Your team spends dozens of hours each week on the repetitive, low-value work of screening inbound pitch decks. Parsing PDFs, manually logging deal info into your CRM, and digging for basic metrics is a drain on analyst and associate time—time that should be spent on deep diligence and building relationships with high-potential founders.

This isn't just an efficiency problem; it's a competitive disadvantage. While your team is bogged down in manual data entry, the best deals are getting funded by firms that surface them faster. The goal isn't just to process the inbound queue, but to instantly identify the signals that separate a top 1% opportunity from the noise.

Stop Manually Screening, Start Analyzing Deals

The traditional deck review process is broken. It relies on manual labor to extract key data points that should be instantly available. An analyst opens a PDF, hunts for ARR, team background, and market size, then copy-pastes that information into Airtable or your CRM. This workflow is slow, prone to error, and fundamentally unscalable.

The real cost is opportunity. The time spent on clerical work is time not spent on high-leverage activities: talking to founders, conducting market research, and closing deals. The foundational work of deal sourcing shouldn't be a bottleneck.

Automating the initial screen allows your team to focus on the strategic analysis—validating the founder's claims, not just finding them.

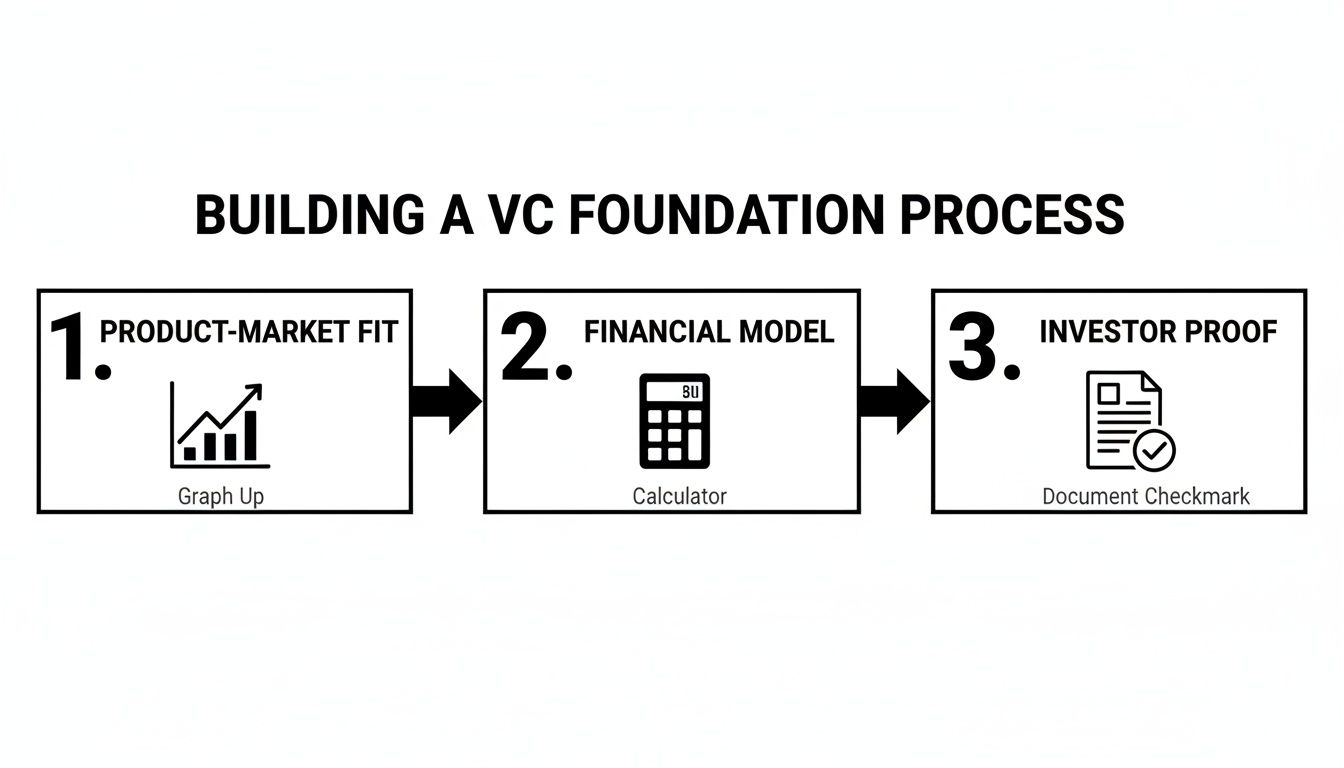

Identifying True Product-Market Fit Signals

Your team doesn't need a lesson on PMF, but they do need to find the data instantly. Instead of manually scanning slides for user metrics, an automated system should surface the hard signals of product-market fit immediately. This means extracting and flagging key data points that indicate genuine customer dependency and scalable economics.

Look for automated extraction of these critical signals:

- Net Revenue Retention (NRR): Instantly flag any mention of NRR over 100%. This is a primary indicator of a sticky product with built-in expansion revenue.

- User Engagement Metrics: Automatically pull DAU/MAU ratios, session lengths, and feature adoption rates from decks to quantify product stickiness without manual reading.

- Unit Economics: Surface the LTV/CAC ratio. A system that can identify and highlight a ratio of 3:1 or higher immediately moves a deal to the top of the pile for further review.

The goal is to spend zero minutes searching for the numbers and maximum time debating what they mean. An automated system should tee up the critical data so your team can immediately begin the real work of analysis.

Validating the Financial Model's Assumptions

A top-down "1% of a $50B market" claim is an instant red flag. But finding the bottoms-up assumptions that support a credible financial model requires digging. Your team wastes time hunting for the inputs—conversion rates, ACV, sales cycle length—that determine if the projections are grounded in reality.

An intelligent screening tool should automatically identify and extract these core assumptions:

- Actual sales funnel conversion rates

- Stated average contract value (ACV)

- Reported sales cycle length

- Customer acquisition costs by channel

This allows your analysts to move directly to stress-testing the model, not building a summary of it. This focus is crucial. With AI companies dominating recent funding, as noted by KPMG, every deal—AI or not—requires a rigorous examination of its path to profitability. An automated tool provides the inputs for that examination instantly.

Key Metrics and Benchmarks by Funding Stage

Your team lives and breathes these benchmarks. The problem isn't knowing them; it's the time wasted confirming a startup meets the relevant criteria for its stage. An automated system should instantly categorize a deal based on its stated metrics and compare it against stage-specific benchmarks.

| Metric | Seed Stage Benchmark | Series A Benchmark |

|---|---|---|

| Annual Recurring Revenue (ARR) | 100k - 500k; some pre-revenue is possible with exceptional team/tech. | 1M - 5M+; strong, predictable revenue is non-negotiable. |

| Product-Market Fit (PMF) | Early signals: high engagement, low churn among initial user cohort. | Proven and repeatable: strong net revenue retention (>100%), clear ideal customer. |

| Team | Visionary founders with deep domain expertise and ability to attract early talent. | A core leadership team is in place (e.g., heads of sales, marketing, product). |

| Go-to-Market (GTM) Strategy | Initial validation of one or two acquisition channels. | A scalable, repeatable GTM playbook with a proven LTV/CAC ratio of 3:1+. |

| Fundraise Goal | Typically 1M - 3M to find PMF and build the core team. | Typically 5M - 20M+ to scale the GTM engine and expand the team. |

Instead of an analyst manually checking these boxes, a system should auto-flag: "Series A raise, but ARR is at Seed stage level." This simple, automated check saves screening time and surfaces potential mismatches in founder expectations immediately.

Optimizing Deal Flow with Structured Data

A pitch deck is unstructured data. Your CRM requires structured data. The friction between these two is where your team's productivity goes to die. Manually creating records, summarizing the company, and logging metrics is the definition of low-leverage work.

The solution is to transform every inbound deck into a structured, queryable asset the moment it hits your inbox. This eliminates manual data entry and enables a more sophisticated, data-driven approach to sourcing.

From PDF to Actionable CRM Record

Every associate knows the drill: scan the deck for the core story components before deciding if it's worth a call. An automated system should perform this scan for them, structuring the narrative into analyzable fields.

Your system should instantly parse and tag:

- The Problem/Vision: What is the core pain point being solved?

- The Solution: How does the product address this pain point?

- The "Why Now?": What market shift makes this opportunity urgent?

- Market Size (TAM, SAM, SOM): Extract the claimed market size figures for quick validation.

The objective is to convert a 20-slide narrative into a concise, structured summary in your CRM, complete with extracted metrics. This allows for rapid comparison across deals and frees up your team to analyze the story, not just transcribe it.

Understanding the narrative structure is key, even if you see thousands of decks. For founders, learning what a pitch deck is is step one; for you, it's about systematically deconstructing it at scale.

Structuring Data for Superior Analysis

A deck shouldn't just be a file attached to a contact. It should be a rich data object. By extracting and structuring key information, you turn an inbox full of PDFs into a powerful, searchable database.

Enforce data consistency by automatically capturing:

- Key Metrics: ARR, user count, churn, LTV/CAC.

- Team Background: Founder names, previous companies (e.g., ex-Google, ex-Stripe).

- Fundraising Details: The ask, use of funds, previous investors.

This creates a proprietary data asset. Now you can run queries like, "Show me all fintech deals with >$250k ARR and at least one founder with payments experience." That level of sourcing is impossible when deal info is trapped in PDFs.

The One-Pager: Data-Rich Executive Summary

Founders use a one-pager to get your attention. Your team should have an internal equivalent for every single deal, generated automatically. This AI-powered summary provides the ultimate high-density overview, allowing for a go/no-go decision in seconds, not minutes.

An auto-generated summary should include:

- Company Vision: The one-sentence summary.

- The Problem: The extracted pain point.

- The Solution: The product's core function.

- Traction: The most compelling extracted metrics (ARR, MoM growth).

- Team: Keywords from founder bios.

- The Ask: Amount being raised.

This isn't about replacing judgment. It's about feeding your team the exact information they need to apply that judgment far more efficiently across a much larger volume of deals.

Engineering a Data-Driven Sourcing Engine

"Spray and pray" is a founder-side anti-pattern. The equivalent for VCs is passive, reactive sourcing. A top-quartile firm doesn't just wait for deals to come in; it builds a systematic, data-driven engine to find them. This requires leveraging every possible advantage, from warm intros to proactive market analysis.

Automating the initial screening of inbound and referral-based deal flow frees up resources for this more strategic, outbound effort. Your team should be hunting for opportunities, not clearing an inbox.

Prioritizing Signal from Warm Introductions

Warm introductions are your highest signal channel. The problem is they still arrive as unstructured emails that require manual processing. An intelligent system should automatically detect decks from trusted sources, prioritize them in the queue, and enrich the CRM record with the name of the referrer.

This allows you to:

- Instantly Triage: Deals referred by portfolio founders or trusted co-investors get flagged for immediate partner review.

- Analyze Referral Patterns: Track which sources consistently send high-quality deals, providing data to optimize your network.

- Maintain Context: The CRM record should capture not just the deck, but who sent it and why.

This turns your network from a series of ad-hoc interactions into a structured, measurable source of high-quality deal flow. To scale this, you must understand the landscape of investors in startup companies and how they interconnect.

Enhancing Pipeline Management with Automation

Your deal pipeline is your firm's lifeblood. Yet, too often it's managed with manual-entry spreadsheets or a poorly utilized CRM. Every interaction, every follow-up, and every internal note needs to be tracked systematically.

Automation is the key to maintaining a clean and actionable pipeline:

- Auto-Creation of Deals: When a deck arrives in a partner's inbox, a deal record should be created automatically in your pipeline tool (like Airtable or Notion), preventing leads from falling through the cracks.

- Task Generation: Automatically assign an analyst to review new deals that meet pre-defined criteria (e.g., sector, stage, revenue).

- Data Integrity: Eliminate typos and inconsistent formatting from manual entry, ensuring your pipeline data is clean and reliable for analysis.

This operational rigor allows you to manage a higher volume of opportunities with less overhead, ensuring consistent follow-up and preventing embarrassing double-contacts. It also lets you analyze market trends from your own proprietary data. Staying on top of macro trends, like those detailed in venture capital funding trends on spglobal.com, is critical, but pairing that with your firm's micro data is where the real edge is found.

Accelerating Diligence with Pre-Screened Data

Getting to a partner meeting is the first step. The real work begins as you move toward due diligence. A well-prepared founder will have a data room, but your team still has to spend hours verifying the claims made in the initial pitch. This process can be dramatically accelerated.

When the initial screening is automated, your team enters the first meeting with a verified set of data points. The conversation can start at a higher level, focusing on strategy and vision rather than basic fact-finding.

From First Meeting to Deeper Analysis

The goal of a first meeting is to pressure-test the story. Your team is more effective when they walk in already knowing the deck's key metrics, team background, and market claims. This allows for a more insightful conversation.

An automated pre-screening process empowers your team to:

- Ask Better Questions: Instead of "What's your churn rate?" they can ask, "Your churn is 2% monthly, which is strong. What have been the key drivers of that retention?"

- Verify Numbers Instantly: The system-extracted data serves as a baseline. The meeting becomes about adding context to the numbers, not discovering them for the first time.

- Focus on Founder-Market Fit: With the business metrics already understood, the conversation can shift to assessing the founder's command of the market and their strategic vision.

This approach transforms the first meeting from a discovery call into a genuine diligence session, saving time for both you and the founder.

Streamlining Due Diligence with a Data Head Start

Due diligence is a deep dive into the company's operations, financials, and legal structure. An organized founder will provide a comprehensive data room, but your team still needs to process and verify everything within it.

An AI-powered screening tool provides the first layer of diligence automatically. It extracts the initial claims, which then become the checklist for your deep-dive verification process.

By having the deck's claims—financials, product roadmap, IP assertions, team bios—already structured in your system, the diligence process becomes a targeted validation exercise. Your team isn't starting from a blank slate; they're working from a pre-populated diligence template. They can cross-reference the data room documents against the initial pitch claims far more efficiently. This structured approach is essential for any firm conducting a thorough review, often guided by a comprehensive Venture Capital Due Diligence Checklist.

This efficiency is a competitive edge. It allows you to move faster from a handshake to a signed term sheet, which in a competitive round can be the deciding factor.

From Term Sheet to Close: Maintaining Momentum

Issuing a term sheet is a significant step, but it's not the end of the process. The final stages of legal diligence, documentation, and closing require careful management to maintain momentum. Any friction here can delay funding and frustrate founders.

While much of this phase is in the hands of legal counsel, a well-oiled internal process ensures your firm is never the bottleneck. Structured data and clear communication pathways are key to moving efficiently from signed term sheet to money in the bank.

The Key Terms Beyond Valuation

Your partners are experts in negotiating liquidation preferences, anti-dilution rights, and board composition. The role of your deal team is to provide the data and analysis that supports these negotiations. A history of deal terms from your own pipeline can provide valuable benchmarks.

By structuring and saving data from past deals, you can answer questions like:

- What is the median liquidation preference we've offered for a Seed stage company in this sector?

- How often have we seen "full ratchet" anti-dilution provisions in the last six months?

- What is the typical board structure for a company at this stage?

A term sheet is the blueprint for the partnership. Having proprietary data on market-standard terms gives your partners a significant advantage in negotiating a deal that is fair, competitive, and aligns long-term incentives.

Ensuring a Smooth Closing Process

Once a term sheet is signed, the final sprint to closing begins. This involves final diligence checks, drafting definitive legal documents, and coordinating all parties for signatures. Disorganization at this stage can kill a deal's momentum.

A centralized, automated system helps by:

- Providing a Single Source of Truth: All deal documents, notes, and contact information are in one place, accessible to the deal team and legal counsel.

- Tracking Key Milestones: Use your CRM to manage the closing checklist, ensuring no step is missed, from background checks to final wiring instructions.

- Facilitating Communication: A clear record of all interactions prevents miscommunication and ensures everyone is working from the same information.

This operational excellence reflects well on your firm. It shows founders that you are a professional, reliable partner, setting a positive tone for the relationship long after the deal has closed.

FAQs for Optimizing Venture Capital Deal Flow

Even the most experienced firms are constantly looking for an edge to improve their sourcing and screening processes. Adopting new technologies and workflows raises important questions about efficiency, accuracy, and impact.

Here are direct answers to common questions VCs have when considering an automated approach to deal flow management.

How Much Time Can Automation Realistically Save a Deal Team?

For a typical firm, an analyst or associate can spend 5-10 hours per week just on the manual labor of screening inbound decks: opening attachments, finding key metrics, and copy-pasting data into a CRM or spreadsheet.

An automated system can reduce that specific task by over 90%.

- Initial Screening: What takes 5-10 minutes per deck becomes an automated, sub-30-second process.

- Data Entry: Manual CRM record creation is eliminated entirely.

- Reporting: Weekly pipeline reports can be generated instantly from clean, structured data.

This doesn't mean your team works fewer hours. It means those 5-10 hours are reallocated to high-value work: talking to more founders, conducting deeper market analysis, and supporting portfolio companies. The ROI is measured in the quality of deals you close, not just the hours saved.

What Are the Biggest Inefficiencies in a Standard VC's Pitch Deck Review Process?

The biggest inefficiency is treating unstructured data (PDFs) as the source of truth. This creates three major bottlenecks that most firms accept as the cost of doing business:

- Manual Data Extraction: The human eye is a slow and inconsistent parser. Your analyst might miss a key metric buried in an appendix, or two different associates might interpret a chart differently.

- Lack of a Centralized, Searchable Database: When deal intelligence is locked inside individual PDFs in a Dropbox folder or attached to disparate CRM records, it's impossible to query your own deal flow. You can't analyze trends or find historical comps efficiently.

- Repetitive Clerical Work: Every single deck requires the same set of manual actions—download, open, read, summarize, copy, paste. This is a classic automation problem that consumes thousands of hours of expensive human capital per year.

How Does Automated Screening Impact Deal Sourcing Strategy?

Automation doesn't replace your strategy; it supercharges it. By handling the high-volume, low-signal inbound queue, it frees up your team to be more proactive and strategic.

It enables a shift from a reactive to a proactive sourcing model:

- Inbound Becomes Efficient: Your inbound/referral channel runs on autopilot, ensuring 100% coverage without consuming analyst time. You never miss a potential gem that comes through a non-traditional channel.

- Analysts Become Hunters: Instead of just processing what comes to them, your team can spend their time actively mapping markets, identifying emerging companies before they are fundraising, and building relationships with future star founders.

- Data-Driven Thesis Building: With all inbound data structured and tagged, you can analyze trends in real-time to refine your investment thesis. You can spot rising micro-sectors based on the volume and quality of decks you're seeing.

Does Automation Reduce the "Human Element" of Venture Investing?

No—it elevates it. Venture capital is, and always will be, a people-driven, relationship-based business. The decision to invest is based on a partner's conviction in a founder and a vision.

Automation is not about replacing that judgment. It's about eliminating the low-value administrative tasks that get in the way of it.

- More Time for Founders: By spending less time on clerical work, your team can spend more time in meetings, on calls, and building genuine relationships.

- Focus on What Matters: The goal is to automate the what (what is the ARR?) so your team can focus on the why (why is this the right team to win this market now?).

- Better-Informed Decisions: Automation provides clean, consistent data, allowing your partners to apply their intuition and experience to a more complete and accurate picture of the opportunity.

For a broader perspective on funding ecosystems beyond venture capital, you can review these 10 essential sources of funding for startups.

At Pitch Deck Scanner, we understand that for VCs, the initial screening of hundreds of inbound decks is a low-value, repetitive task that consumes hours. Our platform automates this entire workflow by connecting to your email, detecting decks, and converting them into structured deals in your CRM, enriched with AI-driven insights. Eliminate manual data entry and surface high-potential deals faster. See how Pitch Deck Scanner can save your team 5+ hours per week.