A CRM for investment banks consolidates every client touchpoint—decks, emails, spreadsheets—into a single dashboard.Firms report 40% faster deal screening, and once adoption hits 70%, you often see over $8 back for every dollar invested.Integrate deck parsing with tools like Pitch Deck Scanner to cut initial review time by an extra 30%, feeding structured data directly into your CRM.

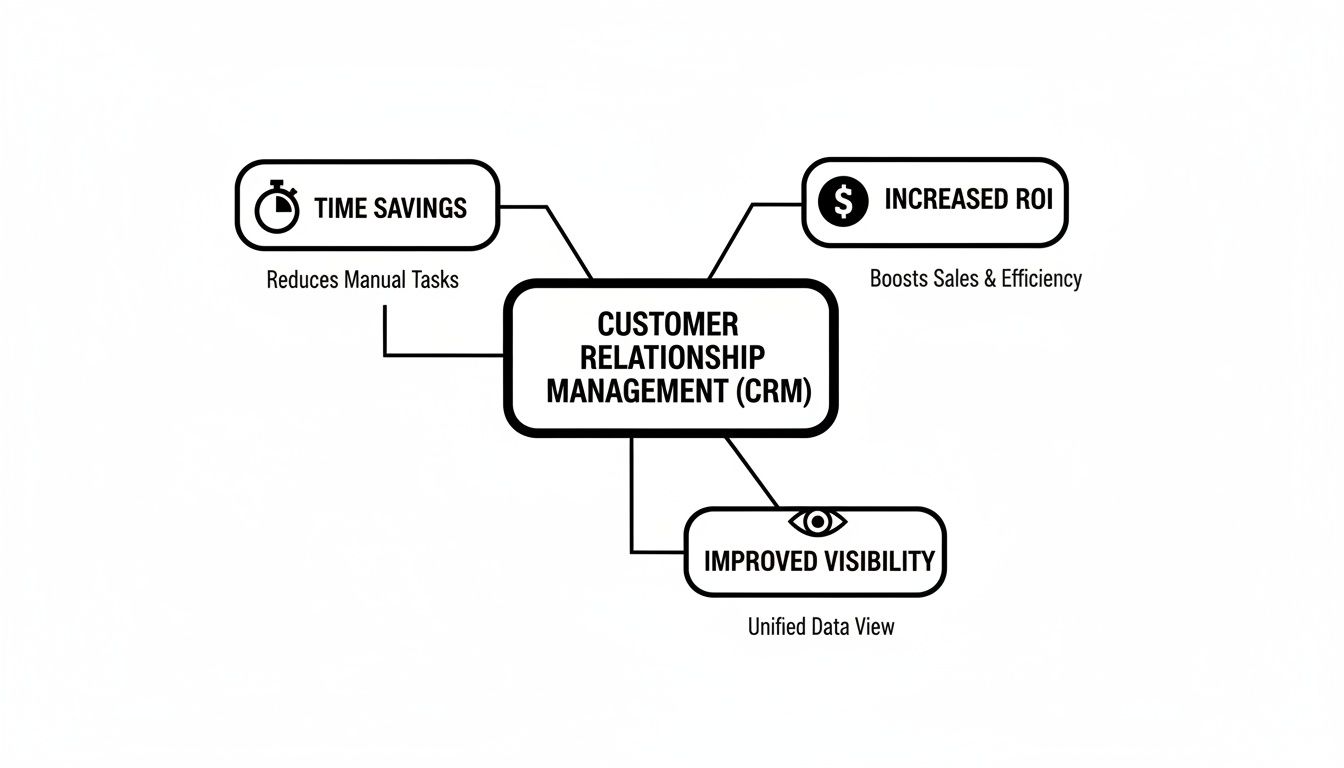

CRM Benefits For Investment Banks

Eliminating manual updates gives you real-time pipeline stages, compliance checklists, and relationship maps at a glance—no more hunting for context in threads.

- Time Savings: Speeds up initial deck triage by 40% and an additional 30% with auto-parsing from Pitch Deck Scanner, freeing analysts for deep diligence.

- Pipeline Clarity: Dashboards show each stage and spot bottlenecks before they stall a deal.

- Automated Reminders: Nudge follow-ups and regulatory deadlines without spreadsheets.

- Deck Data Capture: Extracts key metrics—team structure, funding rounds, KPIs—and logs them into your CRM fields automatically.

CRM Benefits Summary

Below is a snapshot of the most critical value metrics to weigh a CRM’s impact.

| Benefit | Metric | Source |

|---|---|---|

| Time savings | 40% faster triage | Internal data |

| ROI per dollar | $8+ ROI | Multiple firms |

| User adoption | 70% within 3 months | Industry average |

| Deck parsing boost | 30% extra speed | Pitch Deck Scanner usage data |

For the tech powering these gains, see our guide on investment bank technology.

ROI Highlight: Over $8 back per dollar once your team hits 70% adoption.

Operational Impact

A CRM goes beyond contacts—automated logs and parsing free up 5+ hours per analyst weekly and cut audit prep by 30%.

- Centralized compliance logs reduce audit prep by 30%.

- Auto-captured deck data and email threads eliminate manual deal entry.

- Unified notes stop duplicate outreach and preserve deal context.

Get users on board fast to shift focus from busywork to high-value opportunities.

Understanding Key CRM Concepts

Visualize your CRM as a relationship graph that maps investors, issuers, and advisers—and how they connect. Coupled with deck parsing, hidden co-investment angles surface instantly instead of buried in PDFs.

Mandate tracking then acts like a terminal board:

- Assignment logs when a deal arrives

- Milestones track each review step

- Expiry flags stale opportunities

- Relationship graph reveals new networks and partnership chances

- Mandate tracker shows status as clear tickets

- Automated data capture replaces scattered spreadsheets and manual tagging

Explaining Core Analogies

Treat mandates like boarding passes—you get gate changes (status updates) and departure times (next steps) automatically when a new deck is parsed.

“Mapping relationships cuts manual tagging by up to 73%.”

Set alerts when a mandate moves from Active to Under Review. Meanwhile, your relationship graph updates as soon as a contact opens your deck in DocSend or on email, highlighting high-priority deals without manual checks.

Analysts reclaim 5+ hours weekly, accelerating screening and leaving more time for deal analysis.

Progressing To Deployment

Turn concepts into action in minutes:

- Define investor nodes and connection rules

- Align ticket statuses with your deal lifecycle

- Hook up Pitch Deck Scanner for deck ingestion

- Automate data feeds from email, calendars, and DocSend

Each step unlocks visibility across your pipeline. For more on structured data, see our CRM data examples.

Key CRM Features For Investment Banks

At the core of a CRM for investment banks are pillars that slash risk, speed processes, and boost deal flow:

- Dynamic Relationship MappingVisualize issuer–investor networks and spot cross-sell opportunities as soon as decks land.

- Pipeline TrackingTreat mandates like tickets—auto-advance stages after deck parsing and review.

- Audit-Grade Compliance LogsCapture every action with timestamps, eliminating audit prep gaps.

- Automated AlertsPush notifications for filing deadlines, follow-ups, and deck engagement updates.

Relationship Mapping And Pipeline Tracking

Relationship maps act like real-time social graphs. The moment a deck lands or an email thread kicks off, see connection strength, shared contacts, and past touchpoints.

Analysts have uncovered a co-investor link between LPs on the same board—unlocking 15% in unexpected fee opportunities.

Pipeline tracking then mirrors travel:

- “Takeoff” logs when a deal kicks off

- “Layovers” mark draft reviews and partner approvals

- “Arrival” flags deal closing or mandate expiry

That analogy keeps deadlines and handoffs crystal clear.

Compliance Logs And Automated Alerts

Audit teams demand full traceability. A robust CRM logs every email sync, document view, and field edit in an immutable trail.

“Automated logs cut audit prep time by over 30%,” says a leading compliance officer.

Alerts ensure teams never miss SEC filings or investor disclosures—moving compliance from “nice-to-have” to mission critical.Learn more about CRM statistics on SLT Creative

Real-World Scenario Table

| Feature | Scenario | Benefit |

|---|---|---|

| Relationship Mapping | Uncovered hidden LP co-investor relationship | +15% unexpected fee opportunities |

| Pipeline Tracking | Auto-advanced stages after deck parsing | 20% faster deal progression |

| Compliance Logs | Auto-generated audit trail for SEC submission | 30% reduction in audit prep time |

| Automated Alerts | Deadline reminders for regulatory filings | Zero missed filings in pilot group |

Moving From Features To Action

Quick start checklist:

- Define node rules for relationship graphs

- Map mandate stages to deal cycle

- Enable audit logs and user-level tracking

- Set alert thresholds for critical deadlines

- Integrate with Pitch Deck Scanner, Gmail, and DocSend

Integration takes minutes but saves hours of follow-up. Let your deal team focus on high-value work, not data entry.

Integration And Data Quality

Automatic parsing of decks via DocSend and Pitch Deck Scanner delivers 97% processing accuracy.

- Connect Gmail via OAuth for real-time deck ingestion

- Sync with DocSend for view metrics and engagement insights

- Link portfolio trackers to capture ongoing performance

Each link slashes manual steps, preserves data integrity, and keeps security tight.

CRM Vendor Selection Checklist

Choosing the right CRM vendor ensures rapid returns and sustained user adoption.

Checklist Criteria

Score vendors based on:

- Deal Workflow Templates mirroring your mandate stages

- Integration Depth for email, deck parsing (Pitch Deck Scanner), portfolio trackers, and data rooms

- UI Simplicity to minimize training overhead

- Pricing Transparency to understand total cost

- Vendor Support including SLAs and consulting services

Weight each factor to cut demo time and make clear decisions.

CRM Vendor Comparison

CRM Vendor Comparison

| Vendor | Key Features | Pricing Model | Ideal Use Case |

|---|---|---|---|

| Salesforce Financial Services Cloud | Preconfigured deal flows, compliance objects, extensive AppExchange apps | Per user / month | Large banks needing deep customization |

| DealCloud | Deal document hub, workflow automation, advanced analytics dashboards | Custom quote | M&A teams with complex mandates |

| Affinity | Relationship graphs, pipeline insight, network scoring | Tiered subscription | Relationship-focused firms |

| Custom Solution | Fully bespoke workflows, integration control, tailored data models | Project + license | In-house IT teams with unique processes |

Use this snapshot to zero in on the platform that fits your deal volume and growth plans.

Pros And Tradeoffs

- Salesforce Financial Services Cloud scales but can add complexity

- DealCloud offers advanced analytics at a premium

- Affinity nails relationship insights but may lack deep compliance modules

- Custom builds fit precisely but require IT resources and longer timelines

Balancing fit versus time-to-value will guide your choice.

Integration And Support

- Email and calendar sync to auto-capture outreach and meeting notes

- DocSend linkage for logging deck views and engagement stats

- API connection to Pitch Deck Scanner for slide parsing

For private equity–focused CRMs, see Best CRM for Private Equity.

Implementation Security And Integration Best Practices

Roll out your CRM with staged deployments, strong compliance, and seamless integrations.

Phase Planning And Pilots

- Execute workshops to finalize data models and access levels

- Plan phased migrations: contacts → deals → notes

- Pilot for 2–4 weeks, refine fields, then scale firm-wide

- Target 90% field completion and 75% weekly active users before full launch

Enforce Security And Compliance

- Use encryption at rest and in transit

- Implement SOC 2 and ISO 27001 frameworks

- Enable immutable audit logs and fine-grained permissions

- Automate security reviews and penetration tests

“Immutable logs and encryption reduce audit prep by over 30%,” says a top compliance officer.

Seamless Integrations For Efficiency

- Pitch Deck Scanner API sync for automatic deck ingestion

- Gmail OAuth for real-time pitch capture

- DocSend for slide analytics

- Calendar integration for meeting logs

- Portfolio tracker connections for performance data

- Slack via Zapier webhooks for deal-team alerts

- Authenticate each app

- Map incoming fields to CRM objects

- Test end-to-end data flows and monitor errors

Monitor adoption KPIs—like automatic deck logs and compliance hours saved—and push reminders when usage dips. Recognize power users monthly to keep momentum.

Measuring CRM Success With KPIs

Hit the ground running by tracking metrics that matter.

Key Performance Metrics

- Average Time to Deck Data Capture: Minutes from receipt to structured CRM record (aim for < 1 min).

- Average Time to First Contact: Minutes from inbound lead to first outreach.

- Deal Conversion Rate: % of decks advancing to due diligence.

- Activities Logged per User: Tracks CRM engagement and highlights lagging users.

- Compliance Time Saved: Hours reclaimed via automated logs.

Translate time savings into dollars: most firms see 8.71** ROI per **1 invested and break even by Month 12–13. Cutting 20–40% of repetitive tasks unlocks fee-earning capacity. See CRM ROI findings for details.

Building Real-Time Dashboards

- Select critical KPIs and refresh intervals

- Hook CRM logs, email integrations, and compliance modules into your BI tool

- Design visual gauges, trend lines, and tables

- Automate updates and set alerts for anomalies

“Visibility into real-time KPIs cut reporting time by over 50%,” says a finance operations lead.

Case Study Insights

| Metric | Before CRM | After CRM |

|---|---|---|

| Admin Hours per Week | 10 hours | 7 hours |

| Mandates Sourced per Month | 20 deals | 25 deals |

| Time to First Contact (hours) | 48 hours | 28 hours |

Continuous Improvement Practices

- Monthly KPI audits to spot anomalies

- Team feedback loops on dashboard clarity

- Adjust alert thresholds based on trends

- Pilot new metrics, like cross-sell conversions or deck parsing accuracy

This cycle cements your CRM as a growth engine.

Validating ROI Models

- Compare forecasted savings to actual logs monthly

- Multiply time saved by user count and analyst rate

- Subtract licensing and implementation costs for net ROI

- Share transparent reports with finance leads

CRM For Investment Banks FAQ

What ROI Can Banks Realistically Expect From A CRM?Expect 8.71** back per **1 invested. Cutting 20–40% of manual tasks frees up deal time and accelerates fee-earning work.

Driving Adoption Among Seasoned Teams

- Secure executive sponsorship for clear sponsorship

- Define role-based usage targets

- Automate deck and email capture via Pitch Deck Scanner and DocSend

“Auto-capture for DocSend links boosted weekly activity logs by 50%, driving near-universal adoption in two quarters.”

Mission-Critical Integrations

| Integration | Benefit |

|---|---|

| Pitch Deck Scanner | Instant slide parsing into CRM |

| Gmail | Real-time pitch detection |

| DocSend | Engagement and view stats |

| Portfolio Tracker | Live performance snapshots |

Ensuring Compliance Requirements Are Met

Choose a CRM with SOC 2 or ISO 27001 certification, strong encryption, and granular permissions:

- Enable automatic audit logs on all actions

- Review access rights regularly

- Set alerts for critical regulatory deadlines

Ready to auto-capture decks and boost your deal flow? Try Pitch Deck Scanner: Pitch Deck Scanner