Your firm's most valuable asset isn't capital—it's your team's time. Yet, hours are burned daily on the repetitive, low-value work of screening inbound pitch decks. This guide isn't about the abstract concept of investment bank technology. It’s a direct playbook on how VCs can apply battle-tested principles from high-finance to eliminate workflow friction and gain a tangible edge. We’re skipping the fluff and addressing the core problem: the firehose of inbound deals burying the opportunities that actually matter.

Stop Drowning in Decks: Turn Your Inbound Funnel into an Asset

Every minute an analyst spends opening a PDF, hunting for a TAM slide, or manually copy-pasting founder details into your CRM is a minute they aren't spending on deep diligence or building founder relationships. This isn't just inefficient—it's a strategic liability. The bottleneck created by manual screening means promising deals get buried, follow-ups lag, and your firm’s collective intelligence stays trapped in disconnected inboxes and spreadsheets.

This is a playbook for systematically eliminating low-value work. The core principles of investment banking tech were forged in high-volume, high-velocity environments, making them a perfect fit for the modern VC fund. The goal isn't to replace judgment, but to augment it by automating the tasks that drain your team's energy and focus.

The True Cost of a Manual Funnel

The fallout from an unstructured deal flow goes beyond wasted hours. It creates serious operational risks and missed opportunities.

- Inconsistent Data Capture: Manual entry is messy. One analyst logs "ARR," while another types "Annual Recurring Revenue." This makes portfolio-wide search and analysis impossible.

- Lost Institutional Knowledge: What happens to insights from passed deals? They vanish. A startup that was "too early" two years ago might be a perfect fit today, but that original deck and its associated notes are likely lost in an inbox.

- Slow Response Times: The best founders have options. A slow screening process is the difference between getting into a hot round and reading about it later.

The core challenge is turning the inbound deal firehose into a structured, searchable intelligence asset. Automation makes this possible, ensuring no deal falls through the cracks due to process friction.

Adopting an automation-first mindset shifts your team's focus from clerical work to high-impact analysis. Our guide on the benefits of automated data entry details how this foundational change unlocks strategic advantages. This is how you stop managing deal flow and start mastering it.

The Core Tech Stack Powering Modern Finance

To build a high-performance deal flow engine, you have to understand the systems that have powered elite finance for decades. The world of investment bank technology was born in a high-stakes, data-heavy environment where speed and accuracy are non-negotiable. For VCs, this is a proven blueprint for a tighter, more effective operation.

At the heart of any major financial institution are three core functions: high-volume trade execution, sophisticated risk modeling, and robust CRM systems. They all share a common goal: turning a flood of raw information into profitable decisions. That’s exactly what every VC firm does every single day.

This is why global bank technology budgets are climbing at a compound annual growth rate of around 9%. It's an arms race to integrate smarter, faster tech.

Let's map how these core systems in banking directly address the challenges of a VC firm.

Core Technology Pillars in Financial Services

| System Type | Primary Function in Investment Banking | Direct Analogy in Venture Capital Workflow |

|---|---|---|

| Trading Platforms | Execute high-volume trades by analyzing real-time market data to identify profitable opportunities. | Deal Sourcing & Screening: Sifting through hundreds of pitch decks to identify high-potential startups that fit the fund's thesis. |

| Risk Management Engines | Model potential losses and assess portfolio exposure to market volatility and credit risk. | Due Diligence & Portfolio Analysis: Evaluating startup risks (market, team, tech) and monitoring the health of existing investments. |

| CRM Systems | Manage client relationships, track deal pipelines, and maintain a historical record of all interactions. | Founder & LP Relationship Management: Tracking the entire deal pipeline from first contact to close and managing ongoing communication. |

The operational DNA is remarkably similar. Both worlds are about processing vast amounts of information to make high-stakes capital allocation decisions.

Your CRM: The Central Nervous System

For a VC firm, the CRM is the central nervous system of your operation—the single source of truth for every interaction, deal, and metric. When it works, it ends the chaos of siloed inboxes and messy spreadsheets where crucial institutional memory goes to die.

The catch: a CRM is only as good as its data. When analysts manually key in information from pitch decks, the data becomes polluted. Key metrics are missed, entered inconsistently, or skipped entirely. Your most critical asset quickly turns into a glorified contact list, useless for meaningful analysis. For a deeper look, explore our guide to modern deal management software and see how top firms structure their data.

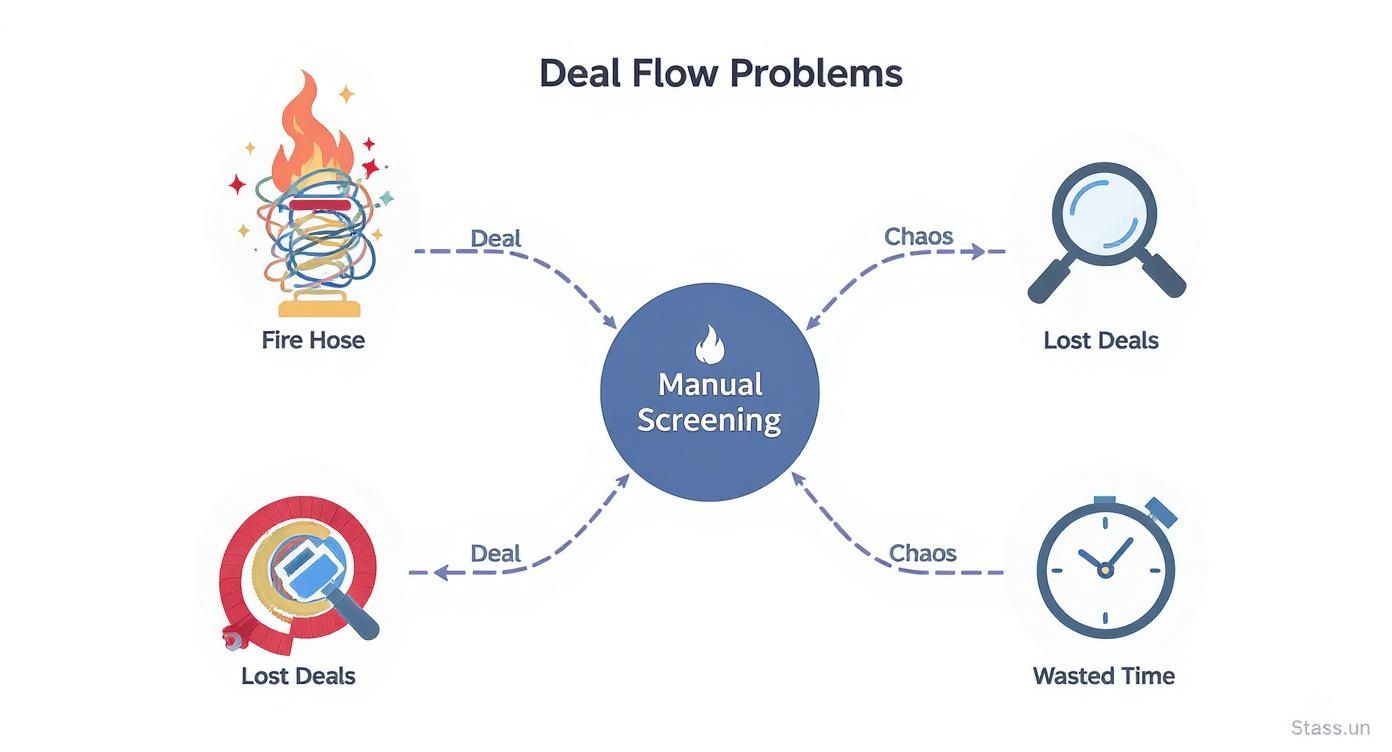

The image below shows how this manual process creates bottlenecks that kneecap a fund's performance.

This diagram shows the direct line from manual screening to operational chaos, missed opportunities, and wasted analyst time—the three biggest drags on any fund's efficiency.

Trading Floors and Deal Flow: A Surprising Parallel

A high-frequency trading desk and a VC’s deal screening process share the same fundamental challenge: finding a valuable signal in an overwhelming sea of noise. A trader scans millions of data points to find a market inefficiency; an analyst plows through hundreds of decks to find one category-defining company.

Investment banks solve this with powerful platforms that automate the ingestion and analysis of market data. These systems don't replace the trader; they do the grunt work of collecting and organizing data, freeing the human expert to focus purely on high-level strategy. This is precisely the operational leverage VCs need.

Once you view your deal flow through the lens of a trading operation, the need for automation becomes obvious. The goal is to build a system that automatically processes inbound data, flags opportunities matching your thesis, and lets your team focus on exercising judgment.

The insight is critical: whether trading stocks or funding startups, top-quartile performance depends on a tech stack that automates repetitive tasks to maximize human intellect.

How AI Is Reshaping Deal Sourcing and Analysis

Let's cut through the noise. The only question that matters is how AI solves the high-friction problems that consume analyst hours and slow down your pipeline. The answer isn’t in generic AI hype but in sharp, purpose-built tools that automate the most repetitive parts of sourcing and screening.

This isn’t a future concept; it’s happening now in institutional finance. The growing adoption of artificial intelligence within investment bank technology is changing how large firms operate. By 2025, 75% of banks with over $100 billion in assets are expected to have AI strategies fully integrated into their operations.

For VCs, the lesson is clear. The same logic that enables a bank to crunch massive market datasets can be applied to inbound deal flow, giving an enormous advantage to the funds that adopt it.

Automation as a Strategic Lever

The single biggest efficiency gain for a VC firm today comes from automating the primary bottleneck: manual pitch deck review. Every hour an analyst spends opening a PDF, hunting for key metrics, and logging company details into a CRM is an hour they’re not spending on founder calls or deep market research.

This is where specialized deal flow automation tools provide immediate value. They don't replace an analyst's judgment; they eliminate the clerical work that precedes it.

- Systematic Ingestion: Instead of manually forwarding emails, AI-driven systems automatically capture pitch decks from any source, including email attachments and secure links.

- Structured Data Extraction: The technology scans every slide, extracts key data points—TAM, ARR, team background, funding stage—and organizes them into a structured format.

- Intelligent CRM Syncing: This structured data is then automatically pushed into your CRM, creating a clean, consistent, and instantly searchable record for every deal, eliminating manual entry.

This approach transforms your deal flow from a chaotic mess of documents into a valuable intelligence asset. Your team can stop asking, "Has anyone seen the deck from company X?" and start running queries like, "Show me all B2B SaaS deals with >$1M ARR and a technical founding team."

The strategic edge isn't just saving time; it's building institutional memory. An automated system ensures every deal, passed or pursued, contributes to a clean, historical dataset that can be mined for future insights.

From Predictive Analytics to Pattern Recognition

Beyond data extraction, machine learning models are becoming powerful tools for sourcing and due diligence. Within investment bank technology, these models sift through huge datasets to predict market swings or score risk. The parallel for VCs is direct.

Predictive Sourcing AI platforms scan public data—hiring trends, tech stack changes, professional networks—to spot breakout startups before they start raising. This shifts sourcing from reactive (waiting for inbounds) to proactive, allowing you to build relationships with top founders before your competitors know they exist. This is a critical advantage for firms focused on effective private equity deal sourcing where proprietary deals are king.

Diligence Augmentation During due diligence, AI can accelerate the review of virtual data rooms, flagging potential red flags or inconsistencies in financial statements and legal documents. It acts as a tireless first-pass analyst, freeing the deal team to focus on strategic judgment calls. To better understand how AI can help process massive amounts of information, check out these AI tools for comprehensive research and analysis.

The Competitive Imperative

For firms aiming for top-quartile returns, adopting AI for deal sourcing and analysis is no longer optional. While network and instinct remain vital, the funds that pair those strengths with data-driven efficiency will see, screen, and win more of the best deals.

By automating the bottom of the funnel—the high-volume, low-value work of initial screening—you free up your most valuable asset: your team’s brainpower. They can focus their expertise where it truly matters: building relationships, understanding complex markets, and ultimately, making better investments.

Integrating Deal Flow Automation into Your Workflow

Execution separates top-quartile funds. The core principles of investment bank technology—speed, accuracy, data-driven decisions—are most powerful when they solve your firm's biggest bottleneck: inbound deal flow. This is a practical guide to re-engineering your workflow.

The goal isn't just adding another tool. It's about fundamentally changing how your firm finds, analyzes, and acts on opportunities by eliminating the manual work that burns out your analysts and shifting their focus to diligence and founder engagement.

Automating Inbound Processing

First, break the cycle of forwarding emails, downloading PDFs, and typing data into a spreadsheet. A modern deal flow automation platform must act as a universal intake valve, systematically capturing every pitch deck that hits your firm’s radar.

This works by integrating directly with your team's primary communication channels, typically email. Instead of an analyst monitoring an inbox, the system automatically detects and ingests pitch decks.

- Email Attachments: The platform identifies emails with deck attachments and automatically processes the files.

- Secure Links: It handles links from services like DocSend, extracting the deck's content without manual clicks or downloads.

- Web Forms: Submissions via your website’s "Submit a Deck" form are routed directly into the processing queue.

The result is a single, unified pipeline. No deal gets lost in a crowded inbox or a personal folder. The entire manual triage process is replaced by a consistent, automated system operating 24/7.

The core principle is creating a single point of entry for all deal flow. This prevents operational chaos and ensures every opportunity is captured and processed with the same rigor.

This step alone saves hours each week. But its real value is setting the stage for structured data extraction.

From Unstructured Decks to Actionable Data

Once a deck is ingested, the system extracts the intelligence within. Specialized AI performs a task similar to an analyst's first-pass review, scanning every slide to find, extract, and structure key metrics.

This goes beyond simple keyword spotting. The models understand the context of financial data and startup terminology, allowing them to accurately pull critical information:

- Key Financial Metrics: ARR, GMV, burn rate, and LTV/CAC ratios.

- Market Sizing: TAM, SAM, and SOM figures.

- Team Composition: Founder backgrounds, previous exits, and key hires.

- Traction and KPIs: User growth, engagement stats, and notable customer logos.

All of this structured data is then pushed directly into your CRM, whether it's Affinity or Airtable. Instead of a new record with just a company name and a PDF, you get a rich, detailed profile with searchable data points—all without a single manual keystroke.

The screenshot below shows a clean pipeline view where deals are automatically populated with structured data, ready for filtering.

This dashboard illustrates how a chaotic inbox becomes a clean, queryable database where every deal is consistently categorized and enriched.

Building a Queryable Intelligence Asset

The ultimate benefit is turning your deal flow from a pile of documents into a strategic intelligence asset. With clean, structured data in your CRM, your team can shift from passively screening to proactively sourcing.

Analysts can now run precise queries to instantly surface deals that fit your fund’s specific investment thesis.

- Stop Reviewing Irrelevant Deals: Filter your entire inbound pipeline to see only deals meeting your exact criteria. For example: "B2B SaaS companies in fintech with ARR > $500k and a founding team with prior enterprise experience."

- Surface Buried Opportunities: Run new queries against your historical deal flow. A company that was too early 18 months ago might be a perfect fit today. A queryable database finds them in seconds.

- Conduct Market Analysis: Use structured data to spot trends. Instantly see how many deals you're getting in a specific sector, average seed-stage valuations, or which geographies are generating the most relevant opportunities.

This approach gives your firm a durable strategic edge. It ensures your analysts spend their time evaluating qualified opportunities, not just looking for them. You build a clean, comprehensive, and instantly searchable database that becomes more valuable with every new deck processed.

Measuring the ROI of Your New Tech Stack

Any new technology must be justified by a clear return on investment. The obvious win from deal flow automation is saving junior analyst hours, but that's the least interesting metric. The true value of an integrated investment bank technology stack is measured in fund performance, not back-office efficiency.

Any business case for new tech must speak the language of strategic KPIs that directly impact your ability to find, win, and grow the best companies. It's about drawing a straight line from software implementation to the outcomes that matter to your LPs.

Beyond Time Saved: Strategic KPIs for VCs

To accurately measure ROI, track metrics that demonstrate tangible improvement in your core investment process.

Here are four KPIs that truly matter:

- Increased Deal Velocity: How fast can you move from deck receipt to a first partner meeting? In a competitive market, speed is a weapon. Automating the initial screen and data entry can shrink this timeline from weeks to days, signaling to top founders that you are decisive.

- Improved Sourcing Quality: What percentage of screened deals advance to a first call or partner review? When automation structures data from every deck, your team can filter for opportunities that perfectly match your thesis, increasing the conversion rate of qualified companies into the pipeline.

- Reduced Missed Opportunities: Every firm has passed on deals that later became unicorns. An automated system creates a searchable, living database of every company you've ever reviewed. This allows you to "rediscover" past deals that are now a perfect fit, a metric that can be explicitly tracked.

- Enhanced Team Collaboration: A centralized, automated deal flow system becomes the single source of truth, eliminating time wasted searching through inboxes or spreadsheets. While harder to quantify, tracking the reduction in duplicate work is a powerful indicator of improved team sync.

Once your CRM is fueled by automated data ingestion, it becomes a dynamic intelligence engine. This is the critical shift that moves a firm from passively screening deals to proactively hunting for the next breakout company.

Quantifying the Business Case

This mindset changes the conversation from "How many hours did we save?" to "How many more A+ deals did we see, and how much faster did we move on them?" For investment banks, understanding the measurable impact of context engineering AI with clear metrics is key to realizing ROI; the same logic applies to venture capital.

If your firm receives 2,000 inbound decks a year, and automation helps you properly screen 20% more of them while cutting your initial response time by 50%, the impact on your ability to source top-tier deals is massive. That is the real return on investment—a bigger, better, and faster pipeline that builds a scalable sourcing advantage.

From Gut Feel to Data-Backed Conviction

The old venture capital playbook is being rewritten. For decades, the game was won on network access. Today, that's being eclipsed by a more powerful edge: "how effectively you process what you find."

The same principles driving modern investment banking technology—speed, data integrity, and deep analytics—are becoming the benchmark for top-tier VC funds. For too long, the manual slog of sifting through pitch decks has been accepted as a cost of doing business.

This is a strategic blind spot. Automation isn't here to replace a VC's gut instinct. Judging a founding team's grit or market timing will always be a human skill. The point is to augment that judgment by eliminating the repetitive work that burns out your smartest people. Every hour an analyst spends copy-pasting data into a spreadsheet is an hour they aren't spending on deep-dive diligence or building rapport with founders.

Finding Your New Edge

The math is simple. Firms clinging to manual processes are actively giving up potential returns. They are slower to act on hot deals, their institutional knowledge is locked in scattered inboxes, and they cannot spot trends within their own deal flow.

In contrast, funds that embrace an automation-first approach are building a scalable and defensible sourcing machine.

Automation transforms your deal flow from an unmanageable firehose into a strategic, searchable asset. The goal is to free up your team to focus exclusively on what makes money: making great investment decisions.

This requires an honest assessment of your operations. Are your analysts truly analyzing, or are they expensive data-entry clerks? Do you have a central, reliable source for every deal you’ve ever reviewed, or is that intelligence fragmented across disconnected spreadsheets?

Adopting the right technology is a critical move for any fund that wants to remain competitive. It gives your team the leverage to do what they do best: run rigorous diligence, build relationships with top founders, and deliver the returns your LPs expect. The tools are here. The only question is whether you’ll use them to build a faster, smarter firm.

Frequently Asked Questions

Let's address common questions from investment professionals evaluating new deal flow technology.

Does Automation Replace an Analyst?

No. It replaces the low-value, repetitive work that burns them out. An analyst's time is better spent on diligence, market analysis, or founder calls, not manually typing data from 50 pitch decks into a CRM.

Automation augments your team, handling the monotonous clerical tasks. This frees up analysts to focus on the high-impact decisions they were hired to make.

How Secure Is Connecting to Our Email and CRM?

Security is non-negotiable. Reputable platforms use enterprise-grade protocols like OAuth 2.0 to connect to systems like Gmail, Outlook, or your CRM. This industry-standard, token-based authorization means the platform never sees or stores your team's login credentials.

Key security features to demand from any vendor include:

- Data Encryption: All data must be encrypted in transit and at rest.

- Data Isolation: Your firm's data should be in a sandboxed environment, completely separate from other clients.

- Compliance: The software must be built following best practices like OWASP guidelines and be prepared for rigorous security audits.

How Does This Handle Emerging Tech like Blockchain?

While deal flow automation focuses on internal workflow efficiency, it operates in a constantly evolving financial landscape. Investment banks are already exploring blockchain for trade reconciliation and KYC. As these technologies mature, automation tools will adapt.

Ultimately, whether a pitch deck covers a SaaS company or a tokenized asset, the core function is the same: transforming unstructured information from founders into structured, actionable data that enables your team to make faster, better-informed decisions. You can find more insights on how evolving tech is impacting investment banking at alpha-sense.com.

Stop wasting hours on manual screening. Pitch Deck Scanner automates your inbound deal flow, extracts key metrics, and syncs everything to your CRM, giving your team a decisive competitive edge. Start your free 21-day trial today.