pitch deck lands in an inbox to the point that deal is fully logged and enriched in your CRM. Document the clicks, the copy-pasting, and the context-switching that consumes analyst time.

This audit isn't about creating a flowchart; it's about identifying points of friction. Where do deals stall? Where does manual data entry introduce errors? These are your primary targets for automation.

Prioritize for Maximum Impact

Once you've identified the bottlenecks, prioritize ruthlessly. A simple matrix scoring each repetitive task on two critical factors is highly effective:

- Time Savings: Quantify the hours your team would reclaim each week if this task were automated. For example, if your team manually processes 50 decks a week at 10 minutes per deck, that's over 8 hours of analyst time weekly—a significant win.

- Implementation Complexity: Assess the effort required to automate. Connecting a specialized tool like Pitch Deck Scanner to your inbox is low complexity. In contrast, building a custom script to scrape proprietary data sources is high complexity.

Start with tasks in the high-impact, low-complexity quadrant. These quick wins build momentum and demonstrate the value of automation to the partnership. Initial email-to-CRM data entry for new pitches almost always falls into this category, delivering a massive ROI for minimal effort. For a deeper look at this systematic approach, this guide on how to automate repetitive tasks is a great resource.

The objective is a virtuous cycle: the time saved from the first automation frees up capacity to tackle the next, more complex challenge. Don't aim to build a perfect end-to-end system from day one. Aim for one meaningful improvement by next week.

Select the Right Technology Stack

Your tech stack should support your framework, not dictate it. Avoid distractions from feature-rich but irrelevant tools. Focus on a few non-negotiable criteria for a VC firm.

Your tools must be:

- Secure and Compliant: This is table stakes. Insist on tools that use modern, secure protocols like OAuth 2.0 for connecting to core systems like your email server. This obviates password sharing and allows for instant, granular access control. Enterprise-grade encryption and adherence to security standards like OWASP are minimum requirements.

- API-Driven and Integration-Friendly: The tool must integrate with your existing systems. Native integrations with your CRM (whether it's Affinity, Attio, or another platform) are essential. Flexibility is also key; look for connectivity through tools like Zapier Webhooks to build custom actions, such as notifying a partners-only Slack channel with key deal summaries.

- Focused on the Job-to-be-Done: Select tools designed for your specific problem. A generic automation platform can be powerful but often requires extensive setup and maintenance. A purpose-built solution for deal flow intake will deliver value much faster.

Launch a Pilot Program

De-risk the implementation with a small, controlled pilot program. Select one or two forward-thinking team members—an analyst and an associate, for instance—to test the new automated workflow for a defined period, such as two weeks.

Assign clear objectives to the pilot. Is the goal to reduce time-to-first-review by 50%? Or to eliminate data entry errors for all their inbound deals?

Solicit continuous feedback during the pilot. Identify what works seamlessly and what edge cases arise. This feedback is crucial for fine-tuning the workflow and creating a practical playbook before a firm-wide rollout. A successful pilot not only validates the technology but also creates internal champions who will drive adoption across the firm.

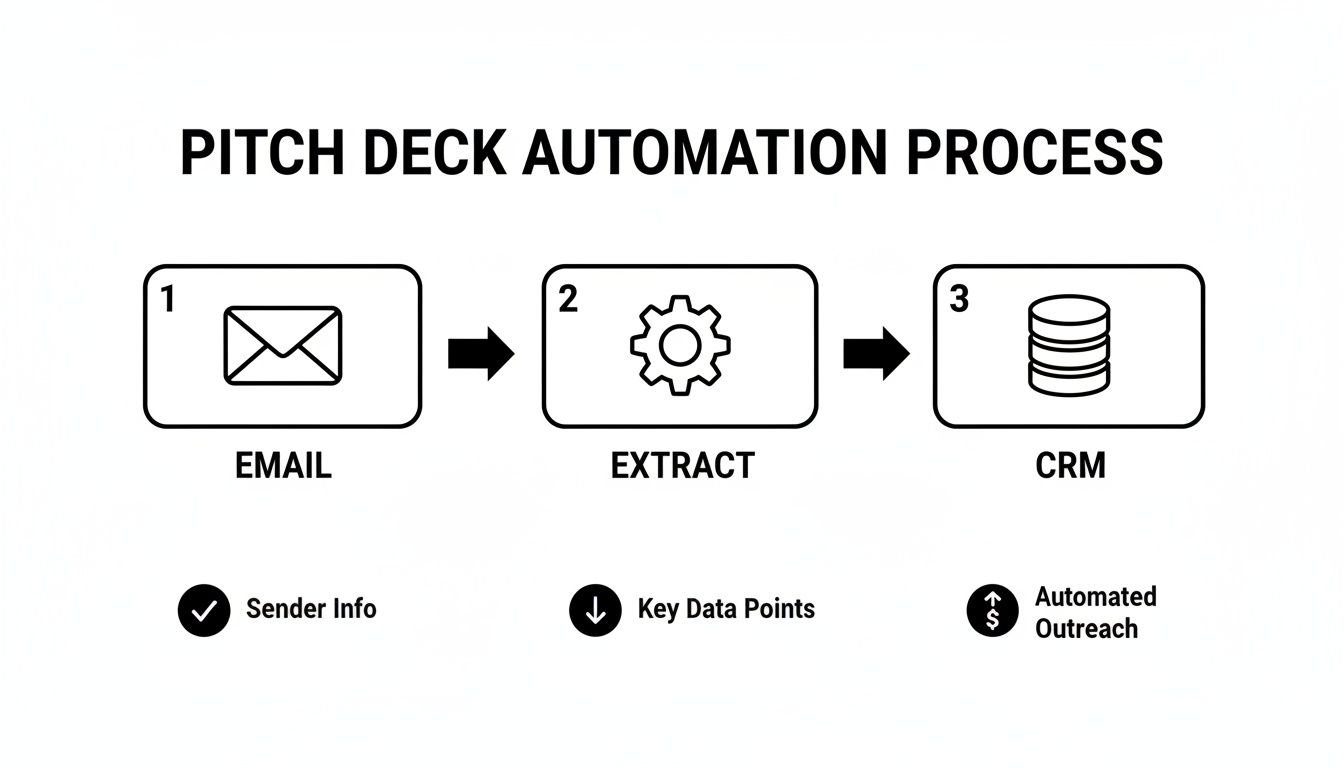

Bringing Your Automation Playbook to Life: From Email Inbox to Enriched CRM

With the framework established, let's apply it to a real-world scenario: automating the entire pitch deck intake process to transform a high-volume, tedious task into an intelligent, hands-off workflow.

The objective is simple: eliminate manual chaos. The desired state is a system where every inbound deal is automatically parsed, structured, and prepared for high-level review.

The first step is connecting a specialized tool to your firm's deal flow inbox. This must be done securely using OAuth 2.0, the standard for granting application access without sharing email passwords. Once connected, the system acts as a persistent monitor, scanning all incoming emails in real time.

Turning Unstructured Decks into Structured Data

The automation begins with detection. The system must intelligently identify emails containing pitch decks, whether as PDF attachments or links to platforms like DocSend.

Handling these links—especially password-protected ones—is a non-negotiable feature for any serious VC tool. It eliminates the process of manually entering passwords and taking screenshots simply to get a deck into your system.

Once the tool accesses the deck, its AI-driven extraction engine begins. This is where unstructured content—slides with text, charts, and team bios—is converted into clean, structured data points.

Key data to extract includes:

- Company Vitals: Founder names, HQ location, and sector.

- Traction Metrics: Crucial KPIs like ARR, user growth, or other quantitative data presented.

- Funding Information: The ask, current stage (Pre-Seed, Seed, Series A), and prior investors.

- Team Composition: Headcount, key hires, and founder backgrounds.

This process effectively converts a 30-page PDF into a structured data object, ready for ingestion by your firm's CRM.

The aim is to automate the extraction of facts, not opinions. The AI should pull objective data like "ARR is $1.2M" or "Team size is 15." This leaves the subjective analysis—"Is this a good team?" or "Is this valuation reasonable?"—where it belongs: with your investment team.

The momentum behind this technology is significant. The broader industrial automation software market is expected to grow from USD 40.83 billion in 2025 to USD 59.71 billion by 2029. This trend is mirrored in specialized VC software, where tools like Pitch Deck Scanner are achieving 97% success rates on DocSend processing, demonstrating the reliability of modern AI for these critical workflows. You can dive deeper into the automation software market's growth on Mordor Intelligence.

Creating and Supercharging the CRM Record

With structured data extracted, the final step is populating your CRM. Instead of an analyst manually creating new company records, the system executes this instantly.

Here’s what that integrated flow looks like inside a CRM like Affinity after a deck has been processed.

A new organization is created automatically, populated with notes, files, and key data points extracted from the pitch deck, eliminating hours of manual entry.

A robust automation flow ensures the new record contains all extracted data, attaches the original pitch deck file, and logs the founder's email body as the initial note. This creates a complete, consistent, and error-free entry for every inbound deal. For firms using different platforms, understanding the mechanics of a Salesforce and Gmail integration provides a useful technical roadmap.

Effective automation doesn't stop at data entry. The final step is enrichment. Once the initial record is created, the system should automatically query public data sources like LinkedIn, PitchBook, or Clearbit to append additional context. This can fill in crucial details not found in the deck, such as founder work histories, total funding to date, or recent company news.

This end-to-end process compresses a task that takes an analyst 10-15 minutes per deck down to seconds. Multiplied across hundreds or thousands of inbound deals annually, the reclaimed time is substantial. It frees your team to focus exclusively on their core function: finding and funding the next category-defining company.

Go Beyond Just Counting the Hours You Save

Saving an analyst 5+ hours per week is a clear win, but focusing solely on time saved misses the strategic impact of automation. It's equivalent to judging a race car by its paint job while ignoring its performance metrics.

To understand the true ROI, you must track the KPIs that drive investment performance: pipeline velocity, data quality, and deal flow capacity. These metrics shift the conversation from simple efficiency to building a sustainable competitive advantage. They differentiate between being busy and being effective.

This flow illustrates how automation transforms a chaotic inbox into a structured, intelligent pipeline within your CRM.

This "ingest, extract, and log" model is the core of effective deal flow automation, converting minutes of manual labor into a process that runs in seconds, 24/7.

Strategic KPIs to Track for VC Automation

Move beyond basic time tracking with a more sophisticated, dashboard-driven view of your pipeline's health.

- Time to First Review: This is your speed-to-lead metric. It measures the time from when a pitch deck email arrives to when it's fully processed, enriched, and ready for analyst review in your CRM. Reducing this from days to minutes means you engage top founders before competitors are even aware of the opportunity.

- Pipeline Data Integrity: Automation eliminates inconsistent data entry. Measure this by tracking the percentage of deal records with complete, accurate data (e.g., funding stage, sector, founder details). High-quality data is the foundation of any credible data-driven investing strategy.

- Deal Throughput: This measures capacity. How many deals can your team process per quarter without increasing headcount? A 20-30% increase in throughput means you are seeing a larger portion of the market, which directly increases the probability of identifying an outlier.

The strategic advantage of automation is not just doing the same tasks faster. It's enabling your firm to handle a higher volume and quality of work without scaling operational costs, which is critical for staying competitive in a crowded market.

To measure the full business impact, you need a framework connecting automation directly to investment operations.

ROI Metrics for VC Workflow Automation

This table breaks down the key metrics for measuring the full impact of automation on your investment operations.

| Metric | What It Measures | Why It Matters for VCs |

|---|---|---|

| Hours Saved Per Analyst | The reduction in manual work hours (data entry, scheduling, follow-ups). | Frees up analysts for high-value work like due diligence, founder meetings, and market research. |

| Time to First Review | The time from receiving a pitch deck to it being fully processed and ready for review. | A shorter cycle time means you engage with promising startups faster than competitors, gaining a first-mover advantage. |

| Deal Throughput Increase | The percentage increase in deals processed per period without adding headcount. | Expands your market coverage and increases the statistical probability of finding outlier investment opportunities. |

| Data Error Rate | The reduction in manual data entry errors within your CRM. | Ensures your pipeline data is clean and reliable, which is critical for accurate reporting and trend analysis. |

| Sourcing Channel ROI | The efficiency and quality of deals coming from different automated sources. | Helps you double down on high-performing sourcing channels and optimize your firm's overall deal flow strategy. |

Tracking these metrics provides a complete, quantifiable narrative of how automation improves not just efficiency, but your firm's overall investment performance.

Seeing the ROI in Real-Time

A live dashboard is essential for tracking these metrics. It should provide an instant snapshot of processing statuses, success rates (e.g., DocSend links successfully parsed), and overall pipeline velocity. This transparency builds trust in the system and gives partners a clear, data-backed view of the firm’s operational capabilities.

The market data confirms this trend. The market for sales force automation software, which powers CRM updates, is projected to grow from USD 12.80 billion to USD 31.92 billion by 2032. This growth is driven by the value firms see in tools that seamlessly structure data in platforms like Affinity. The entire automation software market—projected to grow from USD 36.6 billion in 2025 to USD 181.7 billion by 2034—signals a fundamental shift in how high-stakes work is conducted. You can read more in this detailed sales force automation software report.

By measuring these advanced KPIs, you can prove that automation is a strategic asset that builds a more reliable, responsive, and intelligent deal pipeline—transforming an administrative function into a data-driven investment machine.

Essential Security and Integration Practices

Automating a critical workflow like deal intake requires a serious assessment of security and system architecture. Connecting a third-party tool to your email server and CRM is a significant decision that impacts your operational integrity. You are granting access to highly sensitive data, and you need absolute confidence in the platform's security posture.

Fortifying Your Automation Engine

The first point of scrutiny is how an automation tool connects to your systems. Any serious security discussion begins with authentication.

The non-negotiable standard is OAuth 2.0. This protocol allows you to grant specific, limited permissions to a tool without ever sharing your email or CRM passwords. If a vendor asks for direct password credentials, it is an immediate disqualifier. With OAuth 2.0, you retain control and can revoke access instantly.

Beyond the initial connection, your data must be secured at every stage:

- Encryption in Transit and at Rest: Data moving between your systems and the automation platform must be encrypted with strong protocols like TLS 1.2+. Data stored on the platform's servers should be protected by robust encryption, such as AES-256.

- Data Isolation: Your firm's data must be logically—and preferably physically—isolated from other customers' data to prevent any possibility of cross-contamination or leaks.

- Adherence to Security Standards: Verify that the platform develops its software according to established security frameworks, like the Open Web Application Security Project (OWASP). This indicates a proactive approach to defending against common vulnerabilities.

Security isn't a feature; it's a prerequisite. Your automation stack must be as secure as any other component of your firm's infrastructure. Anything less introduces unacceptable risk to your deal flow, founder relationships, and firm reputation.

Seamless Integration with Your Existing Stack

An automation tool that doesn't integrate cleanly with the systems your team already uses creates more friction than it removes. The goal is an interconnected system where data flows reliably and automatically.

Native integrations are the gold standard. A platform with a direct, API-based connection to your CRM—be it Affinity, Attio, or another leader—is essential. These native connections ensure accurate data mapping and a seamless flow of information from a parsed pitch deck into a new CRM record.

However, no two firms operate identically. Your process likely has unique steps or notification requirements, which is where integration flexibility becomes critical.

Building Custom Workflows Without Code

For unique operational requirements, the ability to connect to a broader ecosystem of tools is crucial. This is often accomplished via Zapier Webhooks, a powerful method for sending data from your automation platform to thousands of other applications.

This flexibility allows you to build custom, multi-step workflows without involving an engineering team. For example, you could configure a rule that:

- When a new deal from a "high-priority" source is processed, an action is triggered.

- That action pushes a deal summary to a dedicated

#deal-flow-alertschannel in Slack. - The message automatically tags the relevant partner for immediate review.

This workflow ensures high-potential deals receive partner-level attention in minutes, not days, bridging the gap between automated intake and human decision-making. By combining robust native CRM integrations with the flexibility of webhooks, you create an automation engine that not only saves time but also makes your firm smarter and faster.

Answering Your Top Automation Questions

Adopting automation for deal flow naturally raises questions. We're discussing your firm's core operational function, so a healthy level of diligence is expected. Here are the most common concerns from investment teams.

Will We Miss Important Nuances in a Pitch Deck?

No—provided the automation is implemented correctly. The purpose is not to replace human insight but to augment it. A well-designed tool functions like a highly efficient junior analyst, handling the extraction and organization of objective data points: team size, funding history, market, and key metrics.

This frees your team to focus immediately on subjective analysis, where true value is created: the narrative, the founder's vision, and the product's unique positioning. Automation handles the "what," freeing up cognitive resources for the "so what?" It also ensures every deck receives a consistent initial screening, preventing quality deals from being overlooked due to human fatigue.

How Hard Is It to Plug These Tools into Our Current Systems?

Modern automation tools are designed for seamless integration. The best platforms offer native, API-driven connections to common VCs CRMs like Affinity or Attio. For email, they use secure standards like OAuth 2.0, enabling access with a few clicks and no password sharing.

For custom workflows, integrations with tools like Zapier act as a universal connector to thousands of other applications. This allows you to build rules like, "When a new deal is processed, create a new row in this Airtable base" without writing any code.

A typical setup and pilot can be live in under an hour. The goal is to deliver immediate time savings, not to create another protracted IT project.

What’s the Real Learning Curve for Our Team?

The learning curve is minimal because the best automation operates in the background. Your team's primary interface—the CRM—remains the same. Instead of manually creating a new record in Affinity, they will find a fully populated record waiting for them.

The operational shift is from data entry to data verification and analysis. The main "learning" required is breaking the habit of manual processing. Quality tools provide a transparent, real-time dashboard so the team can see what is being processed, building trust and encouraging adoption.

It's less about learning a new piece of software and more about unlearning the muscle memory of low-value, repetitive work. By removing this clerical burden, your team can operate at a higher, more strategic level.

Ready to eliminate the administrative drag from your deal flow? Pitch Deck Scanner connects directly to your inbox to automatically parse pitch decks, extract key data, and create enriched, ready-to-review records in your CRM. Start your 21-day free trial and see how much time your team can save.