Your inbox is a constant flood of pitch decks. The pressure to surface quality deals faster requires a systematic approach that combines proactive sourcing with intelligent automation. This guide moves beyond generic advice to provide a tactical breakdown of the top 12 deal sourcing platforms for venture capital professionals. We analyze each tool by its direct impact on your workflow, from identifying proprietary targets to eliminating the low-value, repetitive work of screening and CRM data entry.

The goal is to augment your judgment with technology that gives you back time. This resource is designed for efficiency. Every entry includes direct links and screenshots to help you quickly assess if a platform fits your firm's strategy. We cut through the noise to deliver an analysis of the leading deal sourcing platforms, helping you systematize deal flow and focus on what truly matters: finding and funding the next breakout company. To enhance and automate the initial stages of finding investment opportunities, VCs can explore advanced AI lead generation software that streamlines outreach and qualification before a deal even hits the pipeline.

This is a no-fluff guide. We will explore how each solution handles data ingestion, automation, and critical integrations with tools like Affinity, Attio, and DocSend, helping you build a more efficient sourcing engine.

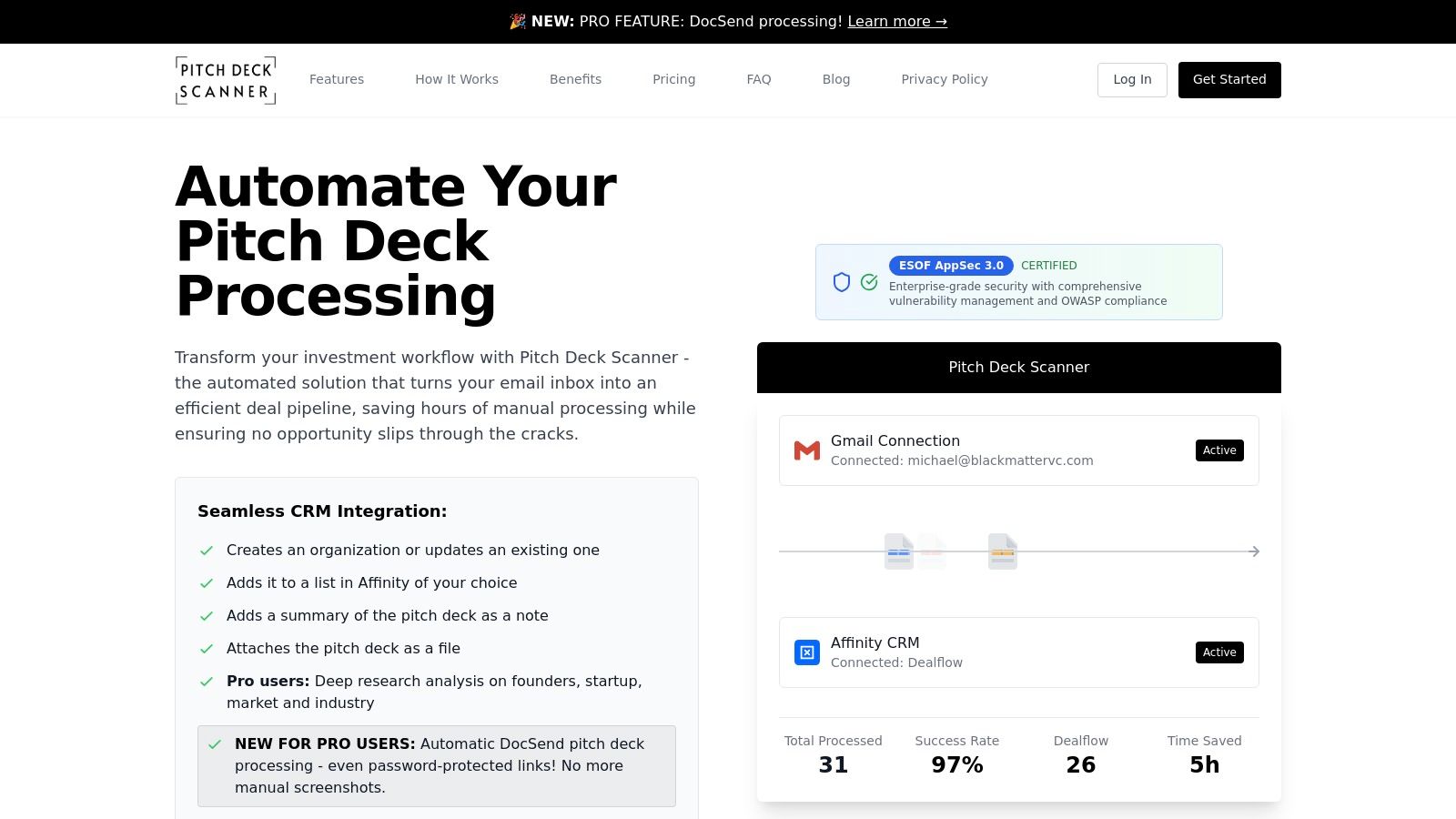

1. Pitch Deck Scanner

Pitch Deck Scanner is an automated workflow engine designed to transform a high-volume Gmail inbox into a structured, reliable deal pipeline. By directly addressing the manual, repetitive tasks of processing inbound pitch decks, it functions as a critical infrastructure layer for venture and growth investing teams. The platform continuously monitors connected inboxes, automatically detecting PDF attachments and DocSend links from potential investments.

It then parses these documents, extracts key data points, and creates structured deal entries directly within a team's CRM. This removes the bottleneck of manual data entry, downloading files, taking screenshots, and logging deals, freeing up analysts to focus on substantive evaluation. The value proposition is clear: systematically eliminate low-value work and ensure no inbound deal is missed due to workflow friction.

Key Features and Use Cases

Pitch Deck Scanner stands out among deal sourcing platforms by focusing on the first, most critical step: capturing and structuring inbound interest efficiently. Its features solve specific, daily pain points for investment teams.

- Automated Ingestion and CRM Sync: The platform’s core function is its direct integration with Gmail and Affinity CRM. Once authorized via secure OAuth 2.0, it operates in the background, saving an average of 5+ hours per team member weekly and boosting deal processing capacity by a reported 30%.

- Advanced DocSend Processing: For Pro plan users, the system automatically handles DocSend links, including those that are password-protected. It extracts the content without requiring manual clicks or logins—a significant efficiency gain for teams receiving a high volume of protected decks.

- Deep Research Enrichment: The Pro plan includes a data enrichment layer that augments new deal entries with public-source intelligence, including founder backgrounds, market analysis, and recent funding signals, providing immediate context for faster initial screening.

- Operational Oversight: A real-time dashboard gives partners or operations managers a clear view of deal flow throughput, tracking processing status and success rates to identify and resolve pipeline bottlenecks.

Practical Considerations

The platform is engineered for security and reliability, featuring enterprise-grade encryption, data isolation, and ESOF AppSec 3.0 certification. Its native integration with Affinity is seamless; connecting to other CRMs like Attio requires using Zapier Webhooks, which adds a configuration step.

Pricing is structured in two tiers after a 21-day free trial. The Basic plan is 30/user/month for up to 100 decks, while the Pro plan at 50/user/month unlocks the crucial DocSend automation and Deep Research features for up to 200+ decks. High-volume firms should note these per-user deck limits.

Website: https://pitchdeckscanner.com

2. Axial

Axial operates as a private, invitation-style network for sourcing lower middle-market M&A, debt, and minority equity deals across the US and Canada. It uses an algorithmic approach to privately match qualified buy-side profiles with sell-side advisor mandates, reducing the noise common on more open deal sourcing platforms.

The platform is designed for investment banks, private equity groups, and corporate acquirers. With over 10,000 deals brought to market annually through its network of more than 3,500 advisory firms, Axial offers significant, curated volume. Its primary value lies in its confidentiality and the quality of its matchmaking process, which streamlines the initial stages of M&A outreach.

Key Features & Use Case

- Algorithmic Matching: Eliminates manual browsing by delivering curated, confidential deal teasers directly based on your firm’s investment thesis.

- In-Platform NDA & Messaging: Streamlines initial communication and due diligence processes within a secure environment.

- Success-Fee Model: For buy-side participants, there are no upfront subscription costs. Fees are incurred upon the successful closing of a deal sourced via the platform. This aligns incentives but adds to the total transaction cost.

- Reputation Data: Leaderboards and closed-deal badges provide insights into the track record of other members, adding a layer of social proof.

Axial is best suited for PE firms and corporate development teams actively pursuing acquisitions in the lower middle market who value a confidential, pre-vetted introduction process over an open, browsable deal marketplace.

Website: https://www.axial.net/

3. Grata

Grata positions itself as a private company intelligence engine for M&A professionals and private equity firms focused on proactive deal origination. Now part of Datasite, it provides a comprehensive database of U.S. middle-market companies, including founder-owned businesses not actively for sale. Its core strength is its deep, keyword-based search, allowing users to uncover specific targets not discoverable through traditional deal sourcing platforms.

With profiles on over 19 million private companies, Grata combines company discovery, executive contact data, and CRM integrations into a single tool. This allows deal teams to move quickly from identifying a target to initiating outreach, making it a powerful tool for proprietary deal flow. Pricing is available upon request through annual contracts.

Key Features & Use Case

- Proprietary Search Engine: Utilizes keyword and deep-text search to scan company websites, identifying targets based on specific criteria like products, services, and business models.

- "Similar Company" Algorithm: Recommends new targets based on the characteristics of a company you’ve identified, accelerating discovery of adjacent opportunities.

- Integrated Contact Data: Provides direct access to executive contact information, streamlining outreach without needing to switch to another data provider.

- CRM Integrations & Chrome Extension: Captures firmographic data and syncs target companies directly to your CRM, automating a manual part of the origination workflow.

Grata is best suited for buy-side firms with a clearly defined investment thesis who engage in proactive, outbound sourcing to find off-market deals in the U.S. middle market.

Website: https://grata.com/

4. SourceScrub

SourceScrub is a private market intelligence platform designed for generating proprietary deal flow. It focuses on identifying founder-owned companies by leveraging non-obvious sources like industry conference attendee lists and trade publications. This "sources-first" approach helps investment professionals map niche markets and build a pipeline of companies that are not actively for sale.

The platform provides enriched company data, including growth metrics and detailed contact information, which is crucial for effective outreach. Its primary function is to help VCs, PE firms, and corporate development teams systematically uncover and engage with targets before they enter a formal M&A process. For firms aiming to refine their private equity deal sourcing, SourceScrub provides the tools to build a unique and defensible pipeline.

Key Features & Use Case

- Proprietary Source Aggregation: Scans and indexes thousands of sources, including conference lists, awards, and trade associations, to surface unique, privately-held companies.

- CRM Enrichment: Integrates directly with CRMs like Salesforce and Affinity to automatically enrich and update company and contact data, ensuring your pipeline information remains current.

- Chrome Extension: Allows users to capture and sync company information directly from their browser while researching, streamlining the initial data entry process.

- Advanced Data & API: Offers data warehouse and API options for firms that require deep integration and custom analytics on top of SourceScrub's dataset.

SourceScrub is best for investment teams focused on proactive, proprietary deal origination who need to go beyond standard databases to find unique opportunities. Pricing is quote-based and tiered by seats and data access.

Website: https://www.sourcescrub.com/

5. PitchBook

PitchBook is a comprehensive data and research platform for the private and public capital markets. Professionals across venture capital, private equity, and M&A use it for deep due diligence, market mapping, and competitive analysis. Its core strength is its massive, interconnected dataset covering companies, deals, funds, and investors, making it a foundational tool for proactive deal sourcing and market intelligence.

Unlike platforms focused solely on active deal flow, PitchBook equips dealmakers to build proprietary pipelines by identifying emerging companies, tracking investor syndicates, and analyzing market trends. While its high price point positions it as a premium product, its depth of data and workflow integrations make it an indispensable resource for many top-tier firms.

Key Features & Use Case

- Global Company & Deal Data: Access extensive profiles on private and public companies, including funding rounds, valuations, investors, and executive contacts, for building targeted outreach lists.

- Workflow & Research Tools: Features like Excel and PowerPoint add-ins and dedicated analyst support streamline the research and reporting process.

- Advanced Screeners: Build highly specific searches to identify companies that fit your investment thesis based on criteria like industry, location, funding stage, and growth signals.

- CRM & Data Integrations: Offers direct API and CRM integration add-ons, allowing firms to enrich their internal systems with PitchBook’s proprietary data.

PitchBook is ideal for VC and PE firms that need a market-standard, data-driven engine for proprietary deal origination and due diligence. Its primary drawback is its significant cost, typically requiring an annual contract negotiated via a sales representative.

Website: https://pitchbook.com/

6. Crunchbase

Crunchbase is a widely-used data platform for discovering information about private and public companies, particularly in the tech sector. While not a deal marketplace, it serves as an essential research and prospecting tool, allowing investors to identify emerging companies, track funding rounds, and find key contacts. Its strength lies in its vast, user-contributed database, making it a go-to for initial market scans and building target lists.

The platform is leveraged by venture capitalists and corporate development teams to monitor industry trends, identify potential bolt-on acquisitions, and surface early-stage targets. With features like AI-powered search and recommendations, it helps filter signals from noise, though the data quality can vary and often requires cross-verification. Understanding how to leverage its data is a key part of the modern investment decision making process.

Key Features & Use Case

- Advanced Search & AI Recommendations: Users can build complex queries based on funding stage, industry, and keywords. The platform's AI suggests similar companies to uncover non-obvious targets.

- Contact Data & Export Capabilities: Paid tiers offer access to verified contact information and allow users to export lists for outreach campaigns or import into a CRM.

- Custom Lists & Alerts: Create and track lists of target companies and set up alerts for key events like new funding rounds or leadership changes, enabling timely outreach.

- Subscription Tiers: Crunchbase offers multiple plans (Pro, Business, Enterprise) with varying levels of access and export limits. Free trials are available.

Crunchbase is best for VC and corporate development teams needing a fast, affordable tool to conduct broad market research, build initial funnels of early-to-growth stage companies, and enrich proprietary data.

Website: https://www.crunchbase.com/

7. Dealroom

Dealroom is a global data and intelligence platform focused on startups and high-growth technology ecosystems. Its value lies in providing comprehensive market intelligence, supporting thematic sourcing, and enabling competitive landscaping. Venture capital and corporate innovation teams use its rich datasets and curated research to identify emerging trends and discover promising companies before they formally seek funding.

The platform’s strength is its detailed taxonomy and real-time signals, which allow investors to map entire industries, track funding momentum, and pinpoint innovators in specific niches. While its coverage is global, it has a particularly strong foothold in the European tech scene. Dealroom is a strategic intelligence tool that powers proactive, thesis-driven origination for investors focused on the innovation economy. Its transparent pricing and powerful API make it a scalable solution for data-driven firms.

Key Features & Use Case

- Advanced Taxonomy & Signals: Users can filter companies using highly specific criteria, from business models and technologies to growth signals like hiring trends.

- Curated Research & Reports: Provides deep dives into specific markets and tech landscapes, helping investors build conviction and refine their investment thesis.

- API & Enterprise Support: Offers robust API access for integrating its data directly into internal CRMs or proprietary deal sourcing platforms.

- Transparent Pricing: Publishes its seat-based pricing online, a notable contrast to the opaque quotes common in the industry, though annual contracts are standard.

Dealroom is ideal for venture capital and corporate development teams that engage in proactive, thematic sourcing and require deep market intelligence to identify and evaluate opportunities, particularly within European and global tech ecosystems.

Website: https://dealroom.co/

8. Mergr

Mergr provides a specialized and affordable database focused squarely on the private equity and M&A ecosystem. It’s a lightweight tool for dealmakers who need quick access to data on PE firms, their portfolio companies, transaction histories, and key personnel. Mergr hones in on control transactions, making it an efficient resource for identifying potential acquirers, add-on targets, and advisor relationships without the noise of venture financing rounds.

The platform’s main strength lies in its simplicity and transparent pricing, which makes it accessible for independent sponsors, boutique investment banks, and smaller PE firms. The user interface is clean and direct, allowing for rapid searches and data exports. It serves as a valuable research and intelligence tool for generating targeted outreach lists and understanding market activity within the later-stage M&A landscape.

Key Features & Use Case

- Focused M&A Database: Provides detailed profiles on PE firms, their investment criteria, active portfolio companies, and historical add-on and exit transactions.

- Simple Search & Export: An intuitive interface allows users to quickly find and export lists of firms or professionals for targeted outreach campaigns.

- Transparent Pricing: Offers a clear, low monthly subscription fee with a 7-day free trial, removing the high cost barrier associated with larger data providers.

- Rankings & Analytics: Delivers insights into M&A activity, including rankings of the most active firms and advisors within specific sectors or regions.

Mergr is best for M&A advisors, independent sponsors, and corporate development professionals who require a cost-effective, easy-to-use database for identifying and researching participants in the control-oriented private markets.

Website: https://mergr.com/

9. Acquire.com

Acquire.com operates as a curated marketplace for the acquisition of startups and small technology businesses, including SaaS and e-commerce platforms. It connects founders looking to sell with a global network of buyers. The platform's main value lies in its transparency and guided workflow, which simplifies the M&A process for deals often too small for traditional investment banks.

Acquire.com offers a browsable marketplace where buyers can review high-level metrics for free, making it a popular deal sourcing platform for those seeking smaller, strategic bolt-on acquisitions. The platform provides tools and support from initial contact to closing, aiming to democratize the startup acquisition process for the sub-$10M market segment.

Key Features & Use Case

- Curated Tech Listings: Focuses exclusively on technology and online businesses, ensuring relevant deal flow for tech-focused acquirers.

- Guided Acquisition Process: Provides a step-by-step workflow with automated NDAs, a legal document builder, and access to in-house M&A advisors.

- Integrated Escrow Services: Partners with secure escrow agents to facilitate a safe and reliable closing process directly through the platform.

- Freemium Buyer Model: Buyers can browse listings and receive alerts for free. A paid subscription is required to contact founders and access private deal rooms, which filters for serious intent.

Acquire.com is best suited for corporate development teams, micro-PE firms, and entrepreneurs looking for profitable, earlier-stage tech companies, particularly in the sub-1M to 5M valuation range, who prefer a transparent, self-service marketplace.

Website: https://acquire.com/

10. BizBuySell

BizBuySell is the largest online marketplace in the United States for buying and selling small businesses and franchises. It dominates the Main Street and lower-end of the small-to-medium business (SMB) market, offering an unparalleled volume of listings directly from owners and brokers. This makes it a distinct resource for investors seeking smaller, bolt-on acquisitions or unique franchise opportunities.

The platform's strength lies in its sheer scale, with over 65,000 listings annually across a vast range of industries. It operates as an open, public listing service, providing broad access but placing a greater emphasis on the buyer to perform initial screening and due diligence, as listing quality can vary significantly.

Key Features & Use Case

- Massive Marketplace Volume: Offers the largest single source of US-based small business and franchise listings, providing extensive inventory for search funds or PE firms targeting smaller acquisitions.

- Broker Directory & Resources: Includes a comprehensive directory of business brokers and provides access to adjacent services like business valuations and financing resources.

- Direct Owner Access: The platform facilitates direct contact with business owners, which can streamline initial conversations for certain types of buyers.

- Paid "Edge" Membership: Buyers can subscribe for premium features, including advanced search filters, new listing alerts, and access to more detailed business data.

BizBuySell is ideal for search funds, independent sponsors, and corporate development teams looking for tuck-in acquisitions or franchise opportunities below the typical lower middle-market threshold. Success requires active filtering and a methodical approach to vetting the high volume of varied-quality listings.

Website: https://www.bizbuysell.com/

11. Empire Flippers

Empire Flippers operates as a highly curated marketplace for buying and selling established, profitable online businesses, focusing on assets like e-commerce stores, content websites, Amazon FBA businesses, and SaaS products. It distinguishes itself through a rigorous vetting process, where each listed business is analyzed for traffic, revenue, and profitability, reducing the volume of low-quality deals.

This brokerage-style approach ensures that buyers are presented with credible opportunities with detailed performance metrics. Empire Flippers requires potential buyers to undergo verification, including proof of funds, before unlocking P&L statements. This gatekeeping mechanism filters out non-serious inquiries and creates a more efficient environment for genuine acquirers, making it a valuable niche among deal sourcing platforms.

Key Features & Use Case

- Rigorous Vetting Process: Each business is pre-screened for at least six months of verifiable profit, ensuring only established and legitimate assets are listed.

- Buyer Verification: Access to detailed financial information is restricted until a buyer provides proof of identity and funds, creating a high-intent environment.

- Structured Closing Support: The platform assists with the migration of assets and ensures a secure transaction process from deposit to final handover.

- Tiered Commission Structure: Sellers pay a success-based commission on a sliding scale, which incentivizes the brokerage to secure a fair market price.

Empire Flippers is best suited for individual investors or PE firms specializing in digital assets who want a curated deal flow of profitable online businesses and prefer a managed, high-touch acquisition process.

Website: https://empireflippers.com/

12. Flippa

Flippa is one of the largest marketplaces for buying and selling online businesses, including e-commerce stores, SaaS products, and content sites. It operates on both an auction and classifieds model, catering to a vast range of deal sizes. This breadth makes it a unique destination for sourcing smaller digital assets or roll-up targets that may not appear on traditional M&A platforms.

While not a typical platform for institutional deal flow, its high volume of listings provides a rich hunting ground for specific digital asset acquisitions. The platform's public nature and wide-ranging quality mean that significant due diligence is required, but it offers unparalleled access to the micro and small-cap end of the digital business market.

Key Features & Use Case

- Broad Asset Classes: Offers a huge inventory across e-commerce (Shopify, Amazon FBA), SaaS, content blogs, mobile apps, and domains.

- Auction & Classifieds Formats: Provides flexibility for both competitive bidding and direct negotiation with sellers for a fixed price.

- Integrated Escrow Services: Utilizes FlippaPay and Escrow.com to facilitate secure transactions, adding a layer of protection for both buyers and sellers.

- Due Diligence Tools: Provides basic verification for seller-claimed revenue and traffic data, though independent verification is highly recommended.

Flippa is best for PE roll-up strategies or corporate acquirers seeking specific technology assets who are comfortable with the hands-on diligence required to sift through a high-volume, variable-quality marketplace.

Website: https://www.flippa.com/

Top 12 Deal Sourcing Platforms Comparison

| Product | Core features | 👥 Target audience | 💰 Price / Value | ✨ Key strengths & ★ Rating |

|---|---|---|---|---|

| Pitch Deck Scanner 🏆 | Gmail OAuth inbox scanning, PDF & DocSend parsing, Affinity sync, Pro Deep Research | VC/growth deal teams, ops | 💰 30 / 50 per user/mo (Basic / Pro), 21‑day trial | ✨ DocSend automation (incl. password links), 97% processing rate, saves 5+ hrs/wk — ★★★★★ |

| Axial | Invitation-only algorithmic matching, NDA & messaging, light CRM | 👥 Buy-side investors & boutique advisors (lower middle market) | 💰 Success‑fee model (pay on close) | ✨ Curated private matches, high deal volume — ★★★★☆ |

| Grata | 19M+ private profiles, contact data, CRM sync, Chrome extension | 👥 PE firms & independent sponsors | 💰 Annual / pricing on request | ✨ Deep middle‑market coverage, fast CRM workflows — ★★★★ |

| SourceScrub | Source-driven company data, conference scrubbing, enrichment, API | 👥 Origination teams building proprietary lists | 💰 Seat & data tiers (quote) | ✨ Proprietary sourcing, CRM enrichment — ★★★★ |

| PitchBook | Global deals, funds, companies, analyst research, add‑ins | 👥 Analysts, PE/VC, benchmarking teams | 💰 High price, annual contracts (sales pricing) | ✨ Market‑standard depth & research support — ★★★★★ |

| Crunchbase | AI search, recommendations, contact add‑ons, exports | 👥 Growth investors, BD & early‑stage sourcing | 💰 Subscription tiers (Pro/Business/Enterprise) | ✨ Fast, affordable market scanning & signals — ★★★★ |

| Dealroom | Company taxonomies, signals, curated research, API | 👥 VCs & innovation teams (Europe tilt) | 💰 Seat‑based, annual pricing | ✨ Strong tech ecosystem coverage, transparent seats — ★★★★ |

| Mergr | PE/M&A database, rankings, exports, analytics | 👥 Independent sponsors & smaller PE firms | 💰 Low monthly pricing, team plans | ✨ Focused on control deals, easy onboarding — ★★★ |

| Acquire.com | Curated startup listings, NDAs, legal docs, escrow partners | 👥 Buyers of micro‑startups, first‑time acquirers | 💰 Low entry; paid buyer plans to unlock contacts | ✨ Guided workflows & closing support for small deals — ★★★★ |

| BizBuySell | Large US marketplace (65k+ listings), broker directory, valuation tools | 👥 Small business buyers, brokers | 💰 Listing fees, optional 'Edge' buyer membership | ✨ Massive inventory & broker network — ★★★ |

| Empire Flippers | Vetted online business marketplace, buyer verification, closing support | 👥 Buyers of established online businesses (e‑comm, SaaS, content) | 💰 Commission‑based seller fees | ✨ Rigorous vetting and detailed metrics — ★★★★ |

| Flippa | Auctions & classifieds for online assets, escrow options, premium buyers | 👥 Buyers/sellers of apps, sites, domains (varied budgets) | 💰 Listing + success fees; buyer verification tiers | ✨ Huge inventory & flexible deal formats — ★★★ |

Integrating Platforms into a Cohesive Sourcing Engine

A modern investment stack is a mosaic of specialized tools, each designed to solve a specific bottleneck in the deal flow pipeline, from proactive discovery to inbound management. The core takeaway is not that a single platform will solve all sourcing challenges, but that a thoughtfully integrated stack creates significant operational leverage.

The distinction between proactive and reactive sourcing tools is critical. Platforms like PitchBook, Grata, and SourceScrub are indispensable for thesis-driven, outbound sourcing. They empower analysts to map markets and identify targets that aren't actively fundraising. Conversely, marketplaces like Acquire.com or Axial serve a different purpose, connecting you with a stream of actively marketed deals. Both approaches have their place in a diversified sourcing strategy.

Building Your Firm's Sourcing Stack

Choosing the right combination of deal sourcing platforms requires an assessment of your firm's unique workflow, investment stage, and primary deal sources. A growth equity fund has different needs than a pre-seed VC.

Your selection process should be guided by key principles:

- Workflow Centrality: How does this tool fit into our current process? The goal is to eliminate friction. Prioritize platforms with deep, bi-directional CRM integration (e.g., Affinity, Salesforce) to avoid creating data silos.

- Specialization vs. Generalization: Do you need a comprehensive market intelligence suite like Crunchbase or a specialized tool for a niche market, such as Empire Flippers for online businesses? A mix is often optimal.

- Automating Low-Value Work: The highest ROI comes from automating repetitive, time-consuming tasks. This is where inbound processing tools like Pitch Deck Scanner provide immense value, handling initial data extraction and logging so your team can focus on substantive evaluation. Manual deck review is a low-leverage activity that should be automated.

From Data Points to Deal Flow

Ultimately, these platforms are conduits for data. The strategic advantage comes from how your team synthesizes this data into actionable intelligence. For instance, many proactive sourcing tools like Grata and SourceScrub have roots in sales technology. Understanding the capabilities of B2B sales intelligence platforms can be crucial for identifying promising companies before they hit the market.

Implementing a new platform is a strategic initiative that requires team buy-in and process adaptation. The right tech stack won't find the next unicorn for you, but it will create the efficiency and bandwidth required to see it clearly when it arrives. By dedicating specific tools to specific pain points, you reclaim your team's most valuable asset: the time and mental space needed to build conviction, conduct deep diligence, and make winning investment decisions.

Ready to eliminate the manual bottleneck of inbound deal flow? Pitch Deck Scanner automates the tedious work of reviewing and logging pitch decks, extracting key metrics, and syncing data directly to your CRM. Stop wasting analyst hours on data entry and start spending more time on what matters: evaluating great companies.

Article created using Outrank