Your inbox is flooded with inbound decks from technology investment banking contacts. It's a pipeline of potential exits, but also a significant operational bottleneck. Every minute your team spends manually parsing PDFs and logging deals into a CRM is a minute not spent sourcing, vetting, or supporting portfolio companies.

This guide provides a framework for leveraging technology investment banking relationships effectively, focusing on the tactical insights needed to drive returns for your LPs.

The Strategic Role of Technology Investment Banking

As a VC, your role is cultivating value over years. A technology investment banker’s role is transactional and focused: engineering a successful sale or public offering within a tight window. They are the architects of the exit, retained to build a competitive market around a portfolio company to maximize its crystallized value.

Their engagement signals a portfolio company's transition from the growth stage to the exit stage.

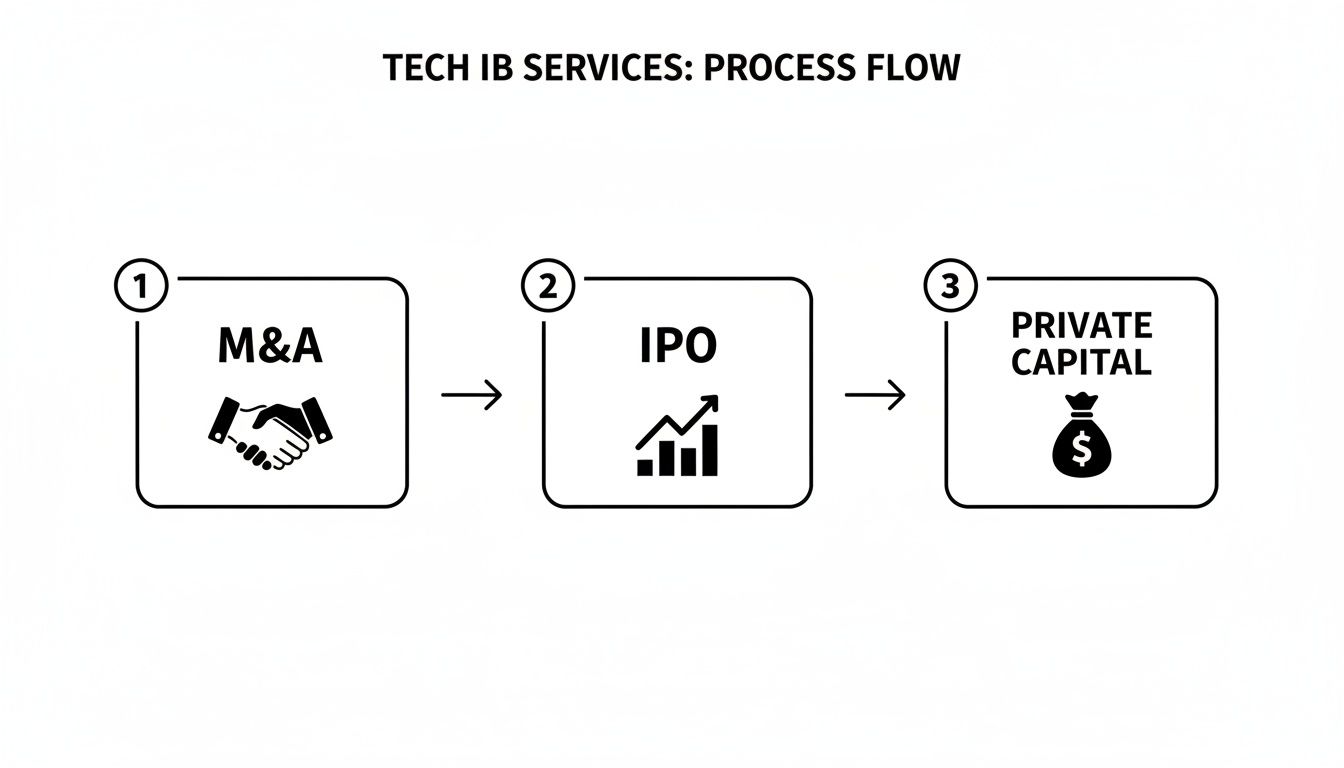

The Three Pillars of TIB Services

Technology investment banking services are tailored to the major liquidity events a venture-backed company will face.

Here is a direct breakdown of their core offerings:

- Mergers & Acquisitions (M&A) Advisory: Bankers manage the entire sale process. They create marketing materials, confidentially identify and approach potential buyers, and drive negotiations on valuation and terms. Their involvement converts a potentially chaotic process into a structured, competitive auction designed to maximize price.

- Initial Public Offerings (IPOs): For companies mature enough for public markets, bankers act as underwriters. They navigate regulatory filings (S-1), craft the roadshow narrative, and manage the stock's pricing and debut.

- Private Capital Raises: For late-stage growth rounds (e.g., Series C+), tech investment bankers can run a process to bring in major capital from non-traditional sources like hedge funds, sovereign wealth funds, or large corporate VCs. Our guide on investment bank technology provides a closer look at these institutional functions.

The core distinction is objective. A VC invests capital and expertise to build long-term enterprise value. A technology investment banker is engaged to crystallize that value through a specific, high-stakes transaction.

Technology is a primary engine of the global economy. In 2025, global M&A volumes hit around $4.3 trillion. Technology M&A consistently constitutes a significant portion of this, often 20–25% of all announced global deal value. You can dive deeper by reading the full global dealmaking review from J.P. Morgan.

Understanding the players and processes that drive these outcomes is critical for VCs.

Key Technology Investment Banking Services for VCs

| Service | Strategic Goal for VCs | Optimal Engagement Stage |

|---|---|---|

| M&A Advisory | Maximize exit valuation through a competitive sale process. | Late-stage; when considering a sale to a strategic or financial buyer. |

| IPO Advisory | Achieve a successful public market debut and secure liquidity. | Mature growth stage; strong revenue and predictable growth. |

| Growth Equity | Secure significant late-stage capital to fuel pre-IPO growth. | Late-stage private (e.g., Series C+); funding scale before an exit. |

Knowing when and how to engage a technology investment bank is a key strategic advantage for any venture capital firm aiming to consistently generate top-tier returns.

Navigating the TIB Deal Lifecycle

Understanding the investment banking playbook is essential when guiding a portfolio company through a transaction. This isn't a chaotic sprint; it's a carefully choreographed process designed to maximize outcomes while mitigating risk. Knowing the flow allows you to anticipate banker needs, interpret updates correctly, and provide founders with decisive advice.

The core services—M&A, IPOs, and private capital raises—each have a distinct timeline and set of milestones.

Let's break down the path from mandate to close.

From Bake-Off to Engagement

The process begins with the "bake-off," where multiple investment banks pitch for the mandate. As a VC on the board, you will sit with founders as banks present their track record, industry knowledge, and valuation perspectives. Your experience is vital in helping founders look past aggressive pitches to select the bank with the most credible strategy.

Following selection, the engagement letter is signed. This binding contract officiates the relationship, detailing the scope of work, success fees, and other key terms. This is the starting gun for the entire process.

Understanding the Deal Team Hierarchy

Miscommunication with the banking team often stems from not knowing who to contact for what. Banking teams are hierarchical; understanding the roles allows you and your founders to get the right information from the right people, quickly.

- Managing Director (MD): The senior partner. The MD sources the deal, provides high-level strategic counsel, and leads critical negotiations.

- Director / Vice President (VP): The project manager. VPs execute the day-to-day process, manage junior bankers, and serve as the primary point of contact for company leadership and the board.

- Associate: The analytical engine. Associates build the financial models, draft marketing documents (e.g., Confidential Information Memorandum), and manage the due diligence process.

- Analyst: The frontline. Analysts handle foundational tasks: data compilation, presentation formatting, and data room organization.

As a VC, direct your questions appropriately. For strategic concerns, engage the MD or VP. For a specific query on a financial model assumption, the Associate is your direct line. This respects their workflow and optimizes everyone's time.

Executing the Transaction

Once the engagement letter is signed, execution begins. For an M&A deal, the team creates marketing materials and initiates confidential outreach to a curated list of potential buyers. For an IPO, the focus shifts to drafting the S-1 registration statement and preparing for the investor roadshow. This phase is intense and document-heavy.

Due diligence is the most demanding stage. Potential buyers or public market investors will scrutinize everything—tech stack, IP, customer contracts. As a board member, your role is to ensure the company is prepared, responsive, and transparent, identifying potential red flags before they can derail the transaction.

Finally, the deal moves toward closing. This involves final negotiations, extensive legal documentation, and securing all necessary approvals. Whether it culminates in ringing the bell at Nasdaq or signing the definitive purchase agreement, that moment is the outcome of a meticulous process run by the technology investment banking team.

Mastering Tech Valuation and Diligence

Valuing a tech company is a mix of art and science. While traditional methods like Discounted Cash Flow (DCF) analysis are still used, technology investment banking focuses on metrics that narrate growth, efficiency, and future potential.

You don't need to build a banker's LBO model, but you must understand the key valuation drivers and diligence red flags. Addressing weaknesses in your portfolio companies long before a banker is engaged leads to a smoother and more lucrative exit.

Core Valuation Methodologies in Tech Deals

Bankers triangulate a defensible valuation by using multiple methodologies.

- Public Comparables ("Comps"): Benchmarking against similar publicly traded companies using multiples like Enterprise Value to Revenue (EV/Revenue). The key is selecting the right peers with similar growth profiles, margins, and business models.

- Precedent M&A Transactions: Analyzing what similar companies have sold for previously. This is a powerful tool, particularly in M&A, as it reveals premiums strategic buyers are willing to pay for market share, proprietary technology, or engineering talent.

- SaaS and Subscription Metrics: For software businesses, recurring revenue is paramount. Bankers scrutinize metrics signaling a healthy, predictable business, as they are a direct proxy for future cash flow.

The numbers must validate the narrative. A high LTV/CAC ratio is not just a metric; it's proof of a capital-efficient growth engine. A net revenue retention rate exceeding 120% demonstrates product stickiness and expansion, telling a story that earns a premium valuation.

Sector-Specific Diligence Checkpoints

Due diligence is where the narrative is stress-tested. Beyond standard financial audits, technology investment banking diligence dives deep into operational and technical specifics. Scrutiny varies by niche. For anyone preparing for a transaction, a deep understanding of the venture capital due diligence playbook from a buyer's perspective is non-negotiable.

Here’s a breakdown of what matters most in key tech verticals.

Valuation Metrics and Diligence Focus by Tech Sub-Sector

The table below highlights how primary valuation drivers and critical diligence questions differ across tech sectors.

| Tech Sub-Sector | Primary Valuation Metric | Critical Diligence Checkpoints |

|---|---|---|

| Enterprise SaaS | ARR / Revenue Multiples | Churn rates, Net Revenue Retention (NRR), LTV/CAC ratio, customer concentration, and sales cycle efficiency. |

| Consumer Internet | Monthly Active Users (MAUs), GMV | User acquisition cost (CAC), engagement metrics (e.g., DAU/MAU), cohort retention, and monetization strategy. |

| Hardware / IoT | Gross Margin, EBITDA Multiples | Supply chain resilience, bill of materials (BOM) costs, IP ownership and defensibility, and product roadmap viability. |

| Fintech | Gross Payment Volume (GPV), AUM | Regulatory compliance, fraud and loss rates, technology stack scalability, and data security protocols (e.g., SOC 2). |

The focus shifts dramatically. A SaaS acquirer will spend days examining customer contracts to verify ARR. A hardware buyer will audit the supply chain for component risk and margin erosion. As a VC, your job is to ensure founders are prepared with clean, defensible answers for every question. This de-risks the transaction and signals readiness for a professional process.

How Market Trends Are Shaping Tech Deals

Technology investment banking is constantly shaped by macroeconomic forces and sector-specific catalysts. For VCs, monitoring these trends is fundamental to advising founders on positioning, market timing, and realistic exit expectations.

Knowing which way M&A and IPO winds are blowing can mean the difference between a top-decile return and a missed liquidity window.

Currently, the market demands quality and predictability. The "growth-at-all-costs" era has been replaced by a focus on efficient growth, a clear path to profitability, and defensible recurring revenue. This shift is a primary determinant of which companies command premium valuations.

The New Premium on Efficiency and AI

The market has bifurcated. While overall deal volume fluctuates, there is intense demand for companies demonstrating two key attributes: capital efficiency and a defensible AI advantage.

Companies with strong net revenue retention and low customer acquisition costs are viewed as durable, predictable assets, making them prime targets for both strategic acquirers and private equity.

Simultaneously, the AI narrative is driving real valuation premiums, but only for companies with proprietary, difficult-to-replicate technology. Acquirers are aggressively seeking AI that can be integrated into their product suites or used to enhance internal operations. This provides a significant advantage to companies that have moved beyond simple API integrations. The impact of AI SaaS companies is fundamentally altering industry valuations and investment theses.

This provides clear directives for VCs and their portfolio companies:

- Substantiate AI Claims: Be prepared to prove the uniqueness and efficacy of your AI during diligence.

- Highlight Efficiency: Lead pitches with hard data on LTV/CAC, magic number, and net dollar retention.

- Articulate Your Moat: Clearly define how your technology provides a durable competitive advantage that cannot be easily replicated.

Private Equity as a Primary Exit Path

Another dominant force is the rise of private equity as a primary buyer of tech companies. PE firms, holding significant dry powder, have become the default exit for many mature, VC-backed software businesses. Their perspective differs from that of a corporate strategic.

Private equity buyers underwrite predictable cash flow, not speculative synergies. They acquire stable, growing software companies with the intent to optimize operations, execute bolt-on acquisitions, and exit within a three- to five-year hold period.

This directly influences how a company should be prepared for a sale. While a strategic buyer might pay a premium for disruptive technology, a PE firm will pay a premium for a well-oiled machine with a loyal customer base. Identifying likely buyer archetypes early allows you to help founders emphasize the right strengths long before a formal M&A process begins.

Navigating Regulatory Headwinds

Finally, increased regulatory scrutiny, particularly for large-cap tech M&A, cannot be ignored. Antitrust regulators globally are examining transactions more closely, especially when a dominant tech player acquires a smaller competitor. This has extended deal timelines and introduced a new layer of risk.

For VCs, this requires assessing the regulatory risk profile of potential acquirers. An exit to a mid-sized strategic or a PE firm may offer a higher certainty and faster path to close than a blockbuster sale to a Big Tech company, even at a slightly lower headline valuation. This calculus is a vital piece of advice for founders weighing their options in the current market.

Automating Your Inbound Banker Deal Flow

The constant flood of pitch decks from investment banking contacts is a high-quality problem. It represents a pipeline of opportunities, but also a massive operational drag on your firm.

Analysts and associates burn hours opening PDFs, chasing DocSend links, extracting key metrics, and manually entering data into your CRM. This isn't just tedious work; it's a direct tax on their ability to focus on high-value activities like deep diligence and thesis development. Every minute spent on data entry is a minute not spent sourcing or evaluating a potential investment.

Shifting from Manual Review to Automated Intake

This is where specialized platforms provide a solution. Instead of your inbox serving as a chaotic to-do list, these tools act as an automated front door for your deal flow. They are designed to ingest deals in the format bankers send them—from direct PDF attachments to password-protected DocSend links.

The objective is to transform an unstructured firehose of emails into clean, structured data ready for analysis.

- Automatic Parsing: The system identifies emails containing pitch decks, then automatically retrieves the file or follows the link to access the content.

- Data Extraction: It processes the deck, extracting critical information: company name, sector, funding stage, key metrics like ARR or team size, and contact details.

- CRM Integration: Finally, it creates a new, fully populated deal record in your CRM, attaching the original deck without manual intervention.

A 15-minute manual task becomes a 15-second automated action. At scale, the cumulative time savings are immense, freeing your junior team to function as true analysts rather than data entry clerks. To optimize your firm's central nervous system, review our guide on selecting the best CRM for investment bankers.

Beyond Data Entry: Enrichment and Intelligence

Modern intake automation extends beyond data entry. Once an initial company profile is created, the system can enrich it with publicly available data, providing instant context to accelerate initial screening.

The dashboard above offers a real-time view of your inbound pipeline, showing what has been processed, what data has been extracted, and where each deal stands in your workflow—a level of clarity impossible to achieve from an inbox.

The goal is simple: by the time an analyst reviews a new opportunity, the foundational data is already organized and enriched. This enables a quick "go/no-go" decision based on substance, not a scavenger hunt for information buried in a slide.

This capability is part of a broader trend where technology is altering the economics of both investment banking and venture capital. For example, generative AI is becoming a standard tool for M&A teams to surface insights more rapidly. In this environment, automated systems are no longer a luxury but a competitive necessity.

Ultimately, automating your inbound deal flow is about building a more disciplined, data-driven, and efficient investment machine from the very first touchpoint. For more ideas on using technology to sharpen operations, explore these diverse business process automation examples.

A VC's Guide to Tech Investment Banking: Your Questions Answered

As a venture capitalist, you operate at the intersection of innovation and high-stakes finance. When your world collides with the structured, transactional process of technology investment banking, specific questions arise. We'll bypass the basics and address what you need to know to manage deal flow and guide your portfolio.

When Should My Portfolio Company Hire a Banker vs. Running an M&A Process Internally?

This is a critical judgment call. A founder-led process is viable only in narrow circumstances, such as a simple acqui-hire or a straightforward tech tuck-in with a pre-existing strategic partner where price maximization is not the sole objective.

However, that approach carries significant risk.

You engage a technology investment banking team to create a competitive market to drive valuation. A banker’s primary value is not making introductions, but orchestrating a disciplined, confidential auction. They possess the network to bring multiple, credible buyers to the table—including non-obvious candidates—and the expertise to manage a complex process without distracting the CEO from running the business.

The trade-off is control versus value. An internal process offers more direct founder control but almost always leaves money on the table. A banker-led process introduces a third party but is purpose-built to discover a company's true market clearing price.

How Do I Vet a Technology Investment Bank for a Specific Exit?

Vetting a bank goes beyond league tables. For a specific portfolio company, your diligence must be surgical. Disregard the bank's overall tech M&A volume. Request a list of deals the specific partners have personally closed in your company’s sub-sector within the last 18-24 months.

During the bake-off, ask the Managing Director these three non-negotiable questions:

- “Who are the three most likely buyers for this company, and describe your direct relationship with the key decision-makers there?” A vague answer is a major red flag.

- “Who from the junior team—the VP and Associate—will be dedicated to this deal daily?” You must confirm that the A-team in the pitch is the execution team.

- “Based on the current market, what is a realistic valuation range, and what specific recent transactions support that view?” This cuts through the sales pitch and tests their real-time market intelligence.

How Much Influence Does a VC Really Have in a Banker-Led Process?

Your influence is substantial but must be wielded intelligently. As a major shareholder and board member, your primary role is to align the board and management on strategic goals before the process begins. This includes establishing a clear valuation floor and defining the characteristics of an ideal partner.

Once the process is underway, act as a strategic advisor and a backchannel. Let the bankers run the formal process. You can leverage your network to gather intel on potential buyers or provide air cover for the CEO during difficult negotiations. The most significant error is attempting to run point yourself, which undermines the bankers and creates confusion. Trust the process, but be prepared to intervene at critical junctures.

What’s the Most Common Mistake VCs See Founders Make During an Exit?

The most common and costly mistake is emotional decision-making. Founders' deep personal investment in their companies is understandable, but it becomes problematic when it leads to fixation on a single "brand name" acquirer, a headline valuation, or minor deal terms. This emotional attachment can cause them to dismiss a superior offer from a less prestigious but more strategic buyer.

Your role as a VC is to be the objective voice of reason. You must gently but firmly remind the founder of their fiduciary duty to all shareholders. Use data to evaluate offers, not gut feelings. You must be the one who can translate the complex terms and risks presented by the bankers into a clear, logical decision-making framework for the founder.

Navigating technology investment banking demands sharp insights and even sharper tools. To eliminate the administrative burden of manual deal intake and ensure your team focuses only on the most promising opportunities, consider Pitch Deck Scanner. See how you can automate your inbound pipeline by visiting https://pitchdeckscanner.com to start a free trial.