The standard Salesforce Gmail integration is designed for sales teams, not venture capital firms. It’s built for a linear sales process, not the high-velocity, document-centric workflow of evaluating inbound pitches. This mismatch forces VCs into manual data entry, wasting time that should be spent on diligence.

Why Standard Integration Fails VC Deal Flow

For an investment team, the inbox is the primary source of deal flow. The standard integration, however, treats Gmail as a place to log activities, not the origin of an opportunity. It has no concept of what an inbound pitch deck is—it sees a PDF or a DocSend link as just another email attachment requiring manual logging.

This creates an immediate bottleneck. An analyst sifting through dozens of inbound decks must repeatedly stop, open the Salesforce sidebar, and manually create Accounts, Contacts, and Opportunities for each one. This repetitive data entry consumes hours that are better spent screening companies. The constant context-switching between reading a deck and CRM administration kills momentum and invites errors.

The Manual Data Entry Problem

The core issue is a lack of intelligent parsing. The out-of-the-box tool cannot:

- Recognize a Pitch Deck: It has no way to distinguish a 20-slide PDF deck from a one-page invoice. To Salesforce, they are all just "attachments."

- Extract Key Information: It won’t automatically pull the company name, founder details, or funding stage from the content of the deck itself.

- Handle Secure Links: It provides no native way to process password-protected DocSend links, a common format for sharing sensitive materials.

This isn't a minor inconvenience; it's a drag on the firm’s efficiency. Any productivity gains from a basic integration are lost when the workflow actively obstructs the user. Low CRM adoption is a direct result of systems that fight against, rather than accelerate, the core workflow. This is the classic conflict for VCs: a high-speed, unstructured inbox clashing with the slow, manual demands of a CRM.

The image above captures this conflict. Opportunities flood into Gmail, while structured fields wait in Salesforce. The gap between them represents hours of lost productivity and, more critically, potentially missed deals. Bridging this gap requires more than a basic connector; it demands an intelligent automation layer. For a detailed breakdown of what this structured data should look like, see our guide on essential CRM data examples for investment teams.

Configuring the Integration for Venture Capital

A standard, out-of-the-box Salesforce and Gmail setup is insufficient for a VC firm. The default settings are built for traditional sales, not investment professionals managing a complex deal flow. To make the integration work for your firm, you must customize it for the realities of venture.

First, do not enable it for everyone. A firm-wide rollout is a mistake. Be selective. Activate the integration only for user profiles that require it: Partners, Associates, and Analysts. This keeps the system clean, simplifies training, and improves security by limiting access to those directly managing the pipeline.

Taming Einstein Activity Capture

Einstein Activity Capture (EAC) automatically syncs emails and calendar events. Left unconfigured, its "sync everything" approach will flood your CRM with noise—internal meetings, lunch plans, and irrelevant calendar invites.

Be surgical with your settings to maintain a clean signal:

- Exclude Your Domain: Add your firm’s domain to the exclusion list. This immediately stops internal back-and-forth from cluttering deal records.

- Refine Calendar Sync: Configure settings to sync only events that involve external contacts. This keeps internal 1-on-1s private but ensures every founder meeting is logged.

- Set Sharing Defaults: Start with a restrictive setting like "View and Edit My Activities." This allows team members to collaborate on shared deals without making every individual's calendar public to the firm.

When configured correctly, EAC provides a powerful view of your team's network and activity.

This relationship map becomes a strategic asset. It instantly reveals who on your team has the strongest connection to a founder or key contact at a target company—critical intelligence for securing a warm introduction.

Mapping Data to Your Deal Flow Objects

Here is where a generic setup completely fails VCs. The integration is pre-built to log emails against standard objects like 'Leads' and 'Contacts'. Your firm likely operates on custom objects like 'Deals', 'Portfolio Companies', or 'Opportunities', with unique fields such as 'Deal Source', 'Investment Stage', or 'Industry Vertical'.

You must customize the email application pane to match your workflow. Use the Lightning App Builder to redesign the Gmail sidebar so it surfaces your custom objects and fields.

The objective is to eliminate manual data entry. When an analyst logs an email from a promising founder, they must be able to link it directly to a 'Deal' record and update the 'Investment Stage' from 'Initial Screen' to 'First Meeting'—all without leaving Gmail.

This level of customization is not optional; it is essential for an efficient process. If you are establishing your systems, it is worth investigating the best CRM for venture capital to ensure your core platform is built for these requirements from day one.

To fully secure your operations, pair this integration with a robust cloud-based document management system. This ensures every pitch deck and due diligence file is stored and managed securely. When correctly configured, your Gmail integration transforms from a clumsy sales tool into a high-powered command center for your deal flow.

Turning an Inbound Deck into an Actionable Record

With Gmail and Salesforce connected, the objective shifts from merely linking systems to creating a seamless path from a founder’s email to a structured record in your CRM. This is about eliminating the manual work that clogs your deal flow pipeline.

The out-of-the-box integration lets you log an email against a Salesforce record, but that’s all. It still requires an analyst to manually create the company record, copy-paste details, and upload the pitch deck. For a firm receiving dozens of inbounds weekly, that is a significant time sink. The solution is to automate the entire handoff.

Automating the Initial Screen

Imagine an email with a pitch deck arrives. Instead of an analyst spending 15 minutes on manual data entry, an intelligent automation tool begins processing the email and its attachments instantly.

This automation layer can:

- Identify and Extract Key Data: It reads the PDF or DocSend link to pull out essentials—company name, founder details, funding stage, and industry.

- Create Structured Records: It uses that extracted data to automatically create a new 'Deal' or 'Opportunity' in Salesforce, populating the custom fields your team uses.

- Attach Source Files: The original pitch deck is automatically attached to the new record, eliminating the download/re-upload cycle.

This fundamentally changes how your team handles inbound deals. The backlog of emails awaiting manual processing disappears, replaced by a clean, consistent feed of structured deals flowing directly into your CRM.

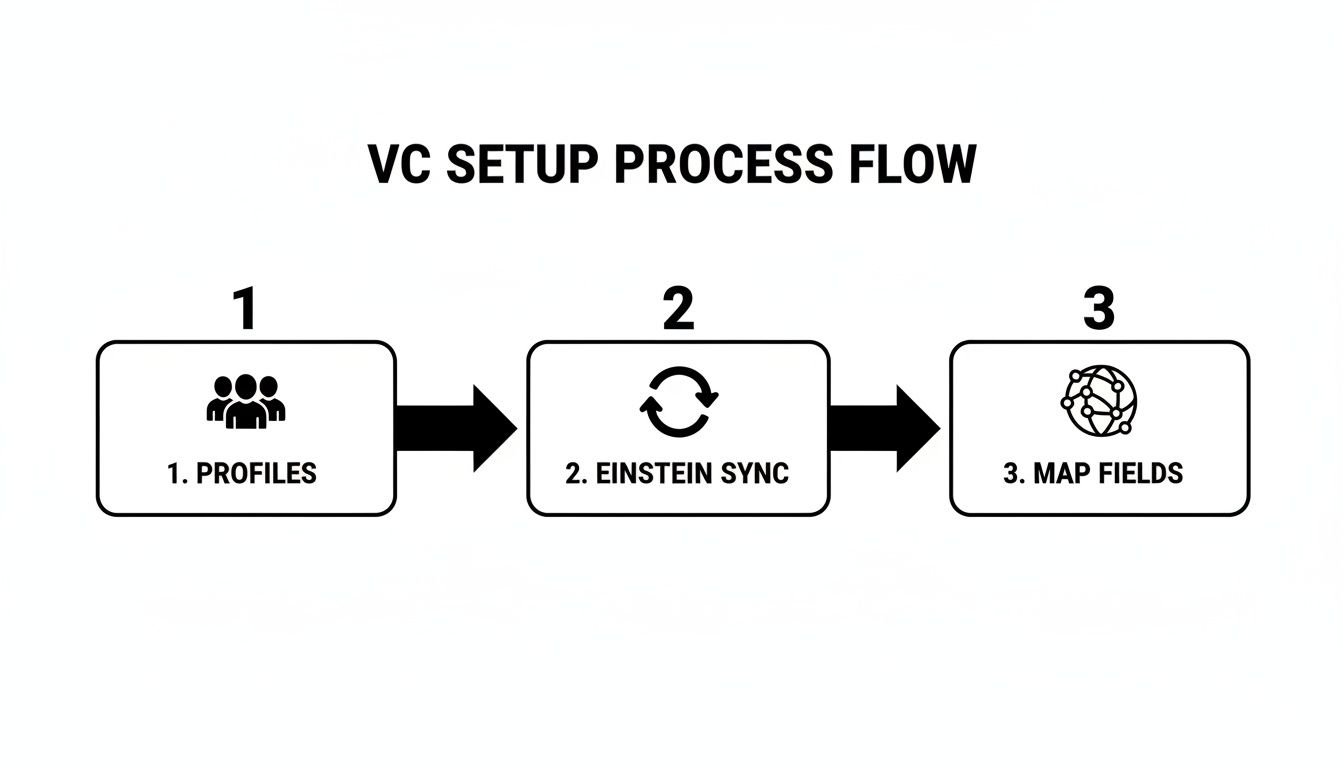

The process flow below illustrates the key components of a VC-optimized setup, from user profiles to the automated sync that drives it all.

This demonstrates how critical a deliberate setup is. Correctly configured user profiles and sync settings are the foundation for any effective data mapping and automation.

From Unstructured Data to Actionable Insight

The power of this approach lies in how it handles unstructured data. A pitch deck is a narrative in a PDF, which traditional software cannot interpret.

By adding an intelligence layer to your Salesforce Gmail integration, you’re not just logging an email. You’re turning an unstructured narrative into a structured, queryable asset. That inbound deck is no longer just a file—it’s a rich data source.

Consider an analyst who receives 15 inbound decks before the Monday partner meeting. With a manual process, they might screen three or four. With an automated parser, all 15 are logged as structured opportunities in Salesforce before the first meeting begins. The team can then evaluate companies based on consistent data, not on who types fastest.

This shift gets your team out of data entry and back to data analysis, where they create value. For the technical details, our guide on how to extract data from PDF documents dives deeper into the mechanics. The result is a faster, more reliable screening process that ensures a quality deal never gets lost in an administrative bottleneck.

Securing Your Deal Flow and Communications

For an investment firm, data integrity and confidentiality are paramount. Connecting your primary communication channel (Gmail) to your system of record (Salesforce) demands that security be integral, not an afterthought.

The primary challenge is preventing accidental data leaks while enabling workflow efficiency. Your first line of defense is at the connection point: OAuth scopes. When a user authorizes their account, they grant Salesforce specific permissions. Review these scopes meticulously. Avoid granting "full access" if the integration only requires "read/write" for specific records. Every unnecessary permission is a potential vulnerability.

Controlling Access Within Salesforce

Once an email is in Salesforce, the next priority is controlling its visibility. User profiles and permission sets are your primary tools. Your default sharing model should be locked down, with access granted on a need-to-know basis.

A proven structure:

- Role-Based Profiles: Establish distinct profiles for Analysts, Associates, and Partners. An analyst may only need to see and edit their assigned deals, while a partner requires visibility across the entire pipeline.

- Permission Sets for Sensitive Deals: For highly competitive or confidential deals, use permission sets to grant temporary access to a small, dedicated group. This ensures communications related to that deal remain isolated to the core team.

This granular control prevents sensitive LP communications or portfolio company updates from being accidentally exposed to the entire firm.

A well-configured permission model ensures your Salesforce Gmail integration enhances deal flow visibility for the right people without compromising the confidentiality your firm's reputation depends on.

Fine-Tuning Einstein Activity Capture

Einstein Activity Capture is powerful for automating email sync but can become a compliance risk if left unconfigured. You must align its behavior with your firm's policies.

First, define what gets captured. Add your firm's domain to the exclusion list to prevent internal communications from being logged in Salesforce.

More importantly, configure the sharing settings correctly. For a VC or private equity firm, the "Share with Everyone" option is almost never appropriate. Rely on the "Share with My Groups" setting to align email visibility with specific deal teams or funds.

Ultimately, your emails must land in the right inbox. To ensure critical deal communications reach founders and avoid spam filters, a solid Email Deliverability Guide is an essential resource. A proactive approach to security protects your proprietary deal flow and maintains the trust of founders and LPs.

Troubleshooting Common Integration Roadblocks

Even a well-configured Salesforce and Gmail integration can encounter issues, particularly within a VC's demanding workflow. Here are the most common problems investment teams face and how to resolve them quickly.

A frequent issue is when an analyst attempts to log an email, but a custom object like 'Deal' or 'Pipeline' is missing from the Gmail side panel. This is not a bug but a configuration oversight.

The fix is typically in the Salesforce publisher layout. Go to Setup > Object Manager, find the relevant object (e.g., 'Deal'), and ensure the "Log Email" action has been added to its page layout. This makes the object available for logging within Gmail.

Another common problem arises when automation encounters a password-protected DocSend link. Automated tools cannot bypass this security, halting the data extraction process.

The solution is a smarter process, not a more complex tool. For these protected links, configure a simple manual flag or task in Salesforce, such as "Manual Deck Review Required." When a protected link is detected, this task automatically alerts an analyst to intervene. This prevents the deal from being dropped while the rest of your automated flow continues.

This hybrid approach is highly effective. Automation can handle 90% of inbound decks, while a human-in-the-loop process manages exceptions.

Resolving Sync and Logging Errors

When an email logs to the wrong record or fails to sync, the cause is often Einstein Activity Capture's association logic. EAC attempts to connect emails to the correct contacts and accounts but can be confused by common names or a contact associated with multiple open opportunities.

Instill a simple habit with your team to combat this. For critical emails, use the manual association feature in the Gmail sidebar. Instead of relying solely on automatic sync, explicitly link an important email to the correct 'Deal' record. This two-second action prevents crucial information from being misplaced in the wrong activity timeline.

Finally, the "side panel won't load" issue is almost always local to the user's browser.

Before escalating to an admin, run through this checklist:

- Clear Browser Cache: Stale cached data is a common source of authentication conflicts.

- Check for Conflicting Extensions: Ad blockers or other extensions can interfere with the Salesforce pane. Disable them to test.

- Re-authenticate: Log out of the Salesforce extension and log back in to refresh the session token.

These steps resolve the majority of loading issues, allowing your team to focus on evaluating deals, not IT support.

Common Questions from VCs

Here are answers to strategic and operational questions VCs have when implementing the Salesforce Gmail integration.

Does Einstein Activity Capture Store Our Email Content on Salesforce Servers?

Yes. When you use Einstein Activity Capture (EAC), it processes and stores a copy of your email and event data on Salesforce's AWS infrastructure. This is necessary for its automated activity syncing features.

For firms with strict data handling requirements, it is critical to review Salesforce's data residency and security policies. Configure EAC’s sharing settings carefully to control data visibility and ensure compliance without sacrificing the efficiency of automated logging.

How Can We Handle Deal Flow From Multiple Inboxes Into a Single Salesforce Pipeline?

This is a common scaling challenge. As a firm grows, so does the number of inboxes receiving pitches. The solution is to centralize intake with a dedicated deals@yourfirm.com email address.

Configure this central inbox to auto-forward new emails to the appropriate team members. Then, use Salesforce assignment rules—triggered by keywords or sender information—to automatically route the new deal record to the correct analyst.

For more advanced automation, connect tools directly to this central inbox via API or OAuth. This allows for automated processing of every inbound deck, creating structured records and ensuring no opportunity is missed, regardless of volume. It standardizes the intake process and eliminates manual chaos.

Can the Integration Differentiate Between a Pitch Deck and a Regular PDF Attachment?

The native Salesforce Gmail integration cannot. It treats all attachments identically, forcing your team to manually open and review each file to determine if it is a pitch deck. This creates a significant bottleneck in the screening process.

Specialized tools built for VCs solve this problem. They use pattern recognition and AI to specifically identify pitch decks, ignoring irrelevant attachments like invoices. These systems then extract key data from the deck to populate the opportunity in Salesforce. This distinction is the key to truly automating the top of your deal funnel.

Stop drowning in manual data entry. Pitch Deck Scanner automates the entire process of turning inbound pitch decks from Gmail into structured, actionable deals in your CRM. See how much time your team can save by visiting our website.