A well-structured startup pitch deck template is a tool for efficiency. For VCs, the best decks are defined by information density and clarity, enabling a rapid, accurate assessment of a business in minutes, not hours.

The New Standard for High-Velocity Pitch Decks

Inbound deal flow is a firehose. The core challenge is surfacing high-potential deals while efficiently filtering noise. A standardized deck structure isn't about stifling creativity; it's about respecting the operational realities of an investment team. It enables a quick, accurate first pass. The right template helps a founder transmit key data points, respecting the fact that an investor's time is their most constrained asset.

A modern deck is built for rapid screening, whether by an analyst or an automated system. It surfaces the essential data points needed for a fast "yes" or "no" on a first meeting, eliminating the email back-and-forth for basic information like ARR or team composition. Before the slide-by-slide breakdown, it's worth understanding what a pitch deck is in the context of today's deal flow.

Shifting from Pure Storytelling to Data Delivery

The old "10-slide rule" is evolving. Brevity is still critical, but the deck itself often is the pitch, reviewed asynchronously long before a founder speaks. The document must stand on its own, leaving zero room for ambiguity.

The data confirms this. An analysis of over 1.3 million investor presentations found that while decks around 10 slides have the highest completion rate (32%), investor engagement remains strong for decks up to 18 slides. After that, attention drops precipitously. This highlights the need for a template that is both concise and comprehensive, balancing a narrative with the hard data required for evaluation. You can review the research behind pitch deck engagement directly.

The goal of a modern pitch deck isn’t just to tell a story. It’s to deliver a structured, machine-readable data packet that allows an investment team to make a rapid, informed decision on whether to allocate further resources.

The Anatomy of a Scannable Deck

An optimized deck is designed for one purpose: rapid information extraction. It's built with the understanding that the first pass isn't a deep dive; it's a high-speed scan for specific signals. Key information isn't buried in prose or obscured in a complex chart. It's presented in a standard format that tools like Pitch Deck Scanner can parse in seconds.

For an analyst or associate, this structured approach is a workflow accelerant. It’s the difference between a deck that flows directly into a CRM and one requiring 15 minutes of manual data entry.

Core Components for a 3-Minute Deck Scan

When a deck lands in the inbox, an analyst is scanning for non-negotiable data points. If these core elements are missing or difficult to locate, the deck is often passed over. This table outlines the absolute requirements for that initial screen.

| Slide / Section | Essential Information | Red Flag if Missing |

|---|---|---|

| Problem / Solution | Clear, concise statement of the pain point and your unique fix. | Vague problem description; solution feels like a feature, not a business. |

| Market Size | TAM, SAM, SOM with credible sources. | No market sizing or wildly inflated numbers without justification. |

| Traction / Metrics | Key metrics (ARR, MRR, # Users, MoM Growth). Use a simple chart. | No quantifiable progress; metrics are hidden or confusingly presented. |

| The Team | Photos, titles, and 1-2 bullet points of relevant experience for each founder. | No team slide, or bios are filled with irrelevant experience. |

| The Ask | How much you're raising and a high-level use of funds. | The "ask" is missing, unclear, or disproportionate to the stage of the company. |

A deck that provides these five points cleanly enables a fast, confident decision to allocate more time or pass. It respects the screening process and demonstrates the founder understands what matters.

A Slide-By-Slide Breakdown of the Definitive Template

A pitch deck should be treated as a structured data packet. For VCs processing hundreds of decks a week, the ones that get meetings are those that facilitate rapid extraction of essential information. A deck following a standard, logical flow doesn't just present a better narrative; it dramatically reduces friction in the initial screening process.

That screening process is a high-speed funnel. Any friction, like a missing metric or a confusing slide, introduces delays and increases the probability of a pass.

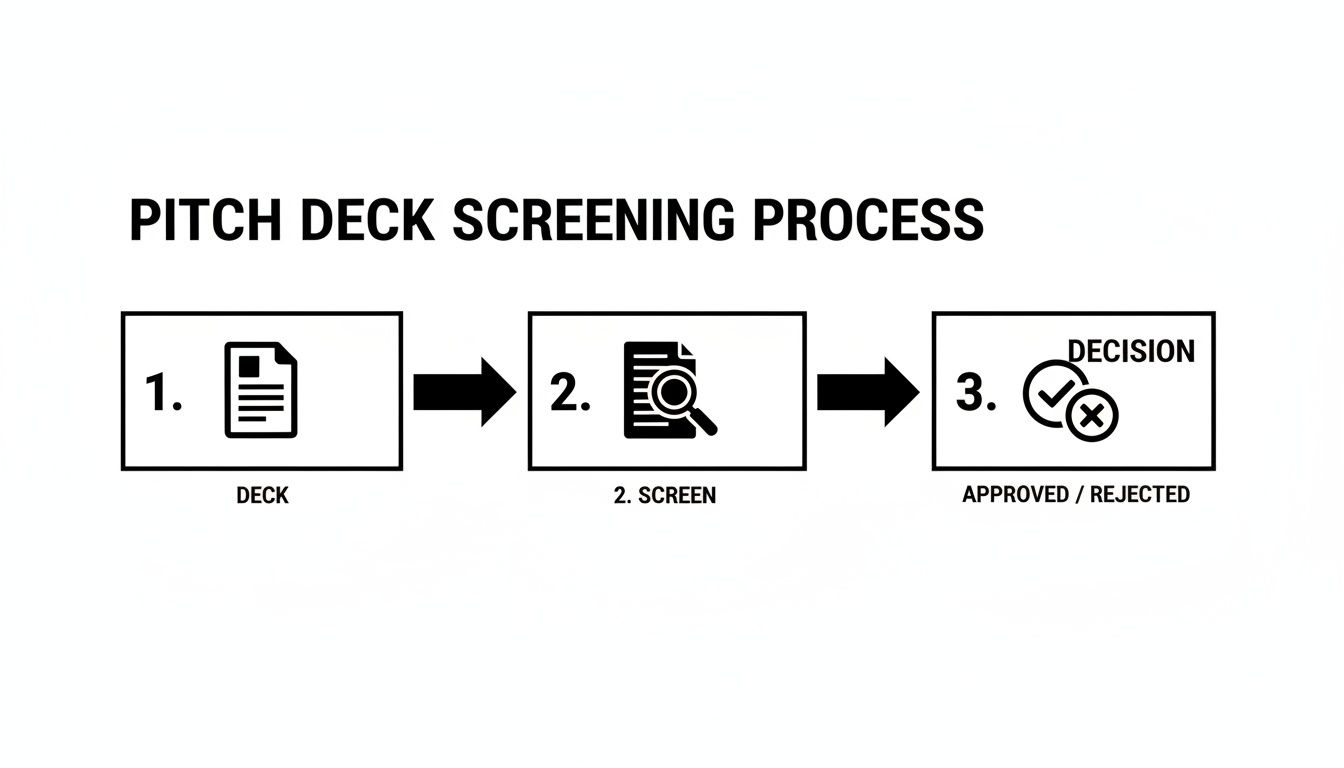

This is a visualization of the typical screening workflow.

The path from receipt to a first decision must be efficient. A standard template is the most effective tool for reducing friction at the critical "Screen" stage.

This breakdown is built for that reality, prioritizing clarity and optimizing each slide for both a quick human scan and automated tools like Pitch Deck Scanner.

Slide 1: Company Vision

The title slide must do more than display a logo. It must instantly answer, "What is this?" in a single sentence. Avoid jargon in favor of a clear, high-level statement explaining what you do and for whom.

- Headline: The one-liner is key. "AI-powered logistics optimization for last-mile delivery fleets."

- Essential Data: Company name, logo, contact info.

- Common Mistake: Vague taglines like "Reimagining the future of delivery." This communicates nothing and forces the reviewer to work to understand the core business.

Slide 2: The Problem

The objective here is to establish the urgency and scale of a real, quantifiable pain point. A strong "Problem" slide does not require domain expertise to be understood. Frame it in terms of money, time, or lost opportunity for a specific customer.

For example, "Managing freelance payments is difficult" is weak. Quantify it: "SMBs waste 15 hours per month and lose 2% of revenue on payment processing errors for contractors." This specificity makes the problem tangible and demonstrates market understanding.

A great problem slide doesn't just describe a challenge; it establishes the economic imperative for a solution. It's the hook that justifies the entire business case that follows.

This slide provides critical context for automated systems to categorize the company and identify its core value proposition.

Slide 3: The Solution

This slide must be a direct answer to the problem just defined. Present the product as the clear, elegant solution, but avoid a feature list. Explain how you solve the specific pain points mentioned.

Use 3-4 bullet points to outline the main benefits.

- For Example:

- Automates invoice processing and payments, cutting manual work by 90%.

- Integrates directly with existing accounting software, eliminating data entry errors.

- Provides a single dashboard for tracking all contractor payments and compliance.

A clean visual, like a hero shot of the dashboard, is more impactful than a dense block of text. The goal is an "aha" moment in seconds.

Slide 4: Market Size (TAM, SAM, SOM)

Investors need to see an opportunity large enough to generate venture-scale returns. Logically break down the market into Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM).

- TAM (Total Addressable Market): The total global demand (e.g., The global market for freelance platform software).

- SAM (Serviceable Addressable Market): The segment you can serve with your business model (e.g., The market for freelance platforms in North America).

- SOM (Serviceable Obtainable Market): The portion you can realistically capture short-term, based on a bottom-up GTM plan.

Cite your sources. Whether it's Gartner, Forrester, or proprietary analysis, showing the work builds credibility. A simple graphic is superior to a list of numbers. This slide is also critical for data extraction; use clear labels like "TAM," "SAM," and "SOM" to ensure correct mapping to the firm's CRM.

Slide 5: Product Demo

Make the solution tangible. Avoid embedded videos—they often break, create large files, and are unreadable by automated tools. A better approach is a series of 3-5 clean, well-annotated screenshots walking through a core user journey.

Showcase the product's "magic." If the key is a powerful analytics dashboard, show it. If it's a seamless checkout flow, show those steps. Annotations should explain the benefit of what's on screen, not just describe the feature (e.g., "Track real-time savings," not "Analytics view").

Slide 6: Business Model

How do you make money? Be direct. State the pricing model and provide key numbers.

- Model: Subscription SaaS, Transaction Fee, Marketplace Rake, etc.

- Pricing: List your tiers (e.g., Basic: 49/mo, Pro: 99/mo, Enterprise: Custom).

- Key Metrics: If available, include core unit economics like Average Revenue Per User (ARPU), Customer Lifetime Value (LTV), and Customer Acquisition Cost (CAC).

A simple pricing table is the most effective format—easy for a human to read and perfectly structured for an automated tool to parse. Do not bury pricing in a long paragraph.

Slide 7: Go-To-Market Strategy

An idea requires a credible plan for customer acquisition. This slide must outline specific, tactical channels.

Avoid vague statements like, "We will use social media marketing." Be specific.

- Initial Channels: Direct sales targeting mid-market companies in the fintech sector.

- Scaling Channels: Content marketing focused on SEO for keywords related to contractor payment pain points; paid acquisition via LinkedIn targeting VPs of Finance.

- Partnerships: Integration partnerships with major accounting software platforms like QuickBooks and Xero.

This slide demonstrates operational thinking and a practical understanding of building a customer base.

Slide 8: The Team

Investors back people. This slide showcases the team behind the venture. Feature key founders with a photo, name, title, and 2-3 bullet points of highly relevant experience each.

Focus on what matters for this business: previous startup experience, key roles at well-known tech companies, or deep domain expertise. Omit hobbies and irrelevant job history. Academic degrees are generally less important than demonstrated execution ability.

Slide 9: Financials and Projections

This is the financial snapshot. It should provide a clear view of the company's health and trajectory. Use a simple table or chart to show key metrics for the past 1-2 years and project them out for the next 3-5 years.

Essential Metrics to Include:

- Revenue (broken down by source if possible)

- ARR / MRR (for SaaS businesses)

- Gross Margin

- EBITDA / Net Burn

- Total Customers or Users

Keep the formatting clean and ensure projections are based on realistic, defensible assumptions. An unsupported "hockey stick" growth curve is an instant red flag. The goal is to show a firm grasp of the business's financial levers.

Slide 10: The Ask

Close with a clear, direct ask. There should be zero ambiguity on this slide.

- The Ask: "We are raising a $2M Seed round."

- Use of Funds: Show the capital allocation with a simple pie chart or bullet points. Be specific.

- 40% Product & Engineering (Hire 4 engineers)

- 35% Sales & Marketing (Hire 2 AEs, expand paid acquisition)

- 15% Operations

- 10% G&A

This final slide confirms the company's stage and shows investors a thoughtful plan for deploying capital. A missing or vague "Ask" is one of the most common and easily fixable mistakes in any startup pitch deck template.

Identifying Founder Competence Through Data

A well-designed pitch deck gets a first look, but the substance of the data signals founder competence. The quality of the metrics presented is often the clearest indicator of an operator's command of their business, separating them from founders merely following a script.

A deck filled with vanity metrics like total app downloads or registered users, with no mention of active users, engagement, or cohort retention, is a significant red flag. It's not an innocent omission; it suggests a lack of understanding of what drives a sustainable business. The best founders present leading indicators of product-market fit.

From Vanity Metrics to Actionable KPIs

The real test is how a founder discusses unit economics and user behavior. A deck that immediately presents the LTV to CAC ratio, payback period, and gross margin signals financial discipline. This is often missing in early-stage pitches and finding it is a massive workflow accelerant.

A deck with clearly labeled cohort analysis charts showing improving retention, or a transparent acquisition-to-conversion funnel, eliminates the need for multiple follow-up emails. Furthermore, these clean, well-labeled data points are perfectly formatted for automated tools like Pitch Deck Scanner, allowing metrics to be logged directly into a CRM without manual entry. You can learn more about how this approach accelerates deal flow here: https://pitchdeckscanner.com/blog/data-driven-investing.

A founder who presents clear unit economics isn't just showing good numbers; they're demonstrating a fundamental understanding of their business levers. That's a signal of competence that no amount of storytelling can replace.

The Nuances of Vertical-Specific Data

"Good data" is not a one-size-fits-all concept. It shifts dramatically by industry, and evaluating a specialized venture requires a tailored lens. The data must speak to the core business model and the specific risks of that vertical.

- Deep Tech & AI: The focus is on technical milestones, model accuracy, or data moats, not necessarily early revenue. A chart showing a model's performance exceeding industry benchmarks is far more compelling than a weak MRR graph.

- ESG & Impact: These companies must balance financial projections with quantifiable impact metrics. Clear progress against specific Sustainable Development Goals (SDGs) or other accepted impact frameworks is non-negotiable.

- Marketplaces: Liquidity is everything. Key numbers are Gross Merchandise Value (GMV), take rate, and balanced buyer/seller growth. Cohort analysis showing sticky, repeat transaction behavior is critical to proving a network effect.

Industry data shows this specialization pays off. For instance, impact-focused startups have raised £45 million using templates tailored to ESG, while AI and data-driven startups have pulled in £120 million with decks that highlight their unique KPIs. The right startup pitch deck template reflects a founder's deep industry knowledge.

Founder Background as a Data Point

Ultimately, an investment is a bet on the team. The data in the deck is a powerful proxy for their competence, but their background provides essential context. The "Team" slide is a summary; a deeper dive into past roles and achievements can reveal patterns of success or highlight potential risks.

For a more complete, data-driven view of the people behind the pitch, a People Enrichment API can offer significant insight into their professional histories. This helps connect a founder's past experience with the story their data is telling. The synthesis of human and business data leads to the most informed investment decisions.

Making Your Pitch Deck Machine-Readable

A crucial, often-overlooked aspect of fundraising is how a deck is processed after submission. VCs increasingly use automated tools to extract key data from inbound decks directly into their CRM. The deck's format can either accelerate this process or relegate it to a slow, manual queue.

A well-formatted deck moves from inbox to analysis software in seconds. A messy one gets flagged, forcing an analyst to perform manual data entry—a bottleneck that delays evaluation. The primary culprits are inconsistent metric labels, text saved as images, and restrictive sharing permissions.

Nail Down Your Metric Labels

Data extraction software relies on consistency. Using "Annual Run Rate," "Yearly Recurring Rev," and "ARR" on different slides to describe the same metric creates ambiguity and forces a manual review.

The solution is simple: pick a standard, text-based label for every key metric and use it consistently. This single change ensures data is parsed correctly and mapped to the right fields in the VC's system.

- For Financials: Use standards: "ARR," "MRR," "GMV," and "CAC."

- For Market Size: Use the standard "TAM," "SAM," and "SOM."

- For Headings: Ensure titles like "Team" or "Financials" are actual text, not part of a background image.

Always Export as a Text-Based PDF

A common error is exporting a deck as a set of images bundled into a PDF. While it may look crisp, it's a black box to automated systems. The software is forced to use Optical Character Recognition (OCR) to "read" the text from the images, a slower and far less accurate process than parsing native text.

A text-based PDF is a machine-readable document. An image-based PDF is a collection of digital photographs. One enables instant data extraction; the other forces a machine to decipher pixels, adding friction and errors at the start of the review process.

When exporting from PowerPoint or Google Slides, choose the setting for "electronic distribution" or one that preserves selectable text. This is the most critical technical step for making a deck compatible with a modern VC's workflow. For more detail, you can read about how VCs extract data from PDF files.

Watch Out for Restrictive Sharing Settings

While DocSend is an industry standard, some security settings can unintentionally block automated systems. Requiring an email address to view the deck or disabling downloads will likely prevent tools like Pitch Deck Scanner from accessing the content.

The best practice is to use a direct link without an email gate. While security is important, overly restrictive settings often force an analyst to manually download or screenshot slides, defeating the purpose of an efficient, automated pipeline. The objective is a deck that is both compelling in content and technically seamless to process.

An Investor's Final Review Checklist and Downloadable Template

With a high volume of inbound decks, a standardized scorecard is essential for separating signal from noise. It enforces a rapid, disciplined "go/no-go" decision in minutes.

This checklist distills the preceding sections into the signals that matter: Is the problem clear? Is the market sizing credible? Does the founder know their numbers? This approach helps analysts spot red flags immediately and lets partners quickly validate whether a deal warrants further diligence.

The Final Go/No-Go Investor Checklist

This table serves as a first-pass filter, enforcing a baseline standard before allocating more team resources.

| Evaluation Criteria | Pass / Fail | Notes for Analyst |

|---|---|---|

| Problem & Solution Clarity | Can you explain the business to a colleague in one sentence? | |

| Market Size Credibility (TAM/SAM/SOM) | Are sources cited? Is the bottom-up SOM believable? | |

| Actionable KPIs vs. Vanity Metrics | Is LTV/CAC, cohort retention, or burn rate present? | |

| Team’s Relevant Experience | Does the team’s background directly address the problem? | |

| Clear Ask & Use of Funds | Is the funding amount and allocation logical for the stage? |

Once a deck passes this initial screen, further diligence can begin. For a comprehensive overview of the next phase, see our startup due diligence checklist.

Your Downloadable Toolkit

To streamline implementation, we have created two resources.

First, the checklist table above is available for download. Share it with your team to standardize your initial review process.

Second, we've created a clean, editable startup pitch deck template (PowerPoint and Google Slides). Send this to promising founders or portfolio companies to help them structure their story effectively, resulting in clearer, more data-rich decks for your pipeline.

Download the Checklist and Template Bundle Here

A Few Common Questions We Get from VCs

The sheer volume of decks reviewed reveals patterns and recurring questions about what separates a great deck from a merely good one. These are critical considerations for any VC aiming to build an efficient and effective screening process.

Here are the most common issues and our direct answers.

What's the Single Biggest Mistake You See in Pitch Decks?

A muddled "Problem" and "Solution." Founders frequently get lost in technical jargon or feature lists, burying the core concept. They fail to articulate a simple, painful problem and a clear, compelling answer.

For an analyst screening dozens of decks before lunch, a pitch that requires effort to understand its basic premise is an immediate pass. It signals the founder may struggle with communication when hiring talent, closing customers, or raising future rounds. A solid startup pitch deck template forces this clarity, making the core business understandable in under 30 seconds.

How Should a Deck Change from Pre-Seed to Series A?

The narrative shifts entirely from vision to validation.

A pre-seed pitch hinges on the "Team" and the "Market." The bet is on the founders' credibility and the size of the opportunity. The financials at this stage are about demonstrating thoughtful market analysis, not precise revenue forecasting.

A Series A deck is fundamentally different. It must be anchored in hard data.

- Traction is King: The deck must demonstrate product-market fit with data, not assertions.

- Show Me the Metrics: This means user growth charts, cohort retention data, real revenue (ARR/MRR), and solid unit economics (LTV/CAC).

- A Justified Ask: The "ask" is not for experimentation. It is for scaling proven acquisition channels.

By Series A, the deck's purpose is to prove the model works and is ready for significant capital to accelerate growth.

Are Video Embeds or Interactive Decks a Good Idea?

Almost never. While they may seem engaging in a live pitch, they are a liability for asynchronous review.

Embedded videos or interactive elements frequently break, create enormous file sizes, and are often skipped by time-constrained reviewers. More importantly for our workflow, automated pipeline tools like Pitch Deck Scanner cannot extract data from a video. A few well-chosen, annotated screenshots are far more effective for demonstrating a product. They convey the necessary information and are easily parsed by both humans and machines.

The golden rule for deck formatting is to prioritize clean information delivery over flashy multimedia. Stick to a standard, easily shareable PDF. This guarantees your key metrics and data points can be pulled into our systems without a hitch, moving your deck through the pipeline faster.

The goal is to remove every point of friction between the deck and a rapid, informed decision.

Stop wasting hours on manual data entry from pitch decks. Pitch Deck Scanner connects to your inbox, automatically extracts key data from PDFs and DocSend links, and creates structured deals in your CRM. Reclaim your time and never miss a promising deal again. Start your 21-day free trial.