Extracting data from a PDF pitch deck is an operational drag that directly impacts deal velocity. For venture capital firms, the challenge isn't just about converting text and tables into structured data; it's about eliminating the high-volume, low-value administrative work that bogs down deal screening and slows down your entire pipeline.

Why Manual Pitch Deck Review Is Costing You Deals

The primary bottleneck for most VC firms isn't sourcing; it's the operational drag of processing inbound deal flow. Every pitch deck in your inbox triggers a manual, repetitive workflow: an analyst opens the PDF, hunts for key metrics, and copy-pastes company names, founder bios, and funding details into a CRM like Affinity or Attio. This process is a direct tax on your firm's most valuable resource: your team's time.

The costs of this manual grind are tangible:

- Time Sink: Analyst time is better spent on due diligence and market research, not data entry. Every hour spent on copy-paste is an hour not spent identifying the next outlier.

- Data Inconsistency: Manual entry guarantees errors and messy formatting. One analyst logs "ARR," another types "Annual Recurring Revenue," corrupting your pipeline data and making firm-wide analysis impossible.

- Lost Opportunities: A pipeline clogged with manual tasks slows your response time. The best founders have options, and the firm that reviews and responds fastest often wins. High-potential decks get buried, and good deals fall through the cracks.

From Niche Task to Core Capability

The ability to extract data from PDFs has moved from a back-office task to a core operational capability. The PDF remains the standard for sharing sensitive information, driving a massive market for tools that unlock the data within.

The global PDF editor software market, valued at USD 3.36 billion, is projected to exceed USD 15.1 billion by 2032. This growth reflects a clear demand to turn static documents into structured assets. You can explore additional insights on the PDF editor software market growth.

For investment firms, the takeaway is simple: manual PDF review is no longer a sustainable model. As deal flow volume increases, the industry is adopting AI-driven tools that eliminate screening friction and standardize deal intake.

Automation isn't about replacing associate judgment. It’s about removing the administrative overhead that prevents your team from exercising that judgment effectively. By instantly parsing every inbound deck into structured, searchable data, you transform your deal pipeline from a cluttered inbox into a strategic asset. This frees your team to focus on what matters: finding and funding the next breakout company.

Choosing Your PDF Data Extraction Toolkit

Selecting a data extraction method is a strategic decision that hinges on your firm's deal volume, in-house technical resources, and desired level of automation. The goal is to strike the right balance between control, cost, and efficiency. Get it wrong, and you've created another bottleneck. Get it right, and your inbound firehose of pitch decks becomes a structured, searchable asset.

Programmatic Extraction For In-House Control

For firms with engineering resources, building a custom parser offers maximum control. Using Python libraries, your team can create a solution tuned to the specific data points your firm prioritizes.

Most custom builds rely on two key libraries:

- PyMuPDF (Fitz): A high-speed library for raw text extraction. It's efficient at pulling words from a page but lacks any contextual understanding of document structure—it sees text, not a team bio or a financial table.

- Camelot: Built specifically to solve table extraction. It excels at identifying tabular data—financials, cap tables, cohort analyses—and structuring it cleanly, often into a Pandas DataFrame.

While powerful, this approach requires a significant and ongoing investment in engineering time for building, maintenance, and adaptation as pitch deck formats evolve.

Low-Code Platforms: A Middle Ground

Low-code platforms like Parseur or Nanonets provide a visual interface where non-technical users can create templates to extract specific data points. An analyst can highlight a metric like "ARR" in one deck and train the tool to find it in similarly structured documents.

This approach empowers ops managers or analysts to build their own extraction workflows without coding. However, it still requires manual setup for new layouts and can struggle with the high variability of pitch deck designs. It's a significant improvement over copy-pasting but falls short of true hands-off automation. As you explore options, it's worth looking into the new wave of AI that allows you to upload documents for streamlining digital workflows that are changing how this data is handled.

The Core Trade-Off: It boils down to a choice between the deep, granular control of a custom-coded solution versus the user-friendly, template-driven approach of low-code platforms. The right answer depends on whether your firm has the dedicated engineering resources to justify building from scratch.

Comparison of PDF Data Extraction Methods for VC Firms

This side-by-side comparison clarifies the options. Each approach has its use case, but the best fit depends entirely on your firm's operational model and resources.

| Method | Technical Skill Required | Best For | Key Limitation |

|---|---|---|---|

| Programmatic (Python) | High (Software Engineering) | Firms needing maximum control and unique data points. | High initial build cost and ongoing maintenance burden. |

| Low-Code Platforms | Low (Tech-savvy analyst) | Teams that want to automate specific, recurring formats. | Struggles with high variability; requires template setup. |

| Purpose-Built Solutions | None (SaaS setup) | Firms focused on total automation and team efficiency. | Less granular control over the extraction logic itself. |

Ultimately, the choice reflects how your firm values its time. Do you invest engineering hours for total control, or do you opt for a ready-made solution that frees up everyone to focus on the deals themselves?

Fully Automated Purpose-Built Solutions

Finally, zero-setup, specialized platforms like Pitch Deck Scanner are engineered specifically for the VC workflow. These tools automate the entire process, from fetching a PDF from an email to populating CRM fields.

This is where intelligent document processing (IDP) moves beyond basic text recognition. The IDP market, valued at USD 2.37 billion, is expected to exceed USD 31 billion by 2034, driven by APIs that achieve up to 99% accuracy on structured documents.

These systems are pre-trained on thousands of pitch decks, enabling them to identify the metrics VCs care about without requiring manual template setup. The advantages are clear:

- Zero Setup: Connect your inbox and CRM, and the system is live.

- Handles Complexity: Natively processes secure DocSend links—a common failure point for other methods.

- End-to-End Automation: Manages the entire pipeline, from inbox monitoring to CRM data mapping. To see this in action, read our guide on the benefits of automated data entry.

This approach eliminates the low-value, manual work of screening and data entry, allowing your team to focus exclusively on evaluating companies and making investment decisions.

Taking Your Pipeline from Inbox to CRM—Automatically

Extracting data is only half the battle. The real value is realized when that data flows directly into your CRM, untouched by human hands. Imagine a pitch deck arriving in an inbox and materializing moments later as a structured record in Affinity. This isn't just a time-saver; it’s a competitive advantage.

The goal is a true end-to-end pipeline, starting at the source—your firm's deals inbox on Gmail or Outlook—and ending with a fully populated opportunity in your CRM.

Hooking Up Your Inbox and CRM

The first step is establishing a secure bridge between your email and your extraction tool. Modern platforms use OAuth 2.0, an industry standard that grants permission without exposing your password. Once connected, the system monitors the inbox for new emails containing PDFs or, critically, DocSend links.

A similar secure connection is then made to your CRM, enabling the tool to not only extract data from a deck but also push it into the correct fields in your deal flow system.

This should be a "set it and forget it" process. Authorize the connections once, and the system processes decks as they arrive. The objective is not to add another tool to manage but to eliminate a manual task permanently.

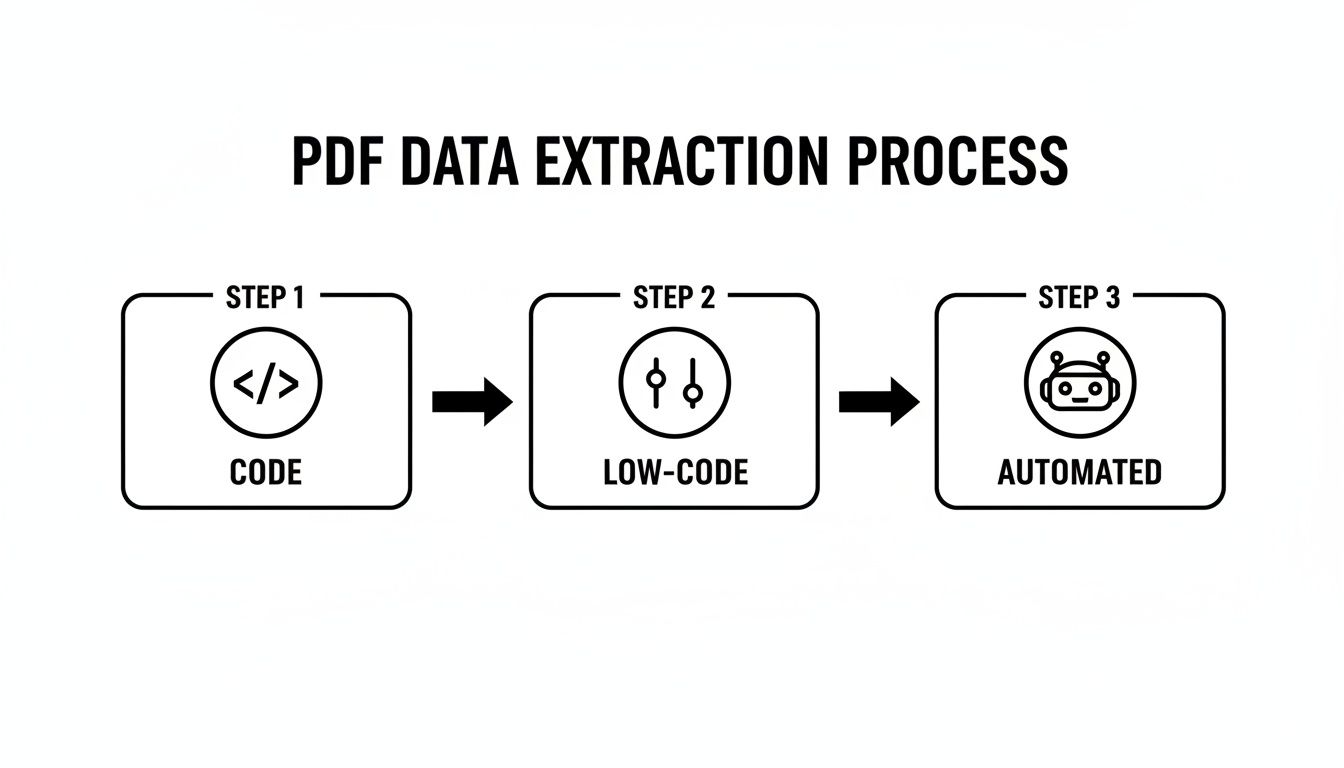

This visualization lays out the different ways you can get this done, from a hands-on coding approach to a fully automated solution.

The workflow shows a clear progression from high-effort, high-control methods to zero-effort, specialized automation, allowing you to select the approach that fits your team's resources and goals.

Mapping Extracted Fields to Your CRM

An effective integration depends on intelligent field mapping. It’s not enough to grab "Company Name"; that data must be pushed to the "Organization Name" field in Affinity. A robust system allows you to define these relationships precisely.

Here’s a typical mapping for a VC pipeline:

- Company Name (from deck) → Organization (in CRM)

- Founder Names (from team slide) → People (linked to organization)

- Website URL (from contact slide) → Website (on organization record)

- Key Metrics (e.g., ARR, MRR) → Custom Notes Field or dedicated metric fields

- Industry/Sector (inferred from deck) → Industry (as CRM tag or field)

This mapping imposes order on chaotic inbound data. Every new opportunity is logged with standardized data points, making searching, filtering, and analyzing your deal flow infinitely more efficient. To see what this looks like, you can check out a gallery of real-world CRM data examples populated entirely through automation.

Handling Attachments vs. DocSend Links

A major obstacle for generic tools is the prevalence of secure sharing platforms. Founders often send a password-protected DocSend link instead of a direct PDF attachment. An effective automation tool must handle both scenarios seamlessly.

Direct attachments are simple to parse. DocSend links, however, require a more sophisticated workflow capable of following the link, navigating access gates, and processing the document. This is a common failure point for DIY scripts and generic parsers not built for the realities of VC deal flow.

Going Further with Zapier and Webhooks

True automation extends beyond the CRM. Using tools like Zapier, a single processed pitch deck can trigger a cascade of actions. For instance, a "Zap" can send a real-time notification to a dedicated Slack channel whenever a new deal is added to your CRM.

This creates immediate visibility for the entire team. An associate can see a promising deck has been processed and act on it instantly, dramatically reducing response time.

- Trigger: New Organization is created in Affinity by the extraction tool.

- Action: Post a message in the

#new-dealsSlack channel with the company name, a brief summary, and a direct link to the CRM record.

This level of integration transforms your pipeline from a static list into a dynamic system. Automating deal flow is a key component of the broader digital transformation in financial services. By connecting your inbox, extraction tool, and CRM, you reclaim hundreds of analyst hours and build a faster, more data-driven investment operation.

Dealing With the Tricky Stuff: Advanced PDF Extraction

Simple PDF parsers are adequate for clean, uniform documents, but VC deal flow is a stream of messy, complex files that break generic tools. Specialized extraction solutions prove their value by tackling the challenges that would otherwise halt your workflow.

One of the most common roadblocks is the secure, expiring link. Founders rarely just attach a PDF; they'll send a password-protected DocSend link that needs a few clicks, maybe a login, and sometimes a passcode just to get inside. Your standard Python script or off-the-shelf parser just sees a URL and gives up. It simply can't navigate those security layers.

Purpose-built platforms are designed for exactly this scenario. They automatically follow the link, handle authentication, and process the document on the other side—all without manual intervention. This isn't a nice-to-have; it's essential for any firm aiming for true "inbox-to-CRM" automation.

Decoding Complex Tables and Financials

After secure links, the next major challenge is accurately extracting data from tables. Pitch decks are filled with tables showing financial projections, unit economics, cohort analyses, and cap tables. To a basic text scraper, this is often a jumbled mess of words and numbers, devoid of context.

Standard tools read a PDF line by line, lacking any concept of the row-and-column structure that gives the data its meaning. An analyst forced to copy this data by hand must often rebuild the entire table from scratch in a spreadsheet—a tedious, error-prone task.

Layout-aware AI models solve this. These tools don't just read text; they analyze the page's visual structure to identify tables. They can correctly match headers to their columns and preserve row integrity, even when a table spans multiple slides.

This capability is critical for two reasons:

- Data Integrity: It ensures that crucial metrics like Cost of Goods Sold (COGS) or Customer Acquisition Cost (CAC) are captured accurately, not dumped into a generic notes field.

- Massive Time Savings: It eliminates the need for analysts to manually reconstruct financial models from PDFs, saving hours on every deck and ensuring data consistency from the start.

The ability to reliably parse tables is non-negotiable. Without it, you are capturing only a fraction of the critical data in a pitch deck, leaving the most important quantitative insights locked away.

Extracting Insights from Visuals and Charts

Text and tables are only part of the story. Pitch decks are visual documents, filled with charts, graphs, and product mockups that contain valuable information. A traditional text-based tool misses this entire data layer, forcing your team to manually scan visuals for key takeaways.

Modern AI-powered systems can now perform visual data extraction. They can analyze an image of a bar chart and extract the specific data points it represents. For instance, the system could identify a graph showing 25% month-over-month user growth and log that metric automatically.

This technology can also interpret other visual elements:

- Product Mockups: Identifying key features or UI elements in screenshots.

- Market Size Diagrams: Pulling figures from TAM/SAM/SOM charts to understand market assumptions.

- Team Photos and Logos: Using image recognition to identify key personnel or logos of notable customers.

This goes far beyond simple text extraction, providing a richer, more complete understanding of an opportunity by capturing both qualitative and quantitative data hidden in a deck's visuals. By turning every part of the PDF into structured data, you arm your team with a superior foundation for screening and due diligence. The global data extraction market is projected to grow from USD 6.16 billion to USD 28.48 billion by 2035, underscoring the importance of this capability. You can dig into the data extraction market trends research for a closer look.

Ensuring Data Accuracy and Security

Automating PDF data extraction is about increasing deal velocity, but speed is worthless without accuracy and security. You are handling confidential founder information; a rock-solid framework for data integrity and security is non-negotiable for maintaining trust.

Bad data leads to bad decisions. A single misplaced decimal in an ARR figure can fundamentally alter the evaluation of a deal. The best extraction tools mitigate this risk by assigning a confidence score to every piece of extracted data. For instance, a tool might extract a "Company Name" with 99% confidence but flag "MRR" at 72% due to ambiguous formatting. This score is the key to building a reliable, semi-automated workflow.

Validating Extracted Data

A practical approach combines automation with targeted human oversight, often called a human-in-the-loop (HITL) review. Instead of an analyst reviewing every field from every deck, your team only intervenes to validate low-confidence outliers.

Here’s how it works:

- Set a Threshold: Define your confidence threshold, for example, 90%.

- Automate the Obvious: Any data extracted above that threshold flows directly into your CRM without human review.

- Flag for Review: Fields falling below the threshold are queued for an analyst to quickly confirm or correct.

This hybrid model allows you to automate ~95% of data entry while focusing your team's attention only where it's truly needed. It solves the "garbage-in, garbage-out" problem without reverting to fully manual review.

The objective isn't 100% automation. The objective is to eliminate 100% of the repetitive data entry, freeing up your team to apply their judgment to the data that matters.

Non-Negotiable Security and Governance

When handling sensitive founder information, security is paramount. Any third-party tool that accesses your deal flow must meet enterprise-grade standards. You are granting access to your inbox and CRM; the vendor's security posture must be impeccable.

Before engaging any platform, verify its security credentials. These are the absolute requirements:

- SOC 2 Compliance: This is the baseline for SaaS companies, proving commitment to secure data management practices verified by third-party auditors.

- Data Encryption: All data, both in transit and at rest, must be encrypted using strong protocols like AES-256.

- Secure Authentication: The platform must use modern standards like OAuth 2.0 to connect to your systems, granting access without ever sharing your passwords.

Additionally, proper data governance is critical. The system should provide data isolation, ensuring your firm's information is completely segregated from other customers. Clear audit trails that log access and actions are also essential for accountability.

These features are as fundamental as the security protocols for virtual data rooms for investors. Choosing a data extraction tool is as much a security decision as it is a productivity one. Your firm's reputation depends on it.

A Few Common Questions

When VCs evaluate automating data extraction from pitch decks, the questions are always practical. They focus on whether a tool can handle the messy reality of high-volume deal flow without creating more work.

Here are straight answers to the questions we hear most often.

How Accurate Is This, Really?

Accuracy depends entirely on the underlying technology. Basic Optical Character Recognition (OCR) or rigid, template-based parsers might achieve 70-85% accuracy on simple text but fail completely with varied layouts and complex tables—making them unsuitable for a serious deal flow pipeline.

Modern Intelligent Document Processing (IDP) platforms, like Pitch Deck Scanner, are specifically trained on thousands of real-world pitch decks. This specialized training enables them to exceed 95% accuracy on the fields VCs care about, such as company name, founders, and key metrics. The best systems also provide a confidence score, flagging any questionable extractions for a quick human review. It's the optimal blend of automation and oversight.

What About Password-Protected DocSend Links?

Yes, but this requires a specialized tool. It is a critical failure point for most generic software. Standard extraction libraries and basic parsers are stopped by secure, expiring, or password-protected DocSend links because they cannot navigate the authentication steps.

A platform built for the VC workflow must automate this entire sequence: follow the link, handle any pass-throughs, process the deck, and push structured data to your CRM. For any firm aiming for true end-to-end automation of inbound deals, this is a non-negotiable feature.

How Technical Does My Team Need to Be for Setup?

The required technical lift varies significantly.

- DIY Python Scripts: This requires a dedicated software developer for both the initial build and, more importantly, ongoing maintenance.

- Low-Code Platforms (like Zapier): These lower the barrier but still require a tech-savvy individual comfortable with APIs and data mapping to implement correctly.

- Purpose-Built SaaS Solutions: These are designed to be no-code. Setup typically involves a few clicks to securely connect your email (Gmail/Outlook) and CRM via OAuth. An operations manager or analyst can complete it in minutes without engineering support.

The right choice depends on your firm's internal resources and whether you prefer to manage a technical project or simply solve a business problem.

How Does This Work With My CRM (Affinity, Attio, etc.)?

Seamless integration is the entire point. The best solutions for VCs offer native, one-click connections with CRMs like Affinity and Attio, eliminating complex API configurations.

You authorize the tool to access your CRM, and it automatically detects your available fields. You then map the extracted data—such as "Company Name," "Founder," "Website," or "ARR"—directly to the corresponding fields in your CRM. Once configured, every new pitch deck that arrives automatically creates or enriches a record in your system, eliminating manual entry.

Ready to eliminate copy-paste and automate your deal pipeline? Pitch Deck Scanner connects directly to your inbox and CRM, transforming inbound pitch decks into structured, actionable data in minutes.

Start your free 21-day trial and see how much time your team can reclaim.